What is AML Software? Top 10 Anti-Money Laundering Software in 2025

Picture this: a high-stakes game of financial cat-and-mouse, where the players are not professionals dressed in suits, but rather cutting-edge algorithms racing against the clock. Welcome to the world of anti-money laundering software!

In an era where a single click can move millions and money laundering is a persistent threat, the need for robust AML software has never been more critical.

This article will explain what AML software is, how AML software works, its benefits, and why it is essential for the financial sector. In addition to that, we suggest the 10 most popular AML software programs that will safeguard your financial operations from nefarious subjects.

What is AML Software?

In basic words, anti-money laundering (AML) software is a set of programs that conducts several analytical operations to check if the financial transactions are trustworthy. These operations are typically done in just a few seconds and then flag suspicious activity for AML specialists and financial professionals.

By employing sophisticated algorithms and data analytics, AML software sifts through colossal volumes of financial transactions, seeking out any signs of illicit activity, and then flags them.

There are three components to any AML software that play a vital role in safeguarding your organization. These are:

- PEP and RCA check which stand for Politically Exposed Persons and Relatives and Close associates of such. AML software checks and examines people who hold important public positions and their connections to make sure their money doesn't come from corruption or money laundering activities.

- Sanctions List Screening is quite self-explanatory. This feature analyzes existing databases of sanctioned individuals and organizations to uncover any potential matches for AML purposes.

- Adverse Media Screening tools utilize online monitoring to find negative press coverage connected to a client.

AML services are utilized beyond banking in industries such as insurance, real estate, e-commerce, fintech, and cryptocurrency.

How AML Software Works

Here's how AML software typically functions:

- Transaction monitoring: AML software continuously monitors and analyzes financial transactions in real-time or retrospectively. It looks for patterns, anomalies, or red flags that might indicate potential money laundering activities. This includes large or unusual transactions, frequent cash deposits, and structuring transactions to avoid detection or sudden changes in behavior.

- Customer Due Diligence (CDD): AML software assists in verifying client identities, conducting background checks, and assessing the risk associated with different customers.

- Watchlist screenings: AML software checks transactions and customer data against various watchlists, including government sanctions lists, politically exposed persons (PEPs) lists, and other regulatory databases.

- Reporting: AML software generates reports and alerts for potentially suspicious activities. These alerts are then investigated by compliance teams within financial institutions. The software also assists in regulatory compliance by maintaining records, facilitating audits, and ensuring adherence to AML laws and regulations.

- Adaptive learning: Advanced AML software often incorporates machine learning and artificial intelligence, allowing the system to continuously learn from new data and adapt to evolving money laundering techniques.

AML software plays a pivotal role in various stages of customer engagement.

When onboarding new customers, AML systems ensure due diligence by vetting their financial and reputational backgrounds.

Post onboarding, AML activities are indispensable for ongoing client monitoring and continuously analyzing their transactions to avoid nefarious actions.

By serving as a continuous AML risk assessment tool, AML transaction monitoring software guarantees a transparent and secure transactional environment, allowing businesses to build trust and ensure compliance in their dealings.

Why Do You Need AML Software?

AML activity is undoubtedly essential to the security and well-being of any organization, but what is the additional value of AML software? Why do organizations choose to invest in an AML suite rather than a couple of simple screening tools that just cross-reference various databases?

Compliance with regulations

AML regulations are usually imposed by the governments of the countries your organization operates in. This AML legislature may vary depending on the place but all of them require financial institutions to follow complex regulatory frameworks and procedures to avoid corruption, money laundering, and terrorist financing.

AML software ensures compliance with these regulations by delivering continuous transaction monitoring for suspicious activities, generating reports for regulatory authorities, conducting risk assessments on customers, maintaining audit trails, and adapting to evolving regulatory requirements. It makes it easy to take into account the everchanging regulations from different regions.

Having an automated AML service enables you to keep your team on track of any new regulations and ensure their compliance without a need for your involvement.ck of any new regulations and ensure their compliance without a need for your involvement.

Enhanced CDD

AML software streamlines the process of verifying customer identities, conducting background checks, and assessing risk by automating these tasks. This speeds up the due diligence process.

Moreover, the software generates alerts for unusual or suspicious activities, prompting closer scrutiny by compliance teams. This helps in identifying potential red flags during the due diligence process.

Risk mitigation

AML software analyzes customer data to create risk profiles, categorizing customers based on their potential risk levels. This helps in allocating resources and attention more effectively to higher-risk customers.

It also enables ongoing monitoring of customer activities, allowing for the detection of suspicious behavior or changes in risk factors over time, which might require further investigation.

Improved reporting and record-keeping

AML softwares automatically report suspicious activities or transactions that require further investigation.

It maintains detailed audit trails of all activities and decisions made during the compliance process, aiding in transparency and accountability.

By centralizing data and integrating various sources of information, AML software facilitates comprehensive reporting. Moreover, advanced AML software can adapt to changing reporting requirements, customizing reports to meet evolving regulatory standards or specific organizational needs.

TOP-10 AML Software for Financial Companies

Given its pivotal role in managing highly sensitive matters and confronting complex challenges, selecting the appropriate AML software is a tall task. The AML market presents a spectrum of choices, each differing in features, customization, pricing, and unique traits.

Our aim is to paint a comprehensive picture of this diversity in AML solutions and services. Leveraging reviews from multiple software review platforms, we compiled an ultimate list of 10 AML software services designed to protect your organization from illicit activity.

1. Creatio

If you’re looking for software that allows you to customize your AML activity and processes freely, Creatio is a great option.

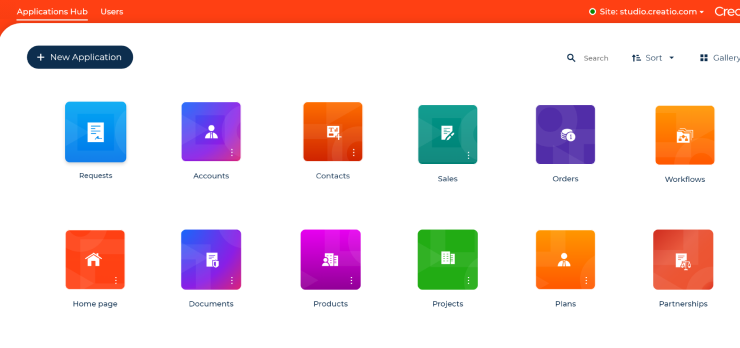

In its essence, Creatio is a no-code platform for automating any business process you can think of. What that means is that you can create various automated processes from components and blocks in Creatio’s Studio without any knowledge of coding and programming.

When it comes to AML monitoring and analysis, Creatio stands out for powerful features as a part of its industry-specific functionality. For example, Creatio’s solution for banks includes a compliance suite that contains AML and KYC (Know Your Customer) Capabilities. What sets these features apart is their flexibility and adaptability — fully customizable and modular, they empower you to construct an AML process that serves your unique needs and requirements.

If you require minimal customization, you can utilize Creatio’s out-of-the-box AML workflows. They enable you to fully automate digital customer identity verification and case investigation and set up regular compliance reporting. You hold the freedom to decide the frequency at which the AML software conducts checks and delivers reports based on your preferences.

Moreover, Creatio leverages AI and ML-powered behavior analytics to flag suspicious activity and immediately alert you to it.

In addition to that, Creatio offers a ComplyTrack add-on that dives deeper into AML activity and enables you to initiate digital investigation dossiers, manage questionnaires, and customize risk score predictors.

The platform prioritizes integration, ensuring seamless compatibility with your existing suite of business automation software. An added benefit of this is that you can integrate additional global databases that are not supported by typical AML software, enhancing screening.

Creatio goes beyond AML operation and presents endless functionality for streamlining your business processes, be it sales, marketing, loan management, or something entirely different. Just like the platform itself, the pricing is also composable, so you can select what functionality you want to purchase.

Key features:

- Holistic support for a range of financial workflows, including AML, KYC, and more

- Seamless configuration and automation of AML workflows, no coding required

- Robust analytics and decision-making enhanced by AI capabilities

2. iDenfy

iDenfy is a sophisticated identity verification software with a strong suite of AML capabilities.

It supports all the major sanctions and law enforcement watchlists and combines its AML and KYC activities to instantly alert compliance officers if there’s any risk of money laundering.

The money laundering AML software also emphasizes monitoring adverse media sources, filtering online publications by negative sentiment, eliminating false positives, and combining it with PEP and sanctions screening.

Reviews highlight iDenfy’s user-friendly interface and easy setup. This software is ideal for companies seeking a simple yet effective AML solution that is user-friendly and swift to set up. The only challenge with iDenfy is a comparative lack of streamlined integration with other business automation tools.

Key features:

- Advanced Adverse Media Screening

- User-friendly interface

- Quick and responsive customer support

3. Actico

Actico, a trailblazer in digital intelligence platforms, provides an extensive suite utilized for fraud prevention, dynamic pricing, underwriting, claims management, and compliance.

Within its suite, Actico tailors specialized AML compliance tools, including the Money Laundering Detection System (MLDS), dedicated to anti-money laundering efforts. This suit includes AML, KYC, and customer screening capabilities as well as compliance costs such as payment screening.

Additionally, the AML platform integrates credit risk management tools, streamlining loan decisions while ensuring compliance with regulatory standards.

Actico is best suited for companies looking for comprehensive out-of-the-box compliance software that supports full protection from money laundering, reputation risks, fraudulent behavior, and market abuse.

Key features:

- Complete compliance management suite

- Risk classification

- AI and machine learning capabilities

4. Ondato

Hailing from Lithuania, Ondato stands as a comprehensive risk management and identity verification solution provider. It specializes in both photo and live video identity verification, encompassing data monitoring, screening, risk scoring, due diligence, and case management.

As an anti-money laundering AML, it prioritizes the onboarding experience. Ondato efficiently manages document verification, personal ID checks, as well as Politically Exposed Person (PEP) and sanctions checks concurrently.

Its white-label option offers seamless deployment, allowing users to integrate Ondato seamlessly into their portals.

Ondato simplifies integration through a streamlined API and an intuitive dashboard for user convenience. However, for businesses in search of an all-encompassing solution, integration with supplementary platforms or tools may be necessary to establish a complete compliance framework. Additionally, some regions might experience limited coverage from Ondato's services.

Key features:

- Full KYC process for onboarding

- White label solution

- KYB (Know Your Business) solutions are available

5. Onfido

Onfido is another identity verification platform that includes AML capabilities. The AML compliance processes are built into its identity verification and mostly focus on onboarding. Their verification services span across 195 countries and encompass support for over 2,500 documents globally, ensuring you can fulfill compliance requirements as your company expands.

Onfido’s strength lies in customization – you can customize the AML process, replacing certain steps or putting them in a different order.

Customers highlighted Onfido’s ability to achieve seamless automation but wished for easier integration and quicker support.

Key features:

- Customizable AML workflows

- Identity documents verification

- Global coverage

6. Vespia

Vespia was founded by KYC experts and former staff of Veriff, and identity verification platform.

Its main selling point is the incorporation of AI capabilities, that reduce false positives and hours of investigating.

The AML platform offers sanctions and PEP screenings as well as real-time adverse media screening. It covers more than 4000 sanctions lists and 4 different PEP tiers.

Key features:

- KYB functionalities for company verification

- Support for both AI and rule-based methods

- AI Compliance Officer

7. Oracle Financial Crime and Compliance Management

Oracle offers a suite of solutions to achieve AML compliance that are integrated with its platform.

The software offers advanced analytics for flagging illicit transactions as well as pre-built scenarios to safeguard your organization from fraud.

Its AI capabilities help to separate between false positives and actual suspicious activities and bring them to your attention. Moreover, Oracle’s AI can identify gaps in your own AML processes and make suggestions and guidance on how to improve them.

The platform boasts powerful data management. You can consolidate fragmented internal data to gain a comprehensive view of your customers while running applications across both your data lake and relational databases, enabling batch and real-time analytics in unison.

The potential challenge of Oracle is its demanding requirements in terms of hardware and budget allocation.

Key features:

- Powerful AI capabilities

- Sophisticated data management

- Advanced analytics and reporting

8. Feedzai

Feedzai, a frontrunner in combating financial crime for financial institutions, fintechs, processors, and merchants, offers comprehensive support for fraud reduction and AML compliance.

This software allows you to deploy a comprehensive fraud management and reporting platform with standard and self-service rules tailored explicitly for AML checks. Feedzai facilitates third-party integrations and provides pre-built SAR filings, expediting your reporting process to relevant agencies.

Clients of Feedzai may encounter challenges due to the platform's complexity, which might be overwhelming for individuals with limited experience in managing fraud-related products. Integration with existing systems isn't straightforward and might necessitate a substantial project, adding to the complexity of implementation.

Key features:

- Built-in anti-fraud features

- Support from financial institutions’ specialists

9. iComply

iComply, also known as iComplyKYC, serves as a digital compliance manager aimed at minimizing AML expenses, expediting processing, and mitigating data privacy risks.

Integration occurs through KYC portals, which are JavaScript code snippets easily embeddable into any website or mobile application. All data management takes place within user-friendly dashboards, offering the flexibility to tailor KYC or AML workflows according to jurisdictional requirements.

Key features:

- User-friendly integration setup

- Adverse media screening

10. Sanction Scanner

Sanction Scanner offers much more than sanction screening. It provides a solution to combat money laundering, fraud, and risk, and enables companies to screen clients, monitor transactions, and identify suspicious activities.

AML features include PEP (Politically Exposed Persons), and adverse media, along with robust transaction monitoring capabilities. Sanction Scanner’s system incorporates a rule-based risk classification dashboard for in-depth analyses.

Sanction Scanner offers robust API integration options and a user-friendly dashboard, allowing seamless adaptation of our solution to meet the unique requirements of businesses across various industries.

Sanction Scanner enables the establishment of customized rules and scenarios tailored to our customers' risk profiles, all without the need for coding. This feature ensures real-time alerts aligned with risk levels, significantly reducing workload while minimizing false positives.

Key features:

- Global database of sanctions

- User-friendly interface

- Flexibility in configuration and customization

In Conclusion

In a landscape rife with risks, anti-money laundering AML stands as a shield. As technology evolves, so too does the battle against financial crimes, and AML software remains a crucial ally in this ongoing fight.

Frequently Asked Questions

What does anti-money laundering software do?

AML software detects and prevents money laundering and financial crimes by monitoring transactions, verifying customer identities, screening for risky individuals or entities, assessing risks, and generating reports for suspicious activities to ensure compliance with regulations.

Who needs AML software?

While governments typically do not require organizations to use specific anti-money laundering software, it significantly streamlines required AML operations and makes your company more efficient. AML is essential for financial institutions, fintech companies, global businesses, government agencies, and professional service providers to prevent money laundering and comply with regulations.

Which software is used in AML?

Several software solutions are used in AML, these can be separated into two major groups:

- Specialized financial software such as Actico, Dow Jones Risk, Feedzai, or iComplyKYC;

- Or general financial services automation software such as Creatio and Oracle.

These are just a few examples; there are many other AML software solutions available, each offering specific functionalities to address compliance and anti-money laundering requirements.