What is Mortgage CRM? 10 Best CRM for Mortgage Brokers

In the fast-paced and highly competitive mortgage industry, success depends on managing client relationships effectively and optimizing loan processing operations. To thrive, mortgage professionals need tools that streamline workflows, enhance client interactions, and ensure efficient handling of complex transactions.

In this article, we explore mortgage CRM solutions - specialized software designed to enhance efficiency and growth of loan businesses. We’ll describe the best mortgage CRM systems available today, their key features, and how leveraging these tools can drive significant business growth for mortgage professionals.

What is Mortgage CRM?

Mortgage CRM is a Customer Relationship Management system built to help mortgage brokers, loan officers, and lenders manage daily processes, streamlining the entire mortgage lifecycle from lead generation through loan origination, processing, underwriting, and closing.

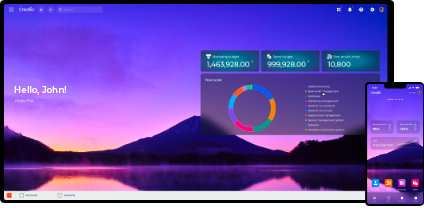

Creatio’s mortgage CRM software

Mortgage CRM software offers features such as automated loan status updates, mortgage and interest rate tracking, and compliance management tools. They also offer robust pipeline management capabilities, allowing brokers to track each client's progress through the mortgage process. By centralizing client data and automating repetitive tasks, the mortgage CRM system helps mortgage professionals focus more on building relationships and closing deals.

Why Mortgage Brokers Need CRM Software

Mortgage CRM software helps manage the complex and often lengthy process of guiding clients from initial contact to closing a loan. By centralizing all the important information, tracking interactions, and automating follow-ups, CRM systems ensure that no lead falls through the cracks and that brokers can maintain timely and personalized communication with clients.

Additionally, mortgage CRM software enhances productivity by automating routine tasks such as document management, compliance checks, and status updates. This allows brokers to focus on building customer relationships rather than getting bogged down by administrative work.

Moreover, the best CRM software tools offer valuable insights through analytics, helping brokers identify trends, optimize their sales strategies, and ultimately grow their business. In an industry where client trust and timely service are paramount, a robust mortgage CRM system is a critical tool for success.

10 Best Mortgage CRM Software

Choosing the right CRM platform can significantly impact your mortgage business's efficiency and growth potential. In this section, we highlight the best mortgage CRMs tailored to the mortgage industry:

1. Creatio

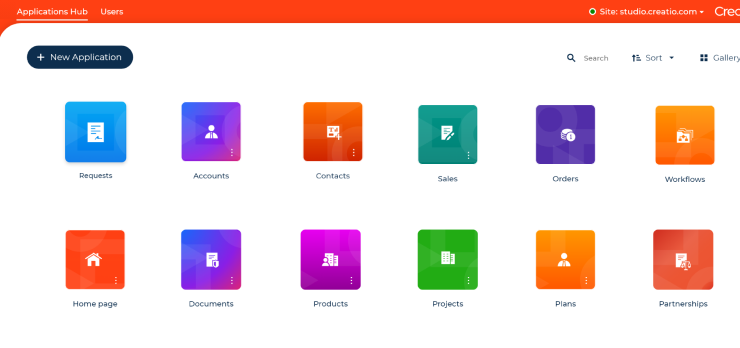

Creatio is the best mortgage CRM software that offers an intuitive and highly customizable solution for loan officers. Renowned for its powerful process automation, Creatio provides users with no-code capabilities, allowing them to tailor workflows to meet specific business requirements, ensuring that every step of the mortgage process is streamlined. Creatio CRM is designed to help mortgage professionals build strong relationships with clients, streamline their workflows, and drive business growth through advanced automation and data-driven insights. Its customizable features and intuitive interface enable brokers to deliver personalized service, enhance operational efficiency, and achieve long-term success in a competitive market.

Key features

- Loan application management - provides end-to-end customer data and automated mortgage verification workflows to ensure personalized loan terms for each customer.

- Loan origination system - streamlines the creation and entry of lending terms, participant information, and collateral documents, ensuring quick and efficient loan origination.

- Copilot virtual AI assistant - enhances CRM capabilities with actionable insights, next-best-action recommendations, and forecasting, helping users make informed decisions and optimize their strategies.

- Loan servicing - organizes the lending process to maintain high-quality customer service, automates loan servicing reminders, provides loan self-service options, and ensures consistent data updates throughout every stage.

- Underwriting - offers complete visibility into mortgage application data, streamlining the underwriting process and equipping underwriters with detailed analytics to approve, postpone, reject, or adjust final financing terms.

- Approval and verification - ensures thorough verification of mortgage application data through flexible checklists and automated review and approval workflows.

- Risk catalog management - digitizes your risk catalog and enhances it with intelligent classification, cross-linking, and drill-down features, enabling quick identification, measurement, and management of risks.

- Lead and opportunity management - tracks and captures leads from different sources and streamlines the mortgage loan sales process by automating end-to-end workflows.

- Partner and referral management - consolidates partner information into a single detailed partner profile and allows tracking of the number and quality of referrals from each partner.

- Marketing automation - helps design, execute, measure, and optimize omnichannel marketing campaigns for various mortgage markets at scale.

- Mortgage portfolio management - streamlines service routines for mortgage products, customer identity verification, and service personalization.

- Comprehensive analytics and reporting - provides in-depth data analysis and customizable reports, offering valuable insights into performance metrics, customer trends, and workflow efficiency.

Pricing

Creatio pricing starts at $25 per user per month and can scale up based on the number of users and required features. This flexible pricing structure allows businesses to adjust their investment according to their evolving requirements.

2. Salesforce

Salesforce CRM offers a scalable lending and mortgage CRM system that simplifies the lending process from origination to service. Salesforce helps build trust and grow relationships while improving efficiency with automation, extensive customization, and integration. Additionally, its robust analytics and reporting tools provide valuable insights, enabling mortgage professionals to make data-driven decisions and optimize their operations.

Key features

- 360-degree views of borrowers - offers complete visibility into all financial holdings and borrower activities from a single, unified perspective.

- Guided applications - streamline the application process with step-by-step instructions and prompts.

- Loan origination - streamlines the process of creating and processing new loan applications to ensure a smooth and efficient loan approval journey.

- Document tracking - monitors the status and location of documents throughout the mortgage process, providing real-time updates.

- Lead management - captures, organizes, and tracks potential clients from initial contact through conversion.

Pricing

Salesforce pricing begins at $25 per user per month for the Starter suite, with more advanced options available at higher pricing tiers.

See also: Salesforce Alternatives & Competitors and Salesforce Marketing Cloud Alternatives & Competitors

3. MondayCRM

MondayCRM is a versatile project management tool that offers a flexible CRM solution suitable for mortgage lenders. It allows users to customize workflows, track client interactions, and manage tasks in a user-friendly interface. MondayCRM offers tailored recipes for automating routine marketing and sales tasks, improving productivity and conversion rates.

Key features

- Enhanced lead profiles - helps create detailed buyer profiles enabling personalized sales interactions.

- Customizable workflows and automation tools - allows mortgage companies to tailor workflows to mortgage processes and automate repetitive tasks.

- Automated customer follow-ups - automatically send follow-up emails or notifications to maintain consistent communication and keep the process on track.

- Automated task assignments - delegates tasks to the right team members based on predefined rules.

- Custom dashboards - helps create personalized dashboards for real-time insights, monitoring progress, and making informed decisions.

- Integration - seamlessly connect with third-party apps and mortgage software, ensuring smooth workflows across all tools.

Pricing

MondayCRM offers a range of pricing tiers starting at $13 per user per month, with features scaling up in higher-tier plans.

4. Keap

Keap is a mortgage CRM software and marketing automation platform that caters to small businesses. It combines client management, email marketing, and sales automation in one platform, making it a great tool for brokers who want to streamline their operations and grow their client base.

Key features

- Automation builder - helps automate processes with a flexible drag-and-drop builder.

- Email & text messaging - automates email and text communications and tracks their effectiveness in dashboards and reports.

- New e-commerce and native payment options - accept payments directly within the platform, streamlining transactions and improving customer convenience.

- Up-selling and cross-selling - automatically suggest relevant products or services to customers, boosting sales and maximizing revenue opportunities.

- Customizable sales pipeline and task management - tailors sales cycle to match unique processes and efficiently manage tasks, keeping sales efforts organized and on track.

Pricing

Keap offers a single pricing plan starting at $249 per month for 2 users and up to 1,500 contacts. The cost increases with additional users and contacts.

5. Total Expert

Total Expert is a purpose-built customer engagement and intelligent automation platform for mortgage and financial services professionals. It provides robust tools to improve sales productivity and automate communications to enhance the customer journey. Total Expert helps mortgage loan officers generate more leads, close more loans, and maximize the outcome of every opportunity.

Key features

- Dynamic customer profiles - creates dynamic customer records with relevant behavioral, demographic, and financial data to help deliver personalized content and product offers.

- Lead generation - helps nurture and expand referral partnerships through dynamic co-marketing campaigns.

- Automatic lead routing - automatically routes incoming leads to the right loan officer to reduce the administrative burden on sales teams.

- Intelligent customer journeys - helps create customized customer journeys and improve application-to-close rates by harnessing real-time data signals.

- Built-in customer intelligence - delivers personalized experiences based on Compliance management tools to meet regulatory requirements.

Pricing

Pricing for Total Expert is available only upon request.

6. Shape Mortgage Software

Shape Mortgage Software is a mortgage CRM provider that caters to the mortgage industry’s unique needs. The platform helps mortgage professionals improve their productivity and efficiency with lead management, pipeline tracking, and automated follow-ups.

Features

- ShapeIQ technology - qualifies and scores mortgage leads to prioritize leads in the sales pipeline efficiently.

- LOS integration - Connect seamlessly with loan origination systems like Encompass, LendingPad, Calyx, and more.

- Pre-built marketing templates - offers a library of ready-to-use templates for effective email and text marketing.

- Enterprise-level integrated dialer - automates communication with an integrated parallel dialer for email, text, and phone calls.

- Artificial intelligence-based lead scoring - uses AI to assess and prioritize leads based on their potential.

- Automated credit pulling - streamlines the credit evaluation process with automated credit pulls, speeding up application processing and decision-making.

- Referral management - manages and tracks referrals to enhance collaboration with partners.

Pricing

Shape offers a single pricing model, starting at $99 per user per month.

7. BNTouch Mortgage CRM

BNTouch's mortgage professional CRM is a fully integrated digital system, CRM, marketing, and POS mortgage business growth platform designed to meet the needs of mortgage professionals. It offers a range of tools for managing leads, nurturing client relationships, and automating marketing efforts.

Features

- Integrated lead distribution platform - distributes leads automatically to team members and allows tracking and analysis of each member's performance.

- Digital 1003 loan platform - simplifies and improves borrower experience with digital document management, in-app push notifications, and in-processing updates via sms.

- Post-funded follow-up platform - offers dozens of pre-configured campaigns and tools to stay in touch with customers after the loan is closed.

- Mortgage content database - provides 170 ready-to-use e-marketing campaigns to help brokers and lenders engage clients effectively through targeted, professional content.

Pricing

BNTouch offers a range of different pricing tiers and options, starting at $165 per month with a $125 activation fee for the Individual plan.

8. Surefire CRM

Surefire CRM is a mortgage customer relationship management system that enhances the efficiency and effectiveness of mortgage professionals. It offers a comprehensive suite of tools to optimize client communication, manage leads, and drive growth. Surefire CRM integrates seamlessly with various mortgage systems, providing a comprehensive platform for managing the entire mortgage lifecycle.

Key features

- Lead management and nurturing - automates lead capture and follow-up processes to ensure timely and personalized client engagement.

- Integration with third-party applications - offers integration with Floify’s POS and 1003 loan application, streamlining the loan process.

- Customized and branded landing pages - provides customized, branded landing pages with forms for the pre-application process, enhancing lead capture.

- Co-branded marketing materials - helps brokers create co-branded marketing materials and flyers with referral partners, boosting collaboration and outreach efforts.

Pricing

Surefire CRM’s pricing starts at $150 per user per month.

9. Cimmaron Software

Cimmaron Software provides a robust mortgage CRM software platform designed to improve client management for mortgage professionals. The CRM software offers a suite of tools that simplify the mortgage process from lead capture to loan closing, making it a popular choice among brokers and lenders.

Key features

- Integrated LOS - seamlessly integrates with major Loan Origination Systems, providing a unified platform for managing the entire loan process from start to finish.

- Automated marketing campaigns - offers pre-built and customizable marketing campaigns that can be automated to engage clients via email and SMS.

- Client and referral partner portals - provides secure portals for both clients and referral partners, allowing for real-time collaboration and status tracking.

- Customizable contact management - provides contact management tools that can be tailored to track client interactions, preferences, and statuses, ensuring personalized service.

- Virtual AI assistant - includes Iris, a virtual AI assistant that helps with task automation, client interaction, and workflow management.

Pricing

Pricing starts at $75 per month with more expensive plans offering more advanced features, like virtual AI assistant Iris.

10. Audium

Aidium is a mortgage CRM platform focused on guiding prospects through the sales funnel. It’s designed to address challenges unique to the mortgage industry using data intelligence and AI. Audium streamlines workflows and enhances customer interactions, making it easier for brokers and loan officers to manage and grow their mortgage businesses effectively.

Key features

- Mortgage lead conversion - offers tools to streamline lead flow, nurture prospects, and convert more leads into deals.

- Mortgage automation - streamlines mortgage processes, improves relationships with clients and boosts lead conversion rates with intelligent workflows.

- Mortgage marketing - simplifies marketing process with intelligent automation and helps personalize messaging for higher conversions.

- Out-of-the-box content - enables loan officers to generate tailored, persuasive, and compliant marketing materials through automation.

- Mortgage referrals - streamlines the referral process by tracking and managing referrals, helping brokers build stronger relationships with partners and clients.

- Reporting & unified data - provides dynamic dashboards and in-depth reports ensuring businesses can make data-driven decisions.

Pricing

Pricing for Aidium is available upon request.

Benefits of CRM for Mortgage Brokers

Implementing a CRM system specifically designed for mortgage lenders can offer numerous benefits that enhance efficiency, improve client relationships, and drive mortgage business growth.

Below are some of the key benefits:

1. Higher conversion rates

A mortgage CRM helps brokers convert more prospects into clients by efficiently managing and nurturing leads at every step of the sales funnel. Automated follow-ups, personalized communication, and targeted marketing campaigns keep potential clients engaged, increasing the likelihood of closing deals.

2. Enhanced productivity

Mortgage industry professionals deal with a multitude of tasks daily, from lead generation to loan processing and closing. A mortgage-specific CRM streamlines these workflows by automating repetitive tasks, such as sending follow-up emails, scheduling appointments, doing loan reports, and tracking loan statuses. Automated workflows also help brokers manage their time better, allowing them to focus on more critical aspects of their business, such as building client relationships and closing deals.

3. Improved lead management

A mortgage CRM allows brokers to capture, organize, and track leads from various sources, ensuring that no opportunity is missed. The system can prioritize leads based on criteria such as the level of interest or the stage in the buying process, helping brokers focus their efforts on the most promising prospects.

4. Increased sales quota

With better lead management, automation, and targeted marketing, brokers can reach more clients and close more deals, leading to a higher sales quota. A CRM allows brokers to maximize their potential and consistently achieve and exceed their sales targets.

5. Enhanced client relationships

Building and maintaining strong client relationships is crucial in the mortgage industry, where trust and personal service are key. A CRM system enables brokers to keep track of all client interactions, from the initial inquiry to post-closing follow-ups. By having all client information centralized and accessible, brokers can provide personalized service, tailor their communication to each client’s needs, and respond to inquiries more promptly.

6. Improved customer satisfaction

By providing timely updates, personalized communication, and a smooth mortgage process, a CRM enhances the overall client experience. Clients appreciate the efficiency and attention to detail, which translates into higher satisfaction levels and positive word-of-mouth referrals.

7. Better compliance and risk management

Mortgage CRMs often include compliance features that help brokers adhere to industry regulations. Automated reminders, secure document storage, and audit trails ensure that all processes meet legal requirements, reducing the risk of penalties.

8. Enhanced collaboration

For mortgage loan officers who work in teams or collaborate with other professionals, such as partners, real estate professionals or financial advisors, a CRM system provides a centralized platform where all team members can access and update client information.

Core Features to Look for in Mortgage CRM

When selecting a CRM for mortgage companies, it's essential to ensure it encompasses a range of features tailored to the unique demands of the mortgage industry.

Here are some core features to consider:

1. Lead management

Effective lead management is crucial in the mortgage industry, where timely follow-up can significantly impact conversion rates. A robust CRM should capture leads from various sources, such as web forms, emails, and phone calls, and organize them in a centralized database. Look for features that allow you to segment and prioritize leads based on criteria like source, interest level, and engagement history. Automated lead assignments and follow-up reminders help ensure that no lead is overlooked and that each one receives prompt attention.

2. Loan origination and tracking

A mortgage CRM should facilitate seamless loan origination by allowing you to create and manage loan applications, track their progress, and store relevant documentation. Look for features that enable easy entry of lending terms, borrower information, and collateral documents. Integration with loan origination systems (LOS) can streamline the process further, providing a unified platform for tracking loan statuses and managing the entire lifecycle from application to closing.

3. Document management

Efficient document management is critical in the mortgage process, which involves extensive paperwork. A good CRM should offer a centralized document repository where you can store, organize, and access all necessary documents.

Key features include version tracking to manage document updates, automated synchronization to keep documents aligned across workflows, and flexible access rights to control who can view or edit documents. This helps ensure that all documentation is up-to-date, easily accessible, and compliant with regulatory requirements.

4. Automated follow-ups and task management

Automation in follow-ups and task management can significantly boost productivity. A CRM should enable you to set up automated follow-up emails, reminders, and task assignments based on predefined triggers. For instance, an automated follow-up can be triggered after a client submits a loan application or when a document is due. This feature ensures that important tasks are completed on time and that clients receive consistent communication, reducing manual effort and minimizing the risk of missed deadlines.

5. Marketing automation

Marketing automation tools help you maintain consistent client engagement through targeted campaigns. Look for CRMs that offer pre-built email and SMS templates, as well as the ability to create a customized drip marketing campaign.

Automated drip campaigns can nurture leads through the loan processes, while personalized multi-channel marketing content can enhance client relationships and increase conversion rates. Integration with social media and other marketing platforms can also expand your reach and streamline promotional efforts.

6. Reporting and analytics

Advanced reporting and analytics features provide valuable insights into your mortgage operations. A CRM should offer customizable reports and dashboards that track key metrics such as lead conversion rates, loan processing times, and team performance. Detailed analytics help you identify trends, measure the effectiveness of marketing campaigns, and make data-driven decisions to improve efficiency and drive growth.

7. Compliance and security

Compliance with industry regulations and data security are paramount in the mortgage industry. Ensure the CRM you choose includes features for managing compliance, such as audit trails and automated checks for regulatory adherence. Additionally, robust security measures should protect sensitive client information from unauthorized access or breaches. Look for features like data encryption, secure user access controls, and regular security updates.

8. Integration capabilities

A CRM should integrate seamlessly with other tools and systems used in the mortgage process, such as loan origination systems, credit bureaus, and financial software. Integration capabilities ensure that data flows smoothly between systems, reducing manual data entry and improving overall efficiency. Check for compatibility with your existing technology stack and the availability of APIs or pre-built integrations.

In summary, a mortgage CRM with these core features can significantly enhance the efficiency and effectiveness of mortgage brokers and loan officers. By selecting a CRM that meets these needs, you can streamline operations, manage customer relationships, improve customer interactions, and drive business growth.

How to Choose a Mortgage CRM

Choosing the right mortgage CRM is crucial for enhancing efficiency and managing client relationships effectively.

Here are key factors to consider when selecting the best mortgage CRM software for your mortgage brokerage:

- Define your needs and goals - identify specific challenges and requirements to ensure the CRM aligns with your business goals.

- Evaluate key features - the right mortgage CRM should offer essential functionalities like lead management, loan origination, and document handling.

- Consider integration capabilities - check for seamless integration with existing systems and tools to ensure seamless data flow.

- Assess ease of use and customization - choose a CRM with an intuitive interface and customizable options to fit your unique processes and make sure that every mortgage lender on your team can use it.

- Consider scalability and growth capabilities - select a CRM that can expand with your business needs, handling more users and transactions as you grow.

- Review pricing and value - compare pricing plans and ensure the CRM provides good value for the features offered and fits within your budget.

By carefully weighing these factors, you can select a CRM that enhances your mortgage brokerage’s efficiency, improves client management, and supports long-term growth.

Leveraging Mortgage CRM for Growth

Mortgage brokers operate in a highly competitive market where efficiency and client relationships built on trust are key to driving business growth. A mortgage CRM is not just a tool for managing client data - it's a powerful platform that can transform the way brokers operate, helping them scale their business and increase profitability.

One of the primary ways a mortgage CRM fosters growth is by optimizing lead management. With a robust CRM, brokers can capture, organize, and prioritize leads more effectively. Automated follow-ups, personalized communication, and targeted marketing campaigns keep prospects engaged and move them efficiently through the sales process. This not only increases conversion rates but also allows brokers to handle a higher volume of leads without sacrificing quality, directly contributing to revenue growth.

Among the many CRM options available, Creatio stands out as the best mortgage CRM for brokers looking to drive growth. Creatio combines powerful automation, seamless integration, and comprehensive customization to meet the specific needs of the mortgage industry. Its intuitive interface and no-code technology allow brokers to easily tailor the CRM to their unique workflows, ensuring that every aspect of their business is optimized for efficiency and growth.

Adopting a robust mortgage CRM platform like Creatio equips brokers with the tools to not only streamline their processes but also build stronger client relationships and enhance overall business performance. By embracing this technology, brokers position themselves to achieve sustained growth and maintain a competitive edge in the dynamic mortgage market.