Top 8 Digital Banking Platforms in 2025

Imagine you’ve just received your paycheck. What if your banking app can quickly sort your money into savings, spending, and investments? This is the power of digital banking, and it’s not an imagination anymore. FinTechs globally have already made it possible with numerous digital banking platforms.

Now, big banks are also moving towards digital banking systems. Customers’ preference toward a more innovative banking experience and good profit potential for the organizations are the two factors that fuelled the growth.

Statista has reported that the money banks make from interest income is expected to grow by 13.39% each year from 2024 to 2028. By the end of 2028, it will reach $1,219.00 billion. So, banks must find the right digital banking software to seize the opportunity.

How does the right software help? Banks can do their work easily and give customers an enhanced and faster banking experience. This is why we are exploring the Top 8 Digital Banking Platform for 2025.

What Is A Digital Banking Platform?

Digital banking software is used by many financial institutions – like banks or credit unions – to provide online banking services. It allows them to move traditional banking activities to digital platforms.

Such software products are helpful for different types of financial businesses, big or small. Here are some uses and features:

- Managing loan and asset accounts with minimal human involvement.

- Managing everyday banking activities like deposits and lending.

- Moving funds from current to various types of savings accounts.

- Marketing automation and client database management.

- Adding new functions to the bank’s primary operations using no-code and low-code tools.

With digital banking software, small banks can attract more customers, and big international banks can reduce manual work by changing it into automatic workflows.

Benefits of Digital Banking Platforms

Digital banking software brings many benefits to banks and financial institutions. Here are some key advantages of using a digital banking software:

Cost efficiency

Digital banking software helps banks save money in several ways. Here are a few of them:

- Reduced staffing needs: Less staff is needed when customers can do things like open accounts or check loans online.

- Less physical space: If more people are banking online, banks don’t need as many physical locations, saving on rent and other building costs.

- Paperless transactions: Digital banking cuts down on the use of paper, which saves money on supplies.

- Automated processes: Tasks get done faster and with less effort when they are automated, saving on labor costs.

- Lowered transaction costs: It's usually cheaper to process digital transactions compared to traditional ones.

Convenience

With digital banking tools, customers can handle their banking needs anytime, anywhere, even from their phones. Think about signing up. Customers won’t have to visit a physical branch. Instead, they can do it right from their phone in minutes. This substantially speeds up the whole process of getting new customers on board. Just a few clicks, and they are set.

More conveniences include:

- Scheduled transfers

- Quick customer service via chat or call-backs

- Budget tracking and management tools

- Digital loan applications and approvals

- Access to financial insights and advice

- Cross-platform accessibility (desktop, mobile, tablet)

Loan application management

Enhanced security

Some people worry digital banking might not be safe, but it’s actually really secure. For instance, digital platforms can use facial recognition or fingerprint scans to make sure only the right person accesses the account. They can also send alerts if someone tries to log in from a strange place. So, in many ways, digital banking provides tighter security than traditional banking.

Efficient cash management

Cash management features are essential for both banks and customers. Having digital banking software is like having a vigilant assistant that monitors every cash flow meticulously. It lets both the bank and customers plan their finances better.

Streamlined decision-making

Digital banking software efficiently analyzes vast datasets to uncover vital insights. You can easily track what strategies are working and what are not. The simplicity of data presentation makes interpreting insights a straightforward task. Many advanced digital banking platforms also use AI and ML for trend and risk analysis in real-time.

How Digital Banking Platforms Are Utilized

Digital banking software isn't just a modern accessory but a fundamental tool for any banking institution. In every banking aspect, it can deliver a better experience – for the customers and for the banking professionals. Here are a few specific use cases that clearly show how digital banking software is reshaping the industry:

Online account management

Bank managers can streamline lengthy processes like account opening by implementing digital banking. On the other hand, customers no longer need to visit a physical branch or even reach out to the call center. They can now quickly check balances, view customized statements, and transfer funds.

Mobile banking

Mobile banking features bring the bank right to your pocket. You can check account balances on the move or transfer money while shopping. For bank managers, it means fewer people coming into the branches. So, there are shorter queues and less rush in the branches.

The young generation is riding the mobile banking wave, too. Statista found in 2021 that 74% of people between the ages of 15 and 24 used mobile banking apps.

Bill payment and invoicing

No more dealing with heaps of paperwork. Digital banking platforms facilitate easy bill payments and invoicing. Customers can pay bills, set up recurring payments, and manage invoices with just a few clicks. For the bank, it's fewer errors and a streamlined process that requires fewer human resources.

Cash flow forecasting

Cash flow management is one of the activities that make or break a financial institution. As a banking professional, you would always want to clearly visualize the inflow and outflow of your cash balances. Modern-day digital banking software gives you clear pictures and data-driven insights into your cash reserves in real-time. At the same time, your customers would also know their income and expenses. So, it’s a win-win.

Remote check deposits

Even a few years back, depositing a check without a visit to the bank was impossible. Digital banking software has changed it. Customers can now simply take a picture and remotely authorize a check deposit. So, what’s the benefit for the banks? It means you will have fewer human resources to serve the customers.

Top 8 Digital Banking Platforms in 2025

When you want to deliver smooth online banking facilities for your clients, choosing the right digital banking software is among the first steps. Your options are countless. So, we've curated the top digital banking software solutions based on user-friendliness, security, and innovative features.

Let’s explore the top 8 digital banking software for 2025.

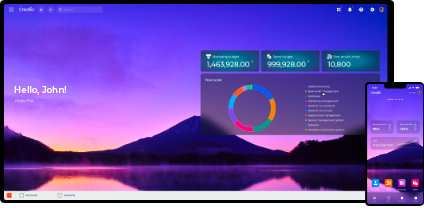

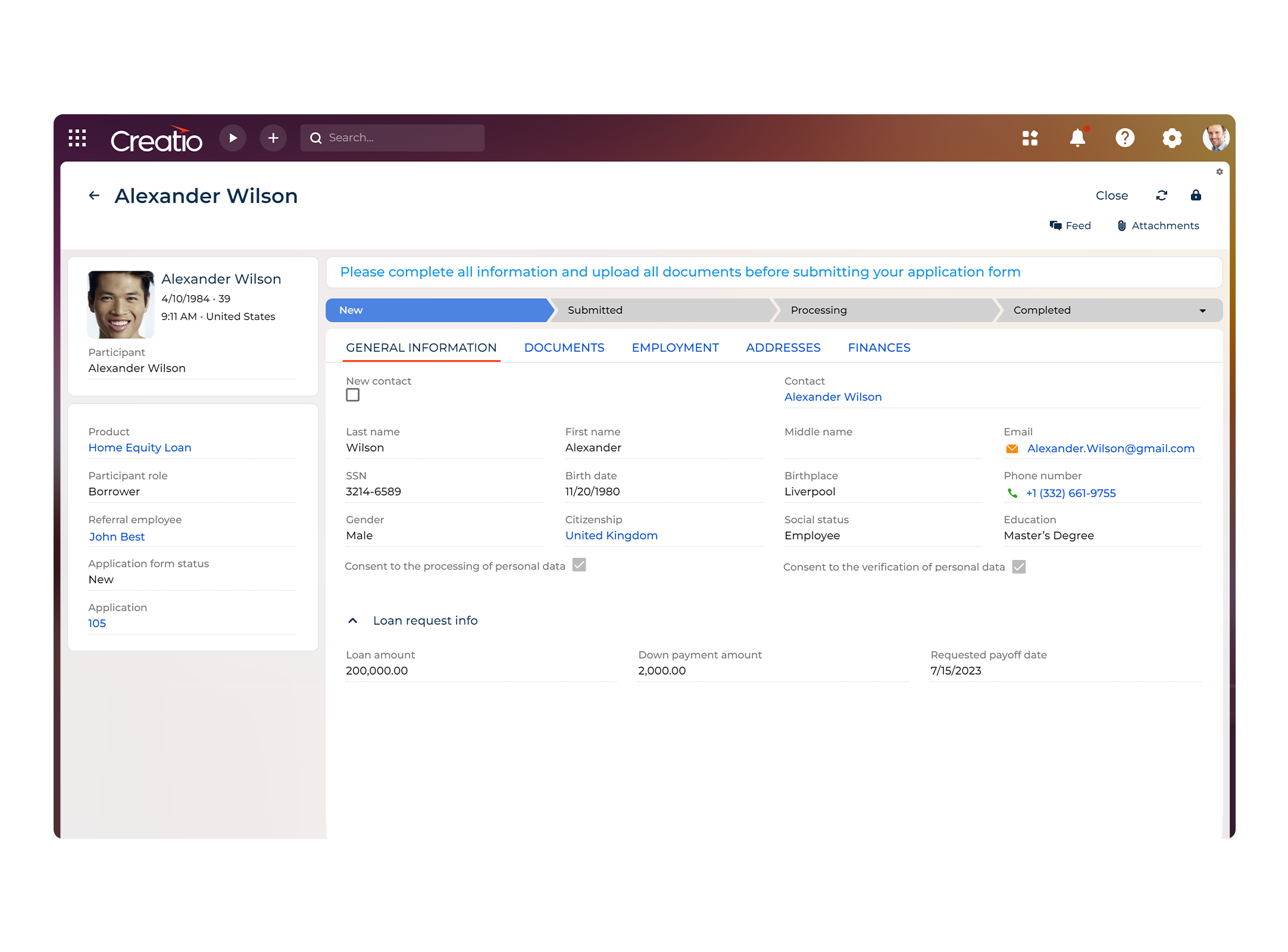

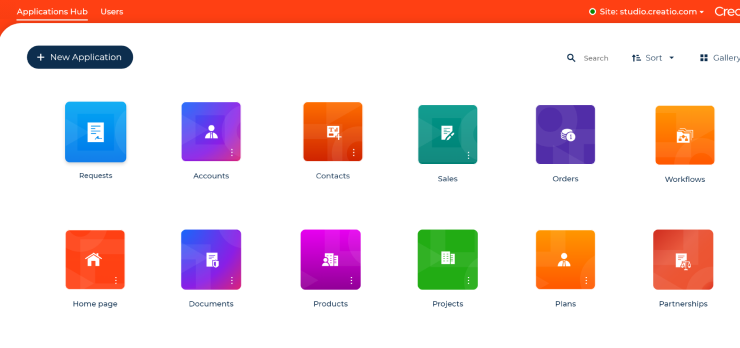

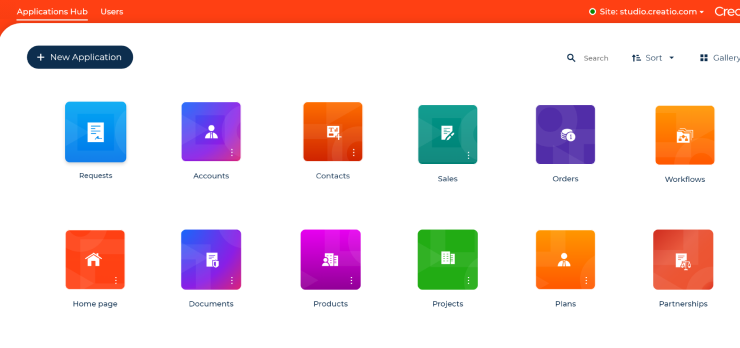

1. Creatio

Creatio offers a cutting-edge, unified CRM and no-code solution that empowers financial institutions to revolutionize their digital banking operations. By embracing Creatio's solution, banks can not only optimize their operational efficiency but also deliver an unparalleled banking experience to their customers, ensuring their financial needs are met with precision and ease.

Here are some of its key features:

- Customer onboarding

- Account operations

- Lending

- Verification and underwriting

- Know your customer

- Compliance and risk management

- Omni-channel engagement

- Customer experience management

- AI-powered analytics and decisioning

- No-code tools for solution customization and custom application development

2. Appway

Founded in 2003 and based in Wellington, New Zealand, the FNZ group acquired the Appway Digital Banking platform. The platform is now known as FNZ and serves many banks and financial institutions globally. FNZ lets you develop an intelligent workflow management process. The platform aims to benefit financial institutions through tangible results in terms of improved cost-to-income ratio.

The FNZ app helps banks with the following features:

- KYC management

- Regulatory reviews of the customers and loan applications

- Client administration

- Compliance management

- Integrations with external apps

3. Oracle

Oracle Banking Digital Experience is a feature-rich SaaS-based digital banking platform. One of Oracle’s key strengths comes with its hot-pluggable features. It means banks, insurance, and financial institutions that use Oracle Banking Digital Experience can quickly add new features to their banking solution menu or remove the less-required ones.

Key features include:

- Document upload, storage, and managementI

- Unified customer touchpoint experience

- Retail, corporate, and SME, banking integration under one umbrella

- P2P payment management

- iMessage, Siri, and social media integration

- Digital wallet with comprehensive wealth management tools

Oracle serves three areas as a digital banking platform – retail origination or customer onboarding, payment management and transfers, and platform-based solutions through a self-service portal.

4. Sopra

Sopra Banking Platform serves financial institutions and banks as a cloud-based service provider with a programmable and highly customizable platform. The digital banking platform offers various banking services like payment handling, loans and asset management, and compliance management.

Key capabilities include:

- Payment processing through quick integration with external payment platforms like Google Pay and ApplePay

- Regulatory reporting and programmable compliance management

- Compatibility with large-scale API platforms like AWS and Axway

5. nCino

Founded in 2011 and based in North Carolina, the nCino Bank Operating System is an intuitive and user-friendly digital banking platform that can significantly ease retail banking and loan management.

Some of the core services offered by nCino include:

- Account opening and onboarding

- Consumer, SME, and corporate loan management

- Portfolio insights and analysis

- Document management for large enterprises

- AI-powered banking operations known as nCino IQ or nIQ provide low-code automation

6. Finflux

Finflux is a cloud-based automation and digital banking platform. The company boasts over 20 million active individual customers and over 60 institutional clients across 15 countries. Finflux promised to streamline how you deliver financial and banking services.

They offer:

- Automated debt collection system

- Loan management

- Lending operations

- Liability and asset management with detailed and actionable insights

- Gold loan system with full optimization of your loan portfolio

- Holistic customer journey management

7. Finacle

Founded in 2000, Finacle has been serving hundreds of medium and large banks and financial institutions globally as a leading and one of the oldest banking software. Since the release of Finacle online banking as the company’s digital banking platform, they have held the same reputation. Elevated and streamlined customer experience is Finacle’s top priority.

Finacle online banking helps with:

- Cash management

- Corporate banking

- Digital engagement tools

- Trading management platforms with automation capabilities

- Payment handling and fund transfers

- Liquidity management

- Lending automation

8. NCR Digital Insight

NCR Digital Insight promises a future-ready and customer-focused banking experience for financial institutions and services. The digital banking platform helps you bring the full range of banking solutions within a single, unified app. The API-driven customization and automation means you can effortlessly add or program new features.

Some of NCR Digital Insight’s features are:

- Account management

- Banking workflows automation

- Advanced data analytics and business insights

- A unified communication interface

Conclusion

Digital banking software solutions have emerged as a necessity for the modern-day financial industries. Both retail and business customers prefer digital banking platforms for the exceptional convenience they can provide.

Yet, many banks and financial companies find it challenging to adapt the solution mostly because of the rigorous IT requirements. This is where Creatio steps in. The no-code digital banking automation platform lets you quickly and easily automate your banking activities, from lending to compliance management and marketing to customer service.

FAQ

What is digital banking platform?

Digital banking platform is a technology software that enables financial institutions to offer banking services to customers through digital channels such as mobile apps and websites.

Is digital banking secure?

Yes, digital banking software prioritizes security. It typically employs encryption, multi-factor authentication, and real-time fraud detection to protect your financial information.

What is the most used banking software?

With the increased demand for digital banking solutions, many digital banking platforms have emerged globally. Some of the leading digital banking platforms include Creatio, FNZ, Oracle, Sopra, nCino, Finflux, Finacle, and NCR Digital.