-

No-code

Platform

-

Studio

No-code agentic platform to build applications and AI agents

Discover

-

Studio

-

AI-Native CRM

-

Industries

- Customers

-

Partners

-

About

Investment Banking CRM Complete Guide + 5 Best Solutions

Updated on

October 02, 2024

12 min read

Creatio: Secure, Ai-Native CRM for Investment Bankers

Investment banking is a fast-paced, complex industry that relies heavily on building strong client relationships and staying ahead of market trends. As deal volumes grow and regulatory requirements tighten, Customer Relationship Management software has become an essential tool for investment banks to manage client data, streamline workflows, and ensure compliance with industry regulations.

This article explores the role of CRM in investment banking, the challenges it helps solve, the top CRM solutions available, and what the future holds for CRM technology in the financial sector.

What is Investment Banking CRM?

CRM in investment banking is a customer relationship management system tailored to meet the specific needs of financial institutions. It helps banks manage client relationships, track deals, and streamline communication, enabling personalized services, efficient workflows, and enhanced client engagement, which are crucial in high-stakes financial environments.

Overcoming Investment Banking Challenges with CRM Software

Investment banking is dealing with a lot of challenges, including efficiently managing client relationships and staying compliant with strict industry regulations. A CRM system designed for investment banks helps streamline business operations and overcome challenges specific to the investment industry.

Below are some common challenges faced by investment banks and how CRM software addresses them:

Problem 1: Managing complex client relationships

Investment banks have to manage relationships with all kinds of clients, including high-net-worth individuals, corporations, and institutional investors. These relationships can tend to be quite complex as each client has unique needs and preferences that have to be met to ensure their satisfaction. Investment banking firm clients typically expect expert advice tailored to their case, seamless deal execution, and high returns on investment.

Keeping track of all the communication, transaction histories, investment portfolios, and preferences of multiple clients can be overwhelming. Especially since, given the nature of the investment banking industry, clients usually require intense communication at the beginning and regular updates throughout the whole relationship. Managing these complex client relationships is challenging but essential, as dissatisfied clients will move to competitors without hesitation.

Solution:

CRM software for investment banking helps navigate these complex relationships by centralizing client data and providing a complete view of each client’s profile in one, easily accessible platform. Bankers can quickly access the client's comprehensive data profiles including deal history, preferences, and communication records without switching between different systems and wasting time compiling all the important information. With a comprehensive view of clients’ data, they can personalize client interactions, provide tailored services, and build strong, long-term relationships.

Problem 2: Tracking deal pipelines

Investment bankers usually have to work on multiple deals at the same time. Keeping track of each deal's progress, deadlines, and follow-ups can be challenging, especially without dedicated tools. However, bankers cannot afford any mistakes, as they can lead to delayed deals, missed opportunities, and client dissatisfaction.

Solution:

CRM systems help track all deals in real-time in a unified platform. Investment bankers using a CRM can easily monitor deal progress, set reminders for important tasks, and share updates with team members. Additionally, CRM software automatically updates clients’ data, sends notifications, and generates reports, ensuring everyone is informed and deadlines are met. This ensures deal teams can focus on managing deal flow and avoid costly mistakes.

Problem 3: Meeting regulatory and compliance requirements

Investment banking institutions operate in a heavily regulated environment, with strict laws and industry standards. Failing to meet compliance with these industry regulations can lead to significant fines and a damaged reputation. However, monitoring and documenting all compliance activities across various jurisdictions can be complex.

Solution:

CRM software can help automate compliance tracking and reporting. It also tracks all regulatory requirements and updates the system to meet them, ensuring the bank’s compliance with the newest regulations. This simplifies the audit process and helps avoid legal complications.

Problem 4: Cybersecurity threats

With increasing cyberattacks and data breach threats, investment banks have to ensure robust security measures to protect sensitive customers’ data and financial information. Failing to do so can result in serious legal issues and loss of client trust.

Solution:

CRM systems are equipped with advanced security protocols like end-to-end data encryption, multi-factor authentication, and role-based access controls. These robust security features reduce the risk of security data breaches and ensure that client information is protected from unauthorized access.

Problem 5: Global coordination

Investment banks often operate in multiple regions, all around the world. These global operations require coordinated efforts across international teams that operate in different countries, time zones, and regulatory landscapes. However, managing teams scattered around the world can be problematic if communication is not properly aligned. Miscommunication between offices can cause many problems, from delayed deals and missed opportunities to inconsistent client service, impacting the bank's reputation and profitability.

Solution:

Investment banking CRM systems offer real-time access to client data and deal updates, ensuring that all team members, regardless of location, can collaborate effectively. This global visibility promotes smoother coordination, enabling teams to work together on deals with ease.

Problem 6: Managing operational risks

Investment banks face a variety of operational risks. Global economic fluctuations like changes in interest rates, stock values, and currency fluctuations can negatively impact banks’ revenue. Technological problems like system breakdowns can disrupt banks’ operations and cause concern for customers. And of course, procedural or human errors can lead to disruptions in client service, compliance breaches, or delays, all of which can harm the bank’s reputation. These risks can negatively impact both the bank’s operations and its reputation, that’s why they need to be managed effectively.

Solution:

CRM software helps investment banks mitigate these risks by automating critical processes, ensuring data accuracy, and providing real-time monitoring of business processes. It also tracks market changes and industry trends, offering valuable insights to help investment bankers adjust their strategies. CRM systems enhance the bank's ability to respond quickly to operational challenges and market fluctuations by reducing errors and supporting data-driven decision-making.

By addressing these challenges, CRM systems empower investment banks to enhance their security, improve client relationships, and streamline global operations. This results in better outcomes for both the institution and its clients.

Staying Human in the Age of AI

Learn how financial institutions leverage AI and no-code to boost efficiency while delivering authentic, personalized customer experiences at scale

Benefits of CRM in Insurance Banking

Implementing CRM systems in investment banking offers numerous advantages that enhance efficiency, improve client relationships, and drive overall success.

Here are some key benefits:

1. Enhanced client relationships

CRM systems gather and analyze all clients’ data and provide a comprehensive view of each customer's needs, investment preferences, risk tolerance, and history of customer interactions with a bank. This helps investment bankers segment their client base, gain deeper insights into their behavior, and personalize services, communication styles, etc.

With CRM software marketing teams can improve their efforts and reach potential clients more effectively with tailored messages. Sales teams can prepare sales pitches that resonate with client’s needs and preferences, allowing them to build stronger relationships. Customer service teams can solve issues and support clients more quickly and effectively.

All in all, investment banking CRMs help all customer-facing teams enhance their operations and improve outcomes.

2. Improved deal management

With a comprehensive CRM solution, investment bankers can track deal flow throughout their lifecycle without any issues. CRM automatically tracks each potential client and deal, allowing bankers to monitor progress, and swing into action when prospects are ready to speak to an advisor.

3. Increased sales performance

CRM systems for investment banking empower bankers to close more deals, meet their quota, and increase revenue. With better visibility into their pipelines, improved deal management, and access to comprehensive clients’ data, they can improve their performance by optimizing sales strategy to individual cases. With information about the prospect’s goals and preferences, it’s easier to prepare a tailored solution that will answer their needs better than a general offering.

4. Increased customer retention and loyalty

CRMs help banks win customer loyalty and improve client retention. Satisfied clients tend to stick with the same trusty bank and are less likely to leave for competition. To help bankers enhance customer loyalty and reduce churn, CRM software provides features that allow them to address client concerns before they escalate into problems and monitor satisfaction levels. By delivering exceptional service and personalized experiences, investment bankers can strengthen their relationships with clients and ensure long-term partnerships.

5. Streamlined compliance and risk management

Investment banking CRM software helps overcome one of the challenges that banks have to face. With a solution tailored to their industry, bankers can ensure compliance with industry regulations and standards like anti-money laundering (AML) laws, Know Your Customer (KYC) requirements, and the General Data Protection Regulation (GDPR).

6. Increased operational efficiency and productivity

CRM systems automate many routine tasks that usually take valuable time away from employees - manual data entry and update, report generation, etc.

With CRM for investment banking employees don't have to waste time on these mundane tasks and can focus on high-value activities like preparing personalized investment propositions, or creative marketing campaigns.

7. Enhanced security

CRM software can help banks overcome one of their greatest challenges - ensuring the safety of client information. With robust security features, CRM systems protect sensitive data from unauthorized access. These systems often include advanced encryption, multi-factor authentication, and strict access controls to ensure that only authorized personnel can view or modify client records.

Additionally, CRM platforms maintain detailed audit trails, tracking every user interaction with client data. This helps banks detect and prevent potential security breaches, ensuring compliance with data protection regulations and maintaining the trust of clients who rely on the bank's confidentiality and discretion.

Features of Investment Banking CRM

Investment banking CRM systems come equipped with a variety of features tailored to meet the unique needs of financial institutions.

Here are some key features of CRM software in investment banking:

1. Client profile management

CRM systems provide banks with a 360-degree view of clients, including their contact information, financial history, current portfolio, communication records, and wealth management programs. This centralized repository ensures bankers have all the necessary information to provide personalized service and support.

CRM for investment banking can automate processes related to account opening and streamline screening and verification procedures. It also improves document management to maximize customer satisfaction and reduce human errors.

2. Automated workflow tailored to investment banking

CRM platforms facilitate automated workflows for routine tasks, as well as industry-specific workflows like deal approvals, merger and acquisition (M&A) tracking, capital raising processes, tracking IPO roadshows, and regulatory compliance checks. These automated processes ensure that critical tasks are completed consistently and on time, reducing the likelihood of errors or delays.

3. Deal tracking and management

Investment banking CRMs offer tools for tracking deals through the whole deal lifecycle, from initial proposal to final closing. This feature allows bankers to monitor deadlines, manage tasks, and collaborate with team members to ensure everything goes smoothly.

4. Lead and opportunity management

CRM systems help investment banking firms track and capture leads from different sources into a unified database. Bankers can design their unique lead management processes to achieve the best conversion rates. With automated data verification, they can focus on increasing conversion without confirming data accuracy in different systems.

Investment bankers using CRM solutions tailored to their industry can easily manage opportunities and create optimal strategies for each potential client. With highly personalized value propositions based on relationship insights, the client's history of previous interactions and next-best-offer capability, they can improve customer engagement and build long-lasting relationships.

5. Risk management tools

CRM platforms in investment banking also come equipped with risk management tools to help banks assess, monitor, and mitigate various operational, market, and compliance risks. These tools track potential risks related to transactions, market fluctuations, and client portfolios, providing real-time alerts and insights.

6. Communication and collaboration tools

Integrated communication features, such as email tracking, chat, and shared calendars, facilitate collaboration among team members. This ensures that everyone involved in client management and business development is on the same page and can communicate efficiently.

7. Reporting and analytics

Investment banking software comes with robust reporting and analytics capabilities that help investment bankers gain insights into client behavior, deal performance, and market trends. Customizable dashboards and reports help decision-makers track key performance indicators and get actionable insights to make informed strategic choices.

8. Integration with other systems

CRM systems can integrate seamlessly with other software used by investment banks, such as accounting, trading, and market research platforms. This integration enhances data sharing and ensures that all relevant information is easily available in a unified platform.

Best Investment Banking CRM Software

Choosing the right CRM is vital for investment banks to optimize operations, manage complex client relationships, and maintain compliance with industry regulations.

Below are some of the leading CRM solutions for the investment banking sector:

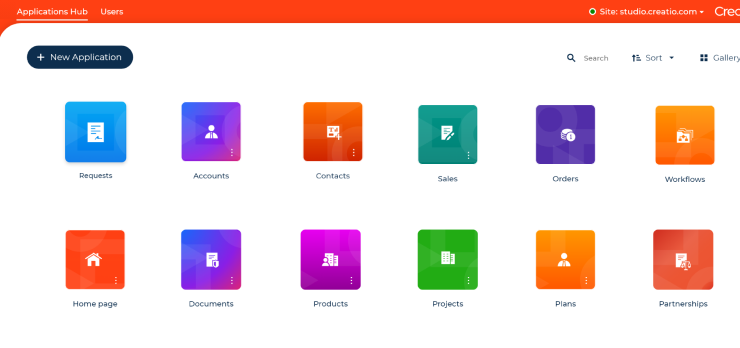

Creatio

Creatio stands out with its no-code platform and composable architecture, which allows investment banks to create and customize their CRM without technical expertise. The platform’s automation features can be tailored to streamline workflows for all customer-facing departments, including deal management, regulatory compliance tracking, and client engagement. Creatio also integrates seamlessly with other systems and over 700 applications, making it highly adaptable to the unique needs of each investment bank.

Creatio’s compliance feature

One of its key advantages is a user-friendly interface and drag-and-drop capabilities, designed to reduce complexity while boosting productivity. Creatio also offers an AI assistant, Copilot, which can improve business processes with intelligent workflow optimization recommendations and help banks make data-driven decisions.

Due to the extensive customization options offered by Creatio, the configuration might take some time. However, for banks looking for flexibility, powerful automation, and robust security and compliance capabilities, Creatio is the best solution.

Creatio was mentioned as one of the top vendors in Forrester’s overview The CRM For Financial Services Landscape, Q3 2024.

G2 Rating: 4.7/5

Transform your investment banking operations with Creatio’s powerful CRM solution

Salesforce

Salesforce is a popular CRM that helps banks optimize deal flow with unique client insights. It offers a compliant deal management feature, seamless collaboration, and AI-driven insights for efficient decision-making. Salesforce CRM helps banks cut down operational costs, and drive innovation.

However, Salesforce is known for its steep learning curve, especially for teams without technical expertise. Salesforce is also an expensive solution, which requires significant investment, especially when using advanced features like AI.

G2 Rating: 4.4/5

See also: Salesforce Alternatives & Competitors and Salesforce Marketing Cloud Alternatives & Competitors

Envestnet

Envestnet offers a client relationship management system called Tamarac CRM, designed specifically for independent advisors. It is an integrated cloud-based platform built on Microsoft Office 365 that offers an intuitive interface, and actionable relationship intelligence.

Envestnet CRM provides tools like Tamarac Trading for portfolio management, Tamarac Reporting for performance reporting, and pre-packaged automated workflows for opening and closing financial accounts, client onboarding, wealth management, etc. Envestnet CRM seamlessly integrates with third-party applications, including the Microsoft Office toolbox and Salesforce.

While Envestment is a good solution for independent financial advisors, it may lack the more advanced features and capability to handle multiple users and cases that investment banks require.

G2 Rating: 4.0/5

Zixflow

Zixflow is a customizable CRM purpose-built for investment banking. It offers customizable templates like fundraising list templates to store, track, and manage leads and client data. Zixflow also provides a visual deal pipeline, a virtual form builder to automate lead generation, an email validity checker, and a 360-degree customer view that helps banks deliver a personalized customer experience.

On the downside, Zixflow may not scale as well for larger firms, and it lacks some of the more advanced analytics and reporting features found in other CRMs.

G2 Rating: 4.9/5

Wealthbox CRM

Wealthbox CRM is designed for financial advisors and wealth management teams, offering intuitive client management and task-tracking features. It provides automated customizable workflows for increasing productivity, pipeline management and contact management capabilities, and integration with email boxes.

Wealthbox CRM is user-friendly with an easy onboarding process that doesn’t require extensive training. However, it lacks advanced deal management and analytics features needed by larger investment banks.

G2 Rating: 4.6/5

Future of Investment Banking CRM

As the financial landscape evolves, the future of CRM in investment banking will likely be shaped by advances in AI. According to Gartner report, the top game-changing technologies in the next three years will be Artificial Intelligence and Generative AI. Over 70% of surveyed CIOs and technology executives plan to implement these technologies as well as low-code/no-code development platforms by 2026.

AI will play a critical role in increasing productivity, driving digital transformation and reducing operational costs. Although GenAI technology promises huge benefits, it also presents certain risks. Finance service leaders are mostly concerned with privacy, transparency, and security issues. To minimize the risks associated with AI, banking firms need to work closely with legal and compliance teams to implement governance measures and provide guidelines.

With increasing regulatory scrutiny and cybersecurity threats, investment banks will increasingly rely on CRM systems to safeguard data and ensure compliance with industry regulations. Industry leaders plan to implement advanced authentication technologies in the near future to enhance cyber/information security.