The Role of KYC in Banking

In today's globalized financial landscape, the rising tide of fraud, corruption, money laundering, and terrorist financing poses a serious global concern. Estimates from the United Nations Office on Drugs and Crime (UNODC) reveal that 2 to 5% of the world's GDP, or $800 billion to $2 trillion in current US dollars, is laundered each year.

To keep the financial system safe and protect customers' interests, banks have put in place a crucial set of measures called Know Your Customer, or Know Your Client, or KYC. In a nutshell, KYC involves three vital steps: first, making sure the customer is who they say they are; second, finding out where their money comes from; and third, figuring out how likely it is that the customer is laundering money.

KYC represents a comprehensive approach that integrates state-of-the-art technology, advanced data analysis, and human expertise. Its goal is clear: to build trust, stop illegal actions, and make sure regulations are followed.

What is KYC in Banking?

In banking, KYC, or Know Your Customer, refers to the procedures banks use to verify a customer's identity, understand their financial activities, and assess the risk of illegal transactions to ensure compliance with regulations and prevent financial crimes.

While specific KYC requirements may vary from country to country, they typically encompass three essential components: identity verification, customer due diligence, and continuous monitoring. Banks must adhere to KYC protocols when initiating account openings and must consistently update KYC data.

Customers typically need to provide proof of their identity and address to meet KYC standards. This proof can involve various methods such as verifying ID cards, using biometric data, or checking relevant documents. If you don't meet the minimum KYC standards, the bank may not open an account for you or end the business relationship. It's important to note that KYC isn't just a banking practice; it's a worldwide legal mandate crucial for ensuring compliance with Anti-Money Laundering (AML) regulations.

Why is KYC Important in Banking?

KYC is crucial in banking for three reasons:

- Financial safeguard. KYC serves as a robust defense against various financial crimes, including identity theft, money laundering, terrorism financing, etc. By checking customers' identities and financial activities, banks can discover suspicious activity and avoid fraud.

- Legal imperative. KYC is not just a best practice; it's a legal requirement in many jurisdictions. Non-compliance can result in hefty fines and reputational damage for banks.

- Trust building. KYC enhances trust between banks and their customers. Customers will feel more confident in their banking relationship if they know their bank is committed to security and following the rules.

What are the Components of KYC in Banking?

KYC procedures and steps vary by bank, but three main components are common:

Identity verification

The first step is gathering and validating consumer information, including name, birthdate, address, and passports or driver's licenses. Identity verification aims to confirm that the individual or business customer is who they say they are.

Customer Due Diligence (CDD)

CDD evaluates customer risk based on occupation, source of funds, and transaction history. This ensures that the customer is not involved in illegal activities. Banks can classify CDD as:

- Simplified Due Diligence (SDD) – is a simplified process for low-risk customers who are less likely to engage in money laundering or terrorism financing.

- Enhanced Due Diligence (EDD) – is a more thorough procedure that explores high-risk customers to identify and reduce money laundering, terrorism financing, and other financial crimes.

Ongoing monitoring

This step involves banks monitoring customer accounts and transactions for unusual or suspicious activity to comply with regulations and detect risks. Banks are legally obligated to notify authorities if the investigation finds suspicious or illegal activity.

What is KYC Automation in Banking?

In a continuously changing regulatory environment, banks must keep up with KYC regulations to avoid sanctions and large fines. But how can the bank achieve this success when traditional KYC processes are notorious for being laborious, error-prone, and expensive? Not to mention, manual procedures significantly slow down how quickly banks can onboard new customers.

The implementation of KYC automation is essential for overcoming these obstacles and carrying out KYC operations quickly, efficiently, and with least risk to the business. KYC automation uses cutting-edge software to streamline and improve the KYC workflow, while decreasing manual data entry and human intervention. The most evident KYC automation benefits are:

- Enhanced operational efficiency

- Reduced labor costs associated with manual data entry and verification

- Minimized potential for human errors

- More comprehensive and consistent risk assessments

- Streamlined customer onboarding

- Enhanced overall competitiveness in the dynamic banking industry

Key Features to Look for in KYC Solutions

A robust KYC solution should have several critical features that help banks manage identity verification and risk assessment:

- 360-degree customer view – a key component that delivers a complete picture of customer data for fast, accurate identity verification and risk assessment.

- Effortless end-to-end automation: automation of the entire KYC process, from data capture and verification to ongoing monitoring and reporting, ensuring a streamlined and efficient workflow.

- Intelligent risk management: incorporating AI and machine learning algorithms for intelligent data analysis, anomaly detection, and predictive insights, improving risk identification accuracy and efficiency.

- Seamless data fusion: the ability to seamlessly integrate with various data sources, both internal and external, to gather and cross-reference customer information effectively.

- Informed decision-making: robust analytics tools to help banks gain insights from KYC data and complete reporting for compliance and audits.

- Tailored user experience: user-friendly interfaces that allow for customization to meet the specific needs and preferences of the bank, ensuring flexibility and adaptability.

- Fortified data security: advanced security features, including encryption, access controls, and audit trails, to protect sensitive KYC data and maintain regulatory compliance.

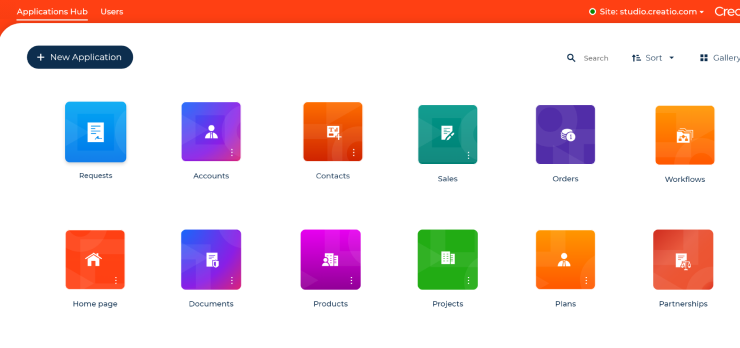

The Creatio solution is a game-changer for KYC in banking, seamlessly integrating all crucial components into a robust, modern platform. With its no-code capabilities, it not only streamlines KYC workflows but also offers extensive automation for various front-office and middle-office tasks, and CRM functions, providing unparalleled flexibility to financial institutions.

Conclusion

KYC in banking is an essential practice in the face of growing financial threats. It serves as a vital financial safeguard, a legal imperative, and a trust-building mechanism between banks and their customers. KYC's multifaceted components, including identity verification, customer due diligence, and ongoing monitoring, collectively work to ensure a secure and transparent financial ecosystem. Additionally, the adoption of KYC automation addresses the challenges posed by evolving regulations and enhances efficiency in customer onboarding and risk assessment, ultimately strengthening the competitiveness in the ever-evolving banking industry.

FAQ

What is KYC in banking?

KYC means Know Your Customer and sometimes Know Your Client. KYC is the set of procedures through which banks verify a customer's identity, understand their financial activity, and assess the risk of unlawful transactions to comply with legislation and prevent financial crimes.

Why is KYC important in banking?

KYC is crucial in banking for three reasons: it serves as a financial safeguard against illicit activities, is a legal requirement in many jurisdictions, and enhances trust between banks and customers.

How is KYC performed?

KYC is performed by verifying a customer's identity, assessing the source of their funds, and continuously monitoring their financial activities to ensure compliance with regulations and identify any suspicious behavior or risks.