Best CRM Software for Insurance Agents: Full Guide with 8 Best CRM’s Inside

Perhaps more than in any other industry, insurance providers’ success depends on their relationships with customers. According to Coveo, just two negative interactions are enough for most customers to turn to a competing insurance business. That's why exceptional customer service is vital in the insurance industry.

Yet, many insurance agents struggle to provide truly exceptional experience. Nowadays, insurance clients expect a seamless, connected, and personalized experience across both digital and in-person interactions. Meeting these expectations provides real business value – Accenture reports that insurers offering personalized services can increase customer engagement by as much as 89%.

It is clear that the traditional approach to client relationships, often marked by siloed and fragmented communication, is contradictory to business growth. A modern customer relationship management (CRM) system is the key to meeting and surpassing customer expectations.

Advanced insurance CRM platforms enable a level of hyper-personalization and seamless service that was once unimaginable in the insurance industry. They provide a centralized, frictionless experience from the very first touchpoint through lifelong customer retention.

This article explains how insurance agents benefit from a modern insurance CRM solution and recommends how to choose the best CRM software for your insurance business.

What is an Insurance CRM?

An insurance CRM (Customer Relationship Management) system is software designed for an insurance business to help manage customer data and cover the entire customer journey. CRM systems combine tools for sales and marketing automation, as well as customer service management, into a single platform.

CRM software enables insurance agents to leverage client data and automate interactions across multiple channels to create an impeccable customer experience. Here's a typical use case for a CRM for insurance agents.

Let's say John contacts an insurance agent to ask if his health insurance policy covers dental work. Since your insurance agents have automated case routing set up, John’s request is immediately transferred to an available customer service agent knowledgeable in this particular policy.

The employee instantly pulls up John’s profile in the CRM for insurance agents and sees that the current policy does not cover his case. Looking at the history of interactions, the agent notices that John has already asked about dental care, which indicates that he might benefit from switching policies.

Keeping this in mind, the agent responds to John’s request and highlights relevant offers, while the insurance CRM automatically creates a record of a new opportunity for upselling and notifies a sales representative.

In this example, a CRM supports all interactions with the customer and empowers insurance agents to provide a smooth experience.

A CRM that heavily incorporates GenAI could carry out this interaction automatically with a chatbot and no human involvement whatsoever.

Why Insurance Agents Need CRM Software

Insurance agents face many obstacles when building customer relationships, which are caused by insufficient data and disconnected tech stacks. A modern insurance CRM helps overcome these obstacles by streamlining operations, improving data-driven decision-making, and ensuring seamless collaboration across teams.

1. Disjointed customer journeys

Does your sales team have to ask the same questions repeatedly when following up with leads? Do customer service managers spend too much time drafting long emails to assign cases?

Without a centralized insurance CRM system, customer interactions become frustratingly inefficient. A CRM for insurance agents provides a 360-degree view of each customer, consolidating all their information and interactions in one place for front-facing teams to consult. This unified view of all the client data ensures a smoother experience for both your team and your clients.

2. Slow manual processes that hinder productivity

Time-consuming but simple tasks such as updating customers’ info, assigning cases, requesting relevant documents, and searching for case-related details waste your employees’ time.

A CRM system can easily automate these routine processes, allowing your employees to focus on what matters most - building relationships and closing deals.

3. Missed opportunities for lead generation

A lack of centralized and comprehensive data can prevent you from identifying leads and upselling opportunities.

Moreover, when data is siloed between marketing, sales, and service teams, it becomes difficult to identify what needs improvement and how to optimize lead generation efforts for better results.

A CRM for insurance agents enables you to track customer behavior, preferences, and needs, and proactively engage with the right prospects at the right time.

4. Low customer retention

When processes are inefficient and interactions feel disjointed, customers are more likely to change providers. CRM software ensures consistent and personalized communication, making it easier to nurture relationships and improve retention rates.

Top Insurance CRM Benefits

Streamlined communications

According to the research by PWC, nearly half of insurance customers expect round-the-clock support. Insurance CRM software provides contact management features that synchronize communication channels like email, calls, and social media, enabling insurance agents to track all client interactions. This ensures a cohesive customer experience and reduces miscommunication.

Increased customer satisfaction

According to Accenture, offering personalized services can boost customer engagement by 89%. An insurance CRM allows businesses to gather and store detailed information about their customers, including preferences, purchase history, communication preferences, and feedback. With this data, insurance agents can personalize interactions, tailor offers, and provide relevant recommendations, enhancing the overall customer experience.

Enhanced productivity

Insurance CRMs streamline numerous sales processes that are both time-consuming and susceptible to human errors. It automates repetitive tasks like data entry and follow-ups, freeing up insurance agents to focus on core responsibilities such as policy sales and client relationship nurturing. This automation significantly boosts productivity levels.

Better decision-making

A CRM plays a pivotal role in empowering insurance agents to gather essential customer data and extract actionable insights, enabling them to refine and enhance their sales strategies.

CRM software offers customizable dashboards that present real-time information, allowing agents to stay updated with the latest trends, customer preferences, and market dynamics. This data-driven approach equips insurance agents with the knowledge they need to make informed decisions, personalize their interactions, and ultimately drive sales growth.

Increased profit

Sales and marketing automation helps establish a consistent sales process that leads prospects through your pipeline.

CRM systems offer valuable insights into your target audience, allowing you to design marketing campaigns and follow-up strategies that resonate more effectively with your ideal clients.

Automated lead tracking and management through CRM ensure no opportunity goes unnoticed. Automated lead scoring enables insurance agents to separate hot leads requiring immediate attention from those that still need nurturing.

Deal tracking allows insurance agents to see what's going on with each opportunity, identify potential obstacles, and address them proactively.

As a result, your sales process becomes more efficient. Coupled with enhanced customer service, a CRM can greatly enhance customer retention and positively impact your business profits.

8 Best CRM Software for Insurance Agents

Insurance CRM platforms need to adapt to the unique challenges associated with the industry: the need for multiple verifications and approvals, a varied product portfolio, and the need for thorough claims investigation. Because of this, a standard holistic CRM may not be the best choice for insurance companies.

In this roundup, we prioritized CRM solutions that allow a high degree of customization or those designed specifically for insurance agents. We compiled a list of the best CRM software platforms that fit the insurance sector.

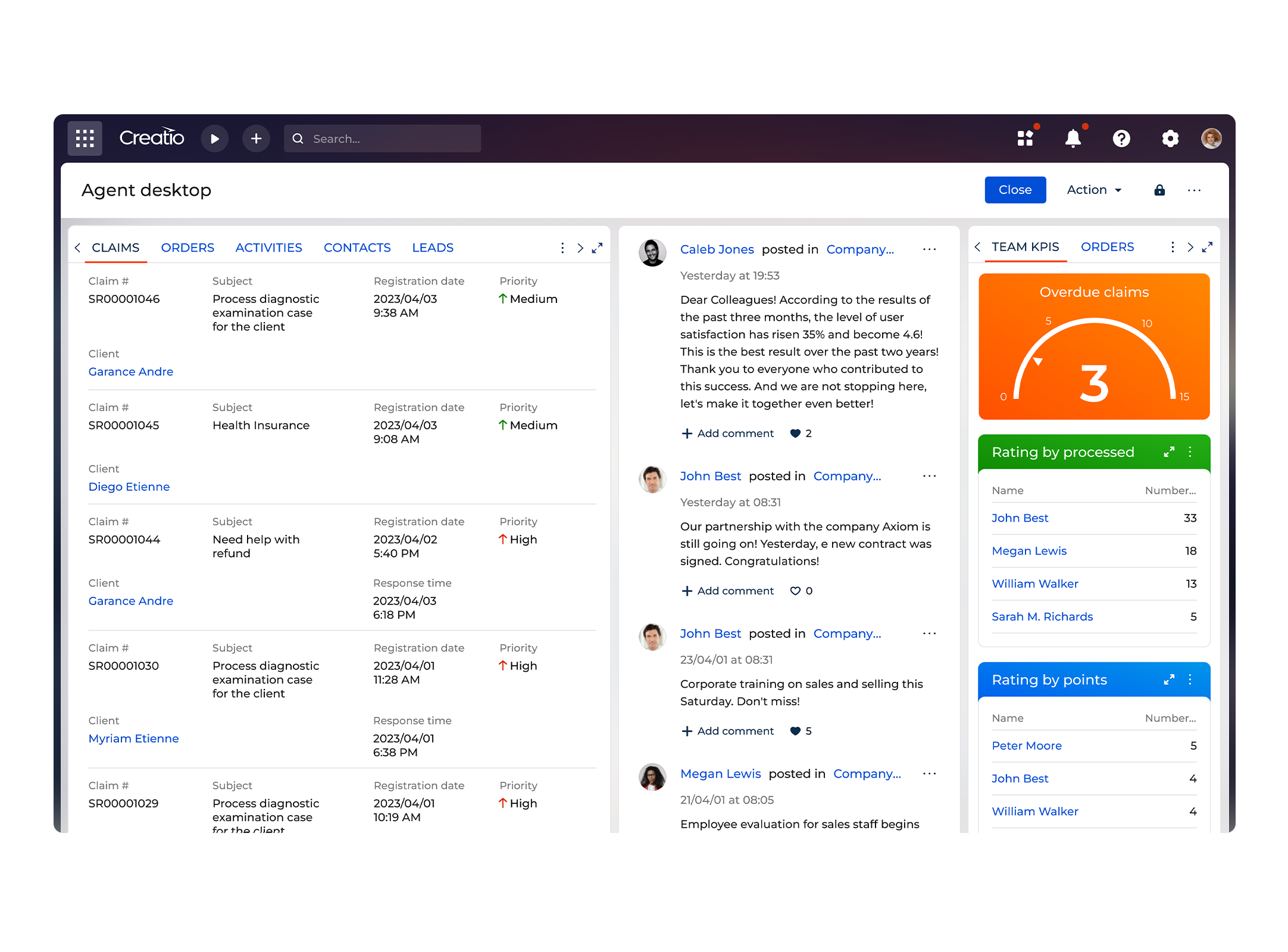

1. Creatio

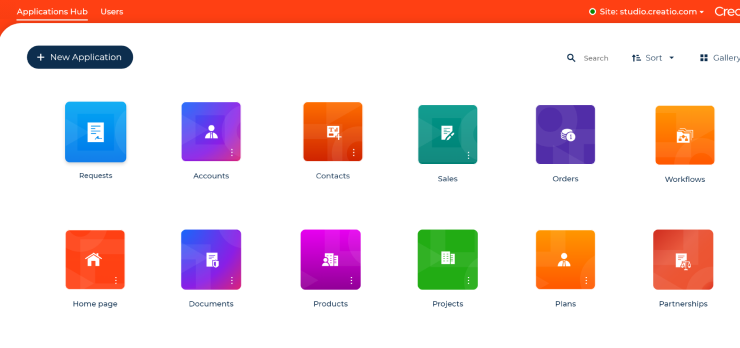

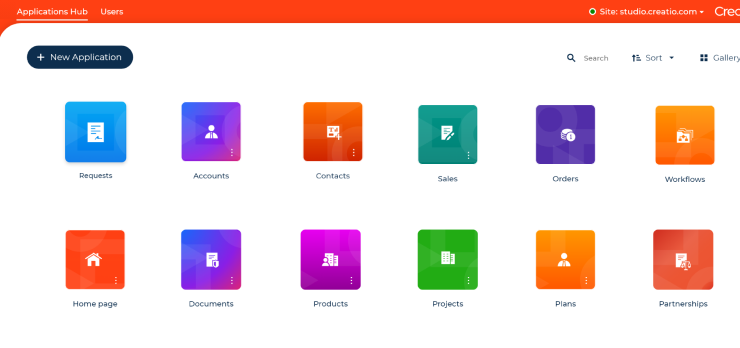

CRM Creatio is highly customizable and, at the same time, offers specialized insurance management tools, making it a perfect choice. Its no-code tools allow users to implement limitless customization without any need for technical knowledge.

The CRM consists of three products - Sales, Marketing, and Service, that address the entire customer lifecycle and streamline your relationships.

CRM Creatio is based on Creatio's no-code platform, Studio Creatio. Its composable architecture empowers users without coding expertise to effortlessly customize their CRM experience, workflows, and applications through robust no-code tools and composable apps.

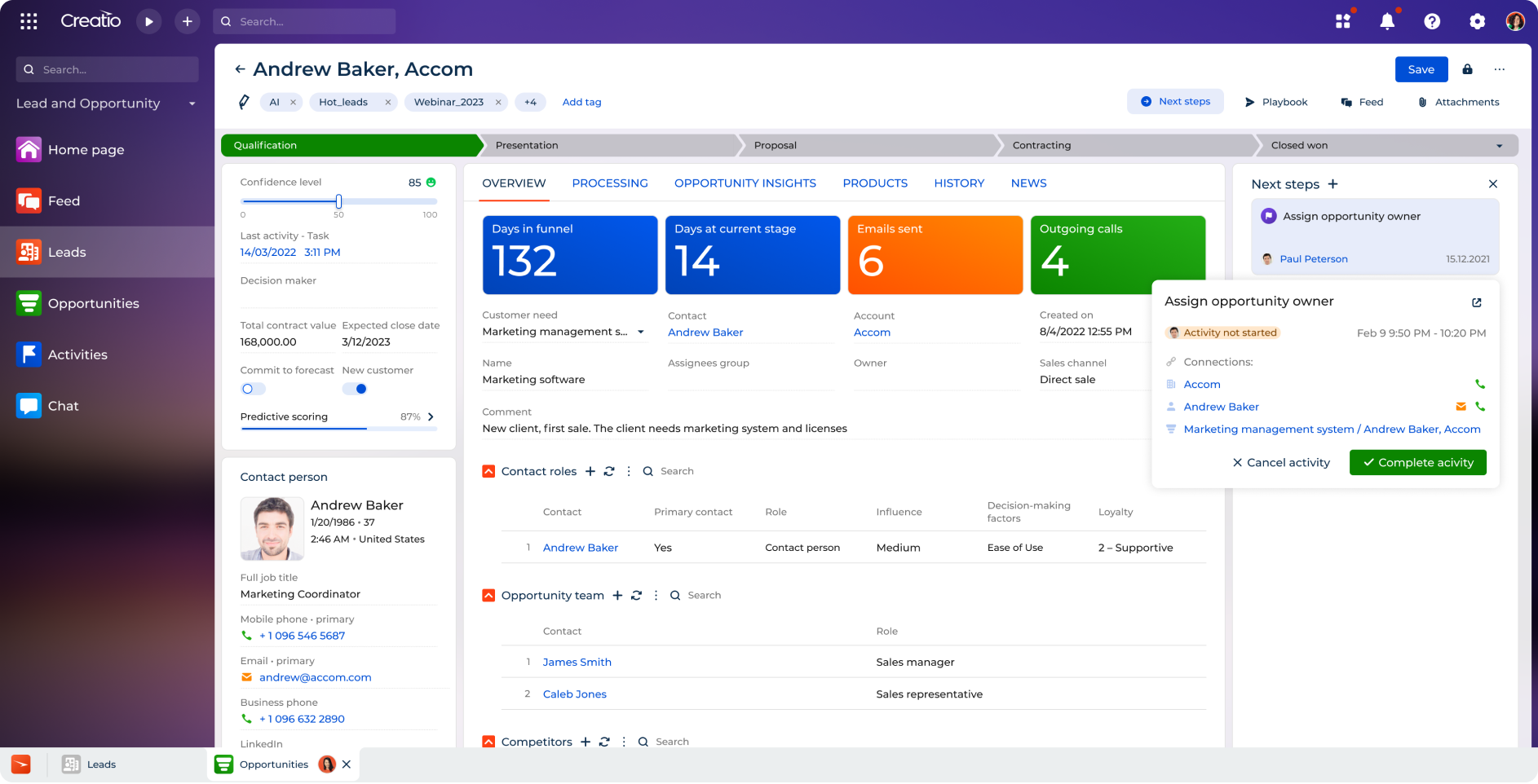

As an AI-native platform, Creatio utilizes predictive, generative, and agentic AI to help you create personalized marketing campaigns, score and manage leads, forecast sales, analyze your pipeline, and more. Creatio.ai serves as your personal assistant, which you can ask to find relevant information, suggest next best actions, or build an automated workflow.

Creatio offers a comprehensive set of insurance-specific features, including:

- Underwriting and verification tools enable quick access to the full insurance application data and utilize flexible checklists and automated review/approval workflows to streamline underwriting processes.

- Document management features allow users to keep a well-organized, transparent document system.

- Claims lifecycle management helps to supervise end-to-end claim lifecycle, from detailed investigations to precise appraisals.

- Policy administration enables the seamless, centralized management of policies.

In addition to that, Creatio's Marketplace provides more than 700 integrations, allowing you to connect other software you may use, for example, for billing and communication.

Overall, Creatio is a great choice for an end-to-end insurance CRM that covers the entire customer journey and automates insurance-specific processes.

Pricing

Creatio stands out with its unique composable pricing model that allows you to purchase its sales, service, and marketing automation products unbundled. The pricing for the core no-code platform starts from $25 per user/month and then you can pay $15 each for Sales, Marketing, and Service products.

See how Creatio's CRM software can elevate your insurance agency

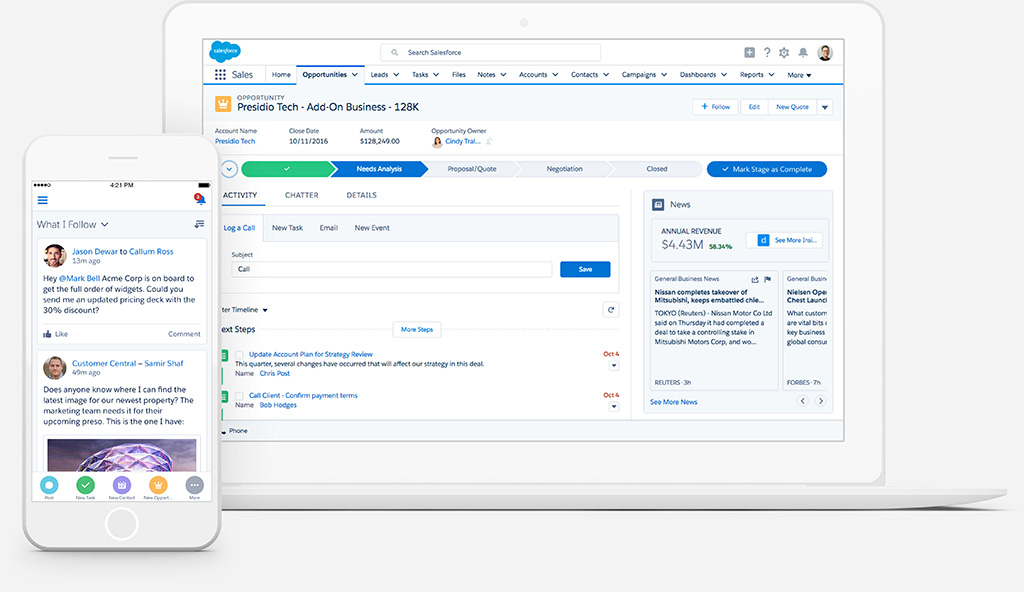

2. Salesforce

Salesforce is one of the most famous CRM software platforms that offer a wide portfolio of sales and marketing automation tools. Its solution for financial services targets the insurance industry, offering tools for claims tracking, service enhancements, mergers and acquisitions support, and RFP submission.

Salesforce leverages data-driven automation to enhance the efficiency of insurance operations and systems, accelerating processes like claims handling, billing, risk analytics, and propensity modeling.

By ensuring seamless connectivity across operations, Salesforce enables you to elevate customer service standards while maintaining cost-effectiveness. It provides 360-degree customer view and sophisticated communication tools to enable users to deliver quick and consistent customer service across every channel.

Being a legacy CRM vendor, Salesforce is a logical choice for an insurance agency that is already using Salesforce products. An insurance company looking for well-established vendors supported by a wide partner and developer network may also benefit from this CRM system.

Pricing

The CRM entails sales and customer service and costs $325 per user/month. In addition to that, you can purchase insurance-specific products for claim management and policy administration for $27 000 and $42 000 respectively.

See also: Salesforce Alternatives & Competitors and Salesforce Marketing Cloud Alternatives & Competitors

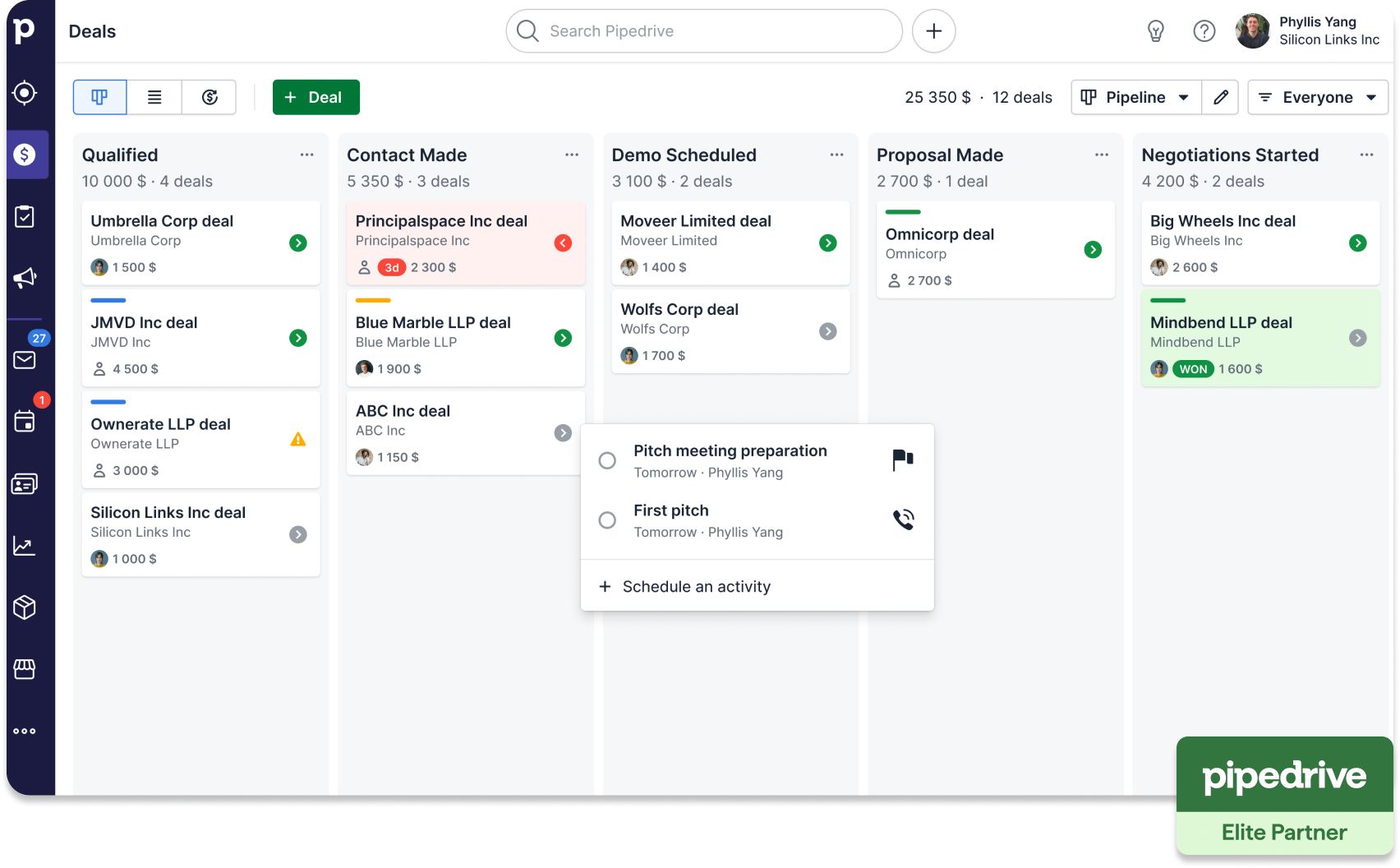

3. Pipedrive

Pipedrive is a CRM designed to strengthen customer relationships, automate operations, and support data-driven decision-making.

Pipedrive provides a unified platform for managing customer communications across various channels such as email, phone, and live chat. This integration ensures a seamless experience for customers and agents alike, enhancing overall operational efficiency and service quality. the platform's sales automation capability and the enforcement of rules to meet service-level agreements (SLAs) further streamline operations and optimize productivity.

Automated renewals are a key aspect, streamlining the renewal process through automated follow-ups and notifications. This ensures timely renewals, contributing to consistent revenue streams. Efficient claims management is another highlight, with automation facilitating quick assignment and resolution of claims.

Its user-friendly UI and powerful sales automation tools make Pipedrive an excellent option for an insurance agency looking for easy-to-use CRM software that can support your customer-facing processes.

Pricing

Pipedriver pricing starts at $15 per user/month.

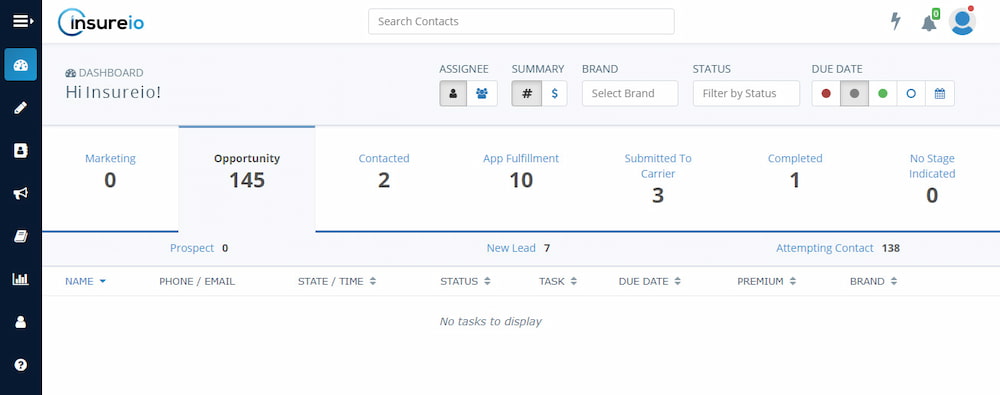

4. Insureio

As the first CRM system designed specifically for insurance companies on that list, Insureio is a feature-rich software that streamlines marketing and leads management. Its primary focus is on empowering insurance agents by reducing administrative burdens and providing specialized insurance management tools, enabling them to prioritize their sales pipelines more effectively.

The platform's key features include robust lead and client management capabilities, ensuring that agents can efficiently track and nurture prospects throughout the sales process. Insureio also offers comprehensive automation tools for sales and marketing activities, including a variety of sales and marketing templates.

Additionally, Insureio's application workflow and approval automation functionalities play a crucial role in expediting the insurance application process, leading to quicker approvals. However, this CRM doesn't offer extensive customer service features, thus, it won't be able to automate the entire customer journey.

Look into Insureio if your insurance agency is looking for a powerful purpose-built insurance CRM software with a focus on lead management.

Pricing

Insureio's pricing starts at $25 per month.

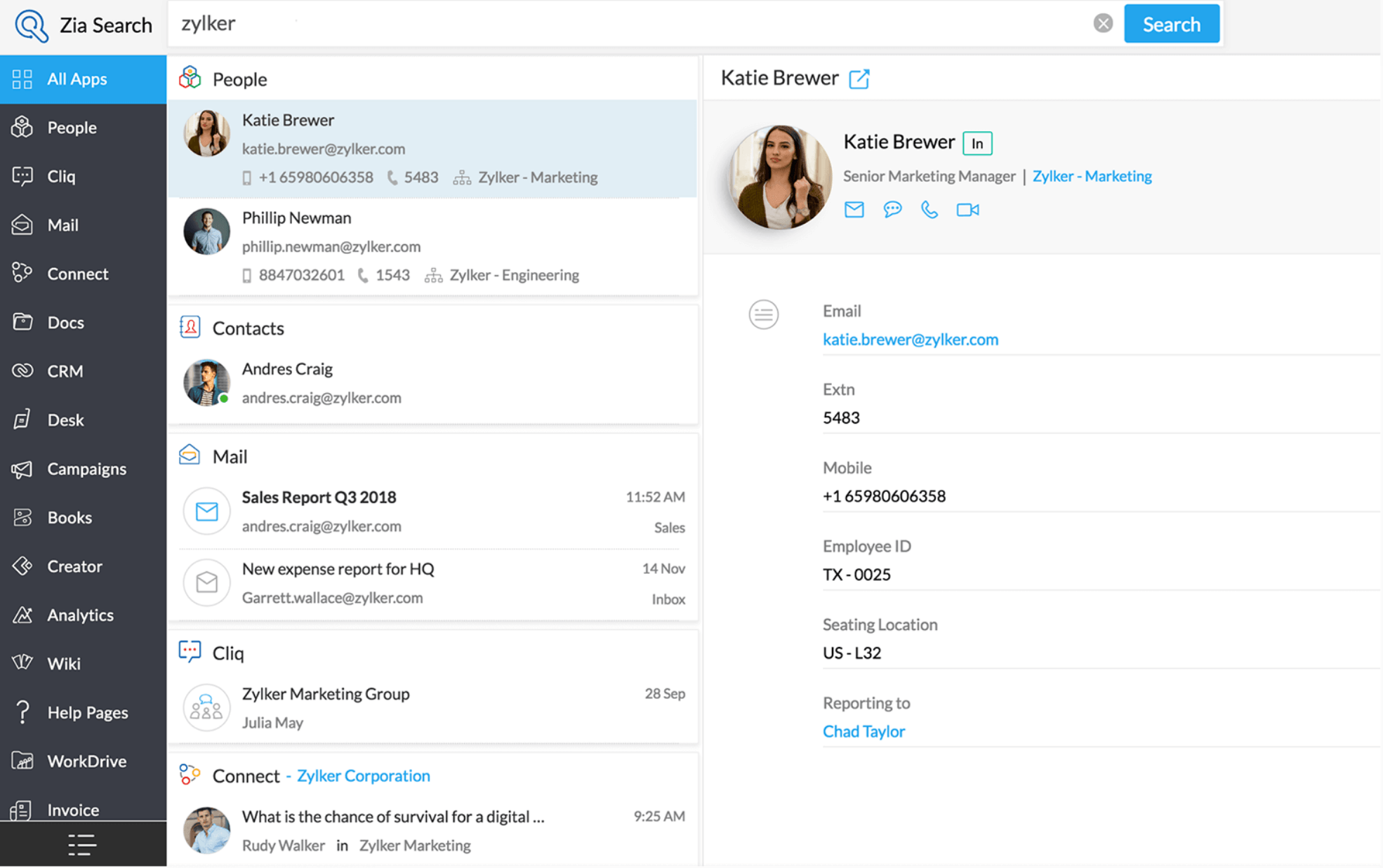

5. Zoho CRM

Zoho CRM offers a range of key features designed to enhance efficiency and productivity for insurance professionals.

One notable feature is its lead management tools, allowing users to capture leads, automate lead scoring, and identify leads with high conversion potential. This streamlined lead management process enables sales agents to focus their efforts on the most promising leads, increasing overall sales effectiveness.

Another crucial aspect of this CRM for insurance agencies is its efficient deal management capabilities. Agents can track deals at various stages, from initial contact to closure, and seize opportunities at the optimal moment for maximum success.

This CRM software also incorporates AI-powered features, such as its assistant Zia, which offers lead and deal predictions. These predictive insights simplify decision-making for the sales team, allowing them to make informed decisions and prioritize their efforts effectively.

Pricing

The pricing for Zoho CRM starts at $20 per user/month.

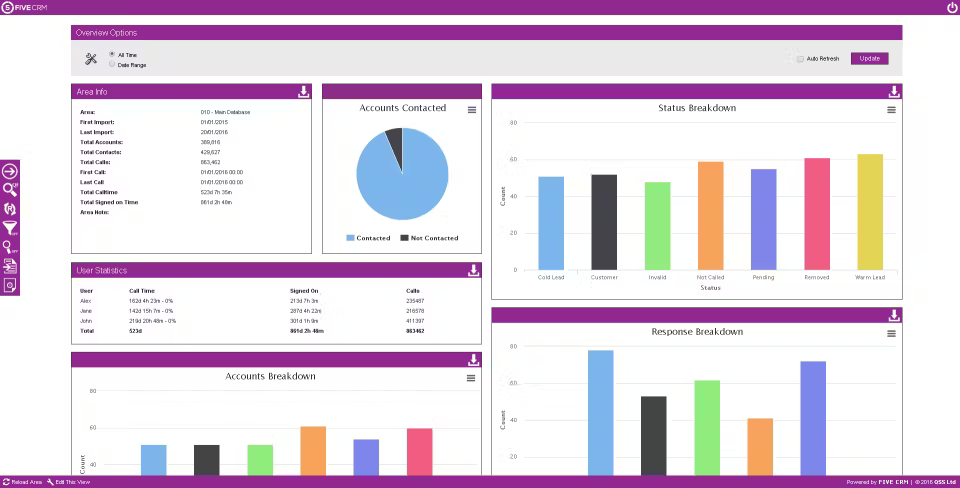

6. FiveCRM

FiveCRM is a customizable CRM for insurance agencies that helps insurance brokers handle customer relationships. The software streamlines lead management, policy handling, and claims processing, ensuring smooth workflows and heightened efficiency.

One of the key features of FiveCRM is its robust sales pipeline management capabilities. Users can visualize and manage the entire sales process, from lead generation to policy issuance, ensuring that opportunities are tracked and nurtured effectively. Additionally, FiveCRM offers a Sales Velocity feature that allows users to monitor the speed at which leads move through the sales pipeline. By identifying bottlenecks and areas for improvement, users can optimize their sales processes, accelerate deal closures, and boost overall sales performance.

FiveCRM's reporting and analytics tools offer valuable insights into customer behavior, empowering users to identify cross-selling and upselling opportunities and optimize their sales strategies accordingly.

Pricing

FiveCRM's pricing starts at $65 per user/month.

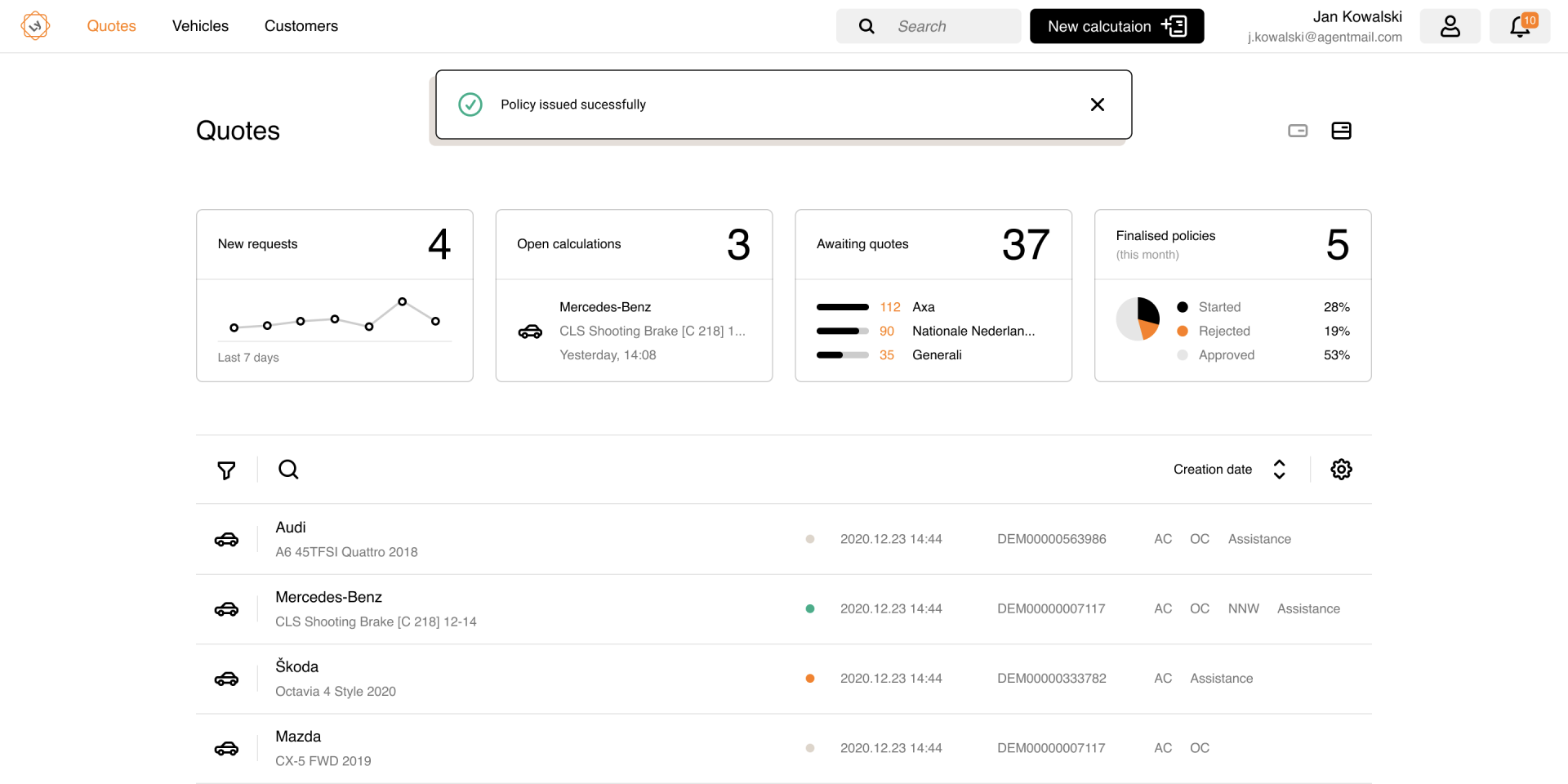

7. Insly

Insly stands out among insurance CRMs because it primarily offers low-code business automation software for insurance companies that includes some CRM features.

One of Insly's standout features is its innovative no-code/low-code product builder, empowering insurance companies to make quick and easy modifications to their products. With this tool, users can customize forms, workflows, documents, and other product aspects without the need for extensive technical expertise. This flexibility enables companies to adapt to changing market demands, improve operational efficiency, and deliver tailored solutions to their clients.

Additionally, Insly offers a portal for insurance brokers that simplifies product distribution processes. Through online applications, broker access, and integration with partners' systems, the platform facilitates seamless collaboration and communication between stakeholders.

This CRM software for insurance agencies is versatile and suitable for various entities in the insurance industry, including insurers, MGAs, brokers, and TPAs. Whether used as a standalone solution or integrated with third-party systems, it can seamlessly fit into your existing tech infrastructure.

Pricing

The pricing is available on request.

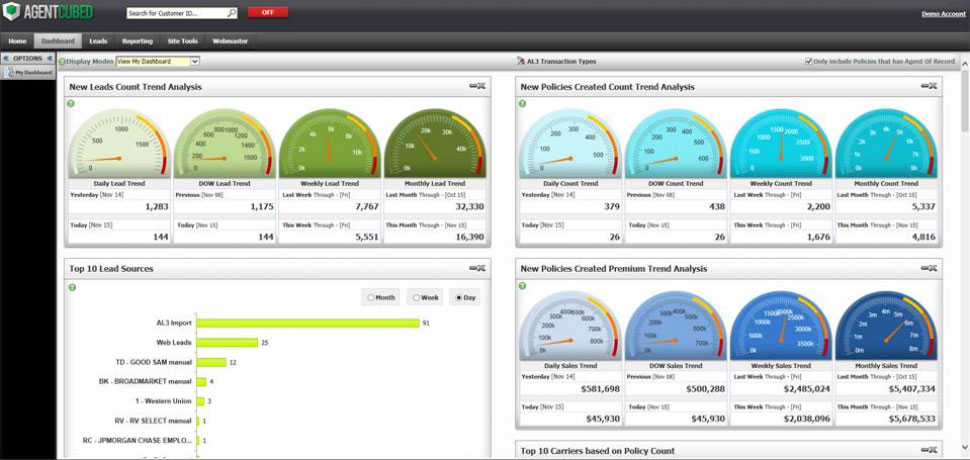

8. AgentCubed

AgentCubed is a cloud-based CRM software tailored specifically for the insurance industry, aiming to streamline workflows and optimize sales processes for insurance brokers.

Its core functionality includes efficient lead routing, which ensures prompt distribution of leads to sales teams, resulting in improved response times and enhanced customer engagement. Additionally, the platform simplifies policy and renewal management, empowering insurance companies to efficiently handle client policies and renewals.

AgentCubed offers advanced features such as evaluating sales operations performance, managing and monitoring customized proposals, and automating sales and marketing communications. These capabilities equip insurance companies with the tools they need to optimize their sales strategies, deliver personalized customer experiences, and drive business growth in a competitive market.

Pricing

The pricing is available on request.

Most Important CRM Features for Insurance Agents

To choose the best CRM software for your company, prioritize the following CRM features:

- Customer 360-view: Aggregating customer data from multiple sources to create a comprehensive and unified view of each customer enables personalized marketing, sales, and support strategies.

- Lead management: Lead management tools ensure that no opportunity is overlooked. Features like lead scoring, task reminders, and follow-up scheduling help you keep track of prospects and close deals faster.

- Omnichannel customer support: Multi-channel communication capabilities ensure seamless customer interactions across various platforms. Make sure your CRM software allows you to communicate with customers by phone, email, social media, and chats.

- Customization: Tailoring the CRM software to match specific business needs and processes, including custom fields, workflows, and user interface modifications. No-code tools allow knowledge workers to customize and create new CRM functionalities and workflows, making no-code CRMs perfect for robust customization options.

- Governance and security: You need to ensure data integrity, compliance with regulations, and implement access controls to protect sensitive information.

- Integrations: Connecting the CRM software with other business automation software allows you to integrate data and business process exchange, increasing your productivity.

- Mobile CRM: Providing access to CRM functionality on mobile devices enables insurance agents to access real-time data while working remotely.

- AI tools: To accelerate your CRM processes, CRM software needs to leverage AI capabilities such as predictive analytics, lead scoring, chatbots, and automation to enhance decision-making, automate repetitive tasks, and personalize customer interactions.

How to Choose Insurance CRM Software?

Choosing the right insurance CRM involves several key considerations to ensure it aligns with your business needs and objectives. Here are some tips to help you make an informed decision:

Identify your needs

Begin by assessing your specific requirements and objectives. Determine what features are essential for your insurance operations, such as lead management, policy handling, claims processing, customer service tools, integrations, mobile capabilities, and compliance features.

Evaluate whether a cloud-based or on-premise solution better suits your needs. Cloud-based CRM systems store data on the vendor's servers, while on-premise solutions maintain data within your own infrastructure.

Each approach offers distinct advantages in terms of cost structure, security control, customization capabilities, and maintenance requirements. For a comprehensive comparison of these options, explore our detailed analysis in "On-premise vs Cloud-based CRM”.

Evaluate customization options

Prioritize the insurance agency CRM software that offers extensive customization capabilities to tailor the platform to your unique business processes. Consider factors such as customizable fields, workflows, reports, dashboards, and user interface modifications.

Assess customer support and training

Look for a CRM provider that offers reliable customer support, training resources, and user-friendly documentation. Ensure they provide adequate onboarding assistance and ongoing support to maximize the CRM's effectiveness within your organization.

Consider scalability

Choose a CRM solution that can scale alongside your business as it grows. Assess factors like the number of users supported, data storage capacity, pricing plans for scalability, and the flexibility to adapt to evolving business needs.

Prioritize vendors with a proven track record in insurance

Many CRM vendors share customer success stories and case studies showcasing the impact on their clients. For example, in this article, Heritage Life Insurance highlights how Creatio's no-code helped transform its customer service strategy. When selecting an insurance CRM to purchase, seek out articles from the vendor covering their experience with an insurance business and customer reviews.

By following these steps and conducting thorough research, you can choose an insurance CRM that best fits your organization's requirements, enhances operational efficiency, improves customer experiences, and drives business growth.

Try Creatio CRM for Insurance Agents

Investing in the right insurance CRM software is vital for insurance agents to enhance customer relationships, streamline operations, and drive business growth. A robust CRM solution empowers an insurance business with actionable insights, automation capabilities, and personalized communication tools.

With seamless integration, endless customization options, robust analytics, and innovative AI tools, Creatio offers a compelling solution tailored to meet the diverse needs of businesses like yours. Sign up for a free trial to discover how CRM Creatio can transform your customer relationships.

Transform your insurance agency operations with Creatio's innovative CRM software