-

No-code

Platform

-

Studio

No-code AI-native platform to build applications faster

Discover

-

Studio

-

AI-Native CRM

-

Industries

- Customers

-

Partners

-

About

Finance CRM - A Full Guide on CRM for Financial Services

Updated on

November 20, 2025

15 min read

In the dynamic world of the finance industry, it is well known that building successful and enduring relationships with customers is one of the key factors for sustained success. As in any other industry, cultivating excellent client relationships is crucial, and this is where the concept of Customer Relationship Management (CRM) becomes significant.

As financial institutions adapt to evolving client preferences, navigate complex regulations, and contend with intense competition, CRM has emerged as an indispensable component of their strategy. However, what precisely is CRM within the context of the financial industry? It is a comprehensive approach that involves both a strategic commitment to developing robust client relationships and utilisation of specialised software to achieve these goals.

In this article, we shall explore the various functions of CRM software within the financial industry, considering how it impacts client interaction and the delivery of financial services.

What is a Finance CRM?

Finance CRM is a bespoke software designed specifically to meet the distinct requirements of the financial industry. Its core objective is to assist financial advisers in establishing, sustaining, and enhancing relationships with their clients

This multifaceted tool encompasses a variety of functions, such as contact management, sales and marketing automation, customer support and service, and analytics and reporting, among others. These capabilities enable financial advisers to offer tailored financial solutions, anticipate clients' needs proactively, and consistently deliver outstanding services.

Furthermore, financial CRM software extends beyond mere relationship management. It also plays a crucial role in compliance management by securely storing and organising sensitive client information, ensuring that financial businesses meet stringent regulatory standards.

In conclusion, finance CRM serves as a reliable ally in maintaining financial compliance, customising products and services to meet individual needs, and enhancing communication effectiveness. Ultimately, its aim is to enhance customers' satisfaction, foster trust, and encourage loyalty, positioning financial service providers for long-term success in a highly competitive market.

Why Do I Need a Financial Software?

Amidst fierce competition, evolving client demands, and rapid digitalisation, CRM proves indispensable in the financial services industry. The figures are compelling: in 2021, sales of bank CRM software totalled $9.5 billion, with projections pointing to significant expansion. By 2031, forecasts suggest a surge to $39.2 billion, reflecting an annual growth rate of 15.7%.

Financial advisers depend on CRM systems for numerous of compelling reasons, pivotal to their success and profitability:

- Personalised customer interactions. The ability of financial CRM software to foster personalised client interactions ensures that customers are not merely served, but also valued. This cultivates higher satisfaction and fosters enduring loyalty – crucial assets in an industry where trust and dependability are paramount.

- Automated administrative tasks. CRM in financial services proves invaluable in liberating financial professionals from the burden of administrative tasks. By automating processes, including document generation or appointment scheduling, financial services CRM systems empower advisers to concentrate on more strategic activities, such as client engagement.

- Seamless collaboration and communication. Financial CRM systems facilitate seamless teamwork within the organisation and with clients across multiple channels. This reliability and timeliness in communication are essential for nurturing robust relationships and fostering trust.

- Champion of compliance. Faced with stringent regulatory requirements, financial services CRM stands as a robust defender of compliance. These systems securely store and manage sensitive financial data, ensuring that the business adheres to customer data protection and reporting regulations, thereby mitigating potential legal and reputational risks.

Which Departments Can Utilise CRM For the Financial Services Industry For Their Advantage?

CRM solutions for financial services are versatile tools that can be applied across various departments within a financial business. These systems can be tailored to fit the specific processes of different organisations, such as banks, credit unions, insurance companies, or investment firms, thereby simplifying daily tasks and enhancing overall departmental effectiveness.

Here, we explore several common departments found in any financial business and examine how a modern CRM software streamlines their daily operations:

Marketing

Leading CRM solutions for financial services empower marketing teams to generate leads more effectively and enhance brand visibility. They facilitate the creation, execution, and optimisation of omnichannel marketing campaigns across various markets and geographies.

With the aid of advanced marketing automation features, CRM systems for financial services enable businesses to achieve efficiency and effectiveness in their marketing endeavours, encompassing lead nurturing campaigns, email marketing, and more. By harnessing automation, marketing teams can deliver timely and targeted communications to prospects and clients, fostering relationships and guiding them through the sales funnel.

Furthermore, CRM for finance provides valuable insights and analytics that empower marketers to assess the effectiveness of their campaigns and optimise their strategies for optimal ROI. By monitoring crucial metrics such as campaign performance, lead conversion rates, and engagement, marketers can identify trends, enhance targeting strategies, and allocate resources effectively to stimulate business expansion.

Sales

Finance CRM enhances sales activities through a centralised platform that manages client interactions, leads, and opportunities. This system ensures that the sales team has immediate access to customer data, including financial profiles, investment preferences, and communication history.

This accessibility enables personalised engagement with prospects and clients, empowering sales representatives to tailor their pitches and recommendations to individual needs and interests.

Furthermore, CRM assists in streamlining administrative tasks associated with sales processes, such as lead management, pipeline tracking, and follow-up communications. By automating repetitive tasks and workflows, the CRM liberates valuable time for the sales team to concentrate on fostering enduring relationships and finalising deals.

Customer service

CRM for financial services equips customer support representatives with a 360-degree view of the customer's data, enabling swift resolution of inquiries and issues. The capability results in heightened client satisfaction, reduced response times, and enhanced overall service quality.

An essential advantage of CRM is its ability to streamline communication and collaboration across departments. With CRM, customer support teams can seamlessly collaborate with sales, marketing, and operations departments to address intricate issues and deliver comprehensive customer support. This ensures consistent and coordinated assistance across all customer touchpoints, fostering increased satisfaction and loyalty.

Front-office

Financial CRM systems are utilised by various front-office roles, including relationship managers, financial advisers, and portfolio managers, to deliver personalised financial advice. These systems provide insights into client financial history and objectives, facilitating well-informed recommendations and enhancing customer engagement.

For relationship managers, CRM provides a comprehensive view of client relationships, enabling them to forge deeper connections and tailor their strategies to meet individual client needs. Financial advisers rely on CRM systems to conduct thorough financial analysis, evaluate client risk profiles, and recommend appropriate investment strategies.

Portfolio managers also derive significant benefits from these systems, which enable them to monitor portfolio performance, analyse market trends, and make informed investment decisions.

Loan origination and underwriting

In lending departments, finance CRM streamlines the loan origination process, facilitating efficient application tracking, automated workflows, and enhanced underwriting decisions. Financial institutions can simplify the loan application process by consolidating applicant information, documents, and communications within a secure platform. This ensures seamless application monitoring, enabling loan officers and underwriters to access all pertinent data throughout the entire loan lifecycle.

Furthermore, CRM facilitates workflow automation by handling routine tasks such as data entry, document verification, and application status updates. This automation eliminates manual processes and reduces administrative burdens, thereby accelerating the loan origination process, significantly cutting turnaround times, and enhancing operational efficiency.

Additionally, CRM supports informed underwriting decisions. By providing comprehensive borrower profiles, credit histories, and financial data, CRM empowers underwriters to conduct meticulous risk assessments and make well-informed decisions.

Compliance and risk management

CRM systems provide secure data storage and enable organised management of sensitive financial information and personal client data. This capability assists financial advisers in mitigating legal and reputational issues, essential for compliance with regulatory standards and robust risk management practices.

In a financial adviser firm, a CRM system's utility extends beyond client-facing teams to encompass administrative departments such as accounting, legal, HR, and more. This comprehensive integration enhances productivity and fosters collaboration across the entire organisation by facilitating data sharing and streamlining processes.

Benefits of Finance CRM

Finance CRM provides numerous advantages to financial advisers, elevating their operations and customer interactions. Below are the primary advantages of CRM for financial services:

Enhancing relationships with clients

Establishing positive relationships with clients is central to success in the finance industry, and CRM for finance plays a crucial role in nurturing these connections. Centralised management of client interactions is paramount, ensuring that every interaction, from initial contact to ongoing communication, is meticulously tracked and managed within a unified platform.

This enables financial advisers to access a comprehensive view of each client's journey, encompassing past interactions, preferences, and financial objectives

Boosting client retention

Financial CRM systems enhance customer retention through personalised communication and timely follow-ups, ensuring clients feel valued and supported. They also provide insights into client behaviours and preferences, enabling financial advisers to address their needs and concerns proactively.

Increasing sales and revenue

Financial CRM systems provide the sales team a centralised platform to manage client interactions, leads, and opportunities, promoting personalised engagement, reducing administrative tasks, and enhancing conversion rates. Additionally, CRM-driven insights inform effective cross-selling and up-selling opportunities, thereby maximising revenue from existing customers.

Enhancing operational efficiency

CRM for financial services enhances front-office processes by streamlining client interactions and enabling highly personalised assistance. In the middle office, they contribute to risk management and compliance tracking, ensuring accurate and timely decision-making. In the back office, CRM systems assist in optimising and managing administrative tasks, reducing manual labour and enhancing customer data management, thereby improving the financial institution's overall operational efficiency.

Improving employee productivity and collaboration

Finance CRM increases employee productivity by automating routine tasks such as data entry, lead allocation, document generation, and beyond. This reduces manual work, minimises errors, and allows staff to concentrate on higher-value activities, thereby streamlining work processes and enhancing efficiency. Furthermore, it fosters teamwork by facilitating data sharing and communication among employees, resulting in improved customer support and more efficient internal processes.

Key Features of Financial CRM Software

In today's diverse market of CRM systems, selecting the optimal CRM for your financial institution can prove challenging. Each CRM solution possesses distinct characteristics, features, strengths, and weaknesses. However, irrespective of the particular CRM you opt for, several fundamental features are crucial for enhancing the operational value of your financial business:

- Unified data management entails centralising and organising client data, encompassing financial history, preferences, interactions, and important documents. This comprehensive view of customer data allows for a deeper understanding of individual client needs and facilitates the delivery of a more personalised experience.

- Marketing and sales automation optimises marketing campaigns, lead generation, and sales opportunity management. These functionalities ensure efficient conversion of prospects into loyal customers, thereby boosting revenue streams and maximising return on marketing investments.

- Client service and support encompasses case management, support ticketing, and efficient query resolution, ensuring customers receive prompt and effective assistance.

- Workflow automation streamlines a range of front-office, middle-office, and back-office processes, including customer onboarding, loan management, verification, underwriting, and more. By automating these workflows, the CRM system accelerates decision-making, reduces manual effort, and enhances operational efficiency.

- AI and machine learning tools assist in data analysis, trend identification, and prediction, empowering financial professionals to make informed decisions and deliver bespoke financial solutions to customers.

- Integrated omnichannel communications guarantee that customers can engage with your organisation through their preferred channels.

- Document management facilitates centralised document storage and retrieval, ensuring prompt access to client records, financial forms, and other critical documents.

- Analytics and reporting tools provide valuable insights into client behaviour, performance metrics, and the efficacy of marketing and sales strategies. These analytics features enable financial advisers to make data-driven decisions, refine their approaches, and continually enhance their services.

Choosing the Right Finance CRM: Factors to Evaluate

Selecting the right financial software is a pivotal decision for financial advisers. To ensure the optimal choice, consider the following key factors:

Identify your requirements

Prior to selecting CRM software for financial advisers, it is imperative to define your organisation's specific requirements and objectives. Conduct a thorough assessment of your current workflows, pain points, and future development plans to ascertain the features and functionalities essential for your business.

Factors to consider include the size of your client base, the complexity of your financial products or services, and compliance with regulatory requirements. Engage key stakeholders across departments to gather insights and ensure alignment with organisational objectives. By clearly outlining your requirements from the outset, you can narrow down your choices and focus on selecting a CRM that best aligns with your distinct needs.

Scope of features

When assessing CRM options for the finance industry, it is essential to consider a comprehensive range of features that align with your specific requirements. Seek CRMs that encompass the functionalities mentioned in the previous part of the article, along with robust contact management, analytics, marketing automation capabilities, and more.

Customisability

Customisation is key to tailoring the CRM to quit your unique processes. Look for a system that provides no-code tools, enabling you to customise the CRM to fit your specific workflows without requiring extensive coding experience or IT resources.

User adoption

The CRM for financial services should include comprehensive training materials and tutorials to facilitate staff adoption. Additionally, round-the-clock customer support ensures assistance is available when needed, particularly during urgent situations.

Ease of use

A modern and user-friendly user interface (UI) is crucial for staff efficiency. The CRM should boast an intuitive design that enables employees to navigate easily and access necessary tools swiftly, thereby reducing the learning curve and boosting productivity.

Seamless integration

Integration capabilities are essential for a financial CRM, enabling seamless connectivity with other crucial tools and systems used within your business. Seek CRMs that offer straightforward integration with accounting software, financial planning tools, and document management systems to streamline data exchange and eliminate manual processes.

Integration with accounting software and portfolio management capabilities is essential for wealth management firms, investment advisers, and financial organisations. This facilitates seamless client portfolio tracking and the generation of financial reports. Furthermore, integration with third-party financial data providers enhances decision-making by providing real-time insights for investment analysis and risk management.

Security

Financial data is highly sensitive, necessitating robust security and data governance measures are paramount. The chosen CRM tools must adhere strictly to industry-specific data security and privacy regulations, such as GDPR or CCPA. They should incorporate encryption, access controls, and robust data protection features to safeguard clients' information.

Scalability

Consider the long-term scalability of the CRM system. It should possess flexibility and adaptability to accommodate changes in your organisation’s size, data volume, and additional features as your business expands.

Openness

CRMs for finance should give priority to open architecture or provide open APIs, facilitating seamless integration with various financial and non-financial applications. This openness ensures a unified ecosystem that utilises a wide array of tools and data, thereby enhancing operational efficiency and customer service.

Pricing

Cost is a critical consideration when selecting the optimal CRM for your business, particularly, if budget constraints are a concern. Concentrate on identifying applications that provide flexible pricing plans customised to meet your specific requirements. Seek options that align closely with your business requirements to ensure maximum value from your investment.

Moreover, evaluate CRM providers that offer transparent pricing structures devoid of hidden fees, enabling accurate cost forecasting.

Top 6 Financial CRM Solutions

1. Creatio

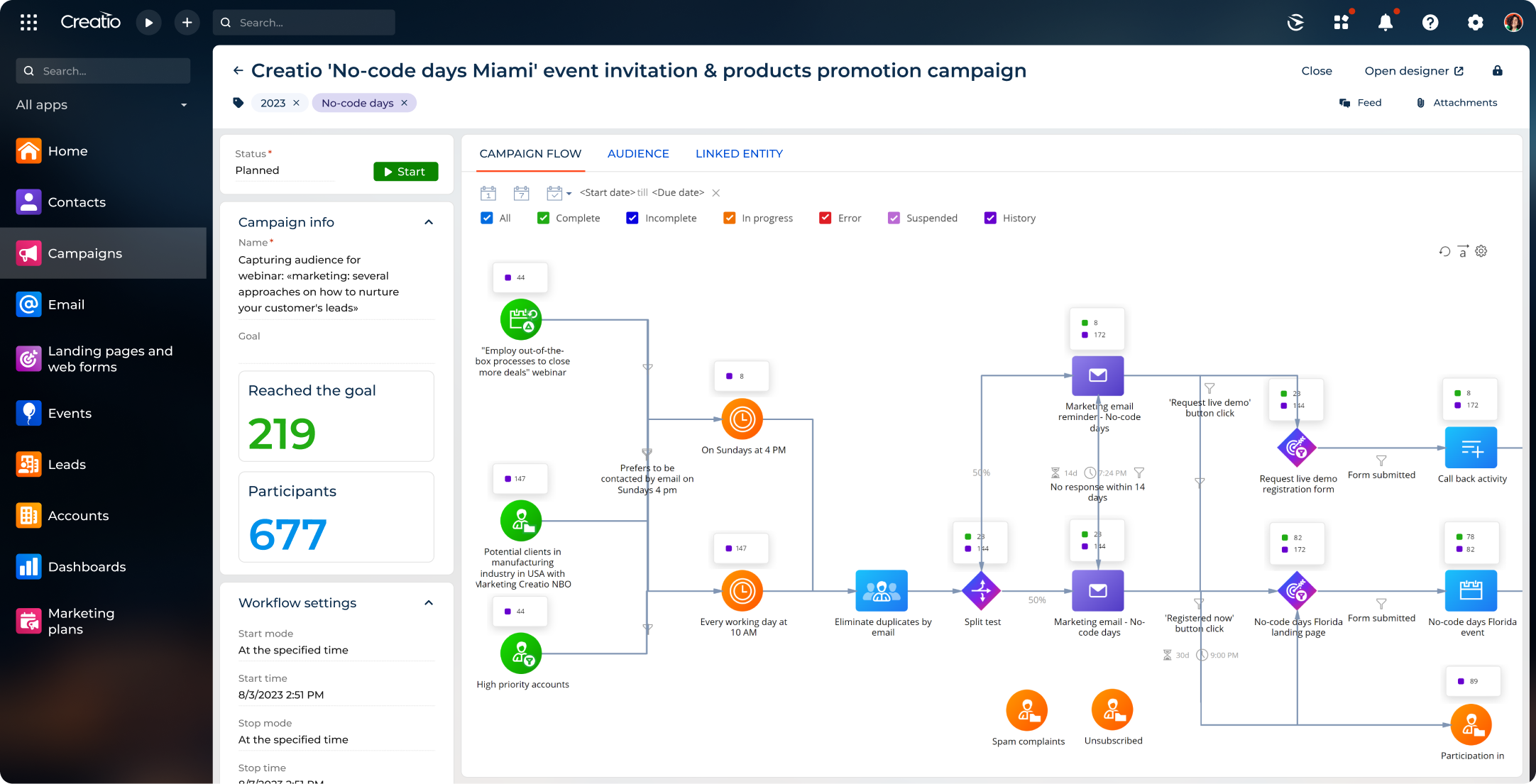

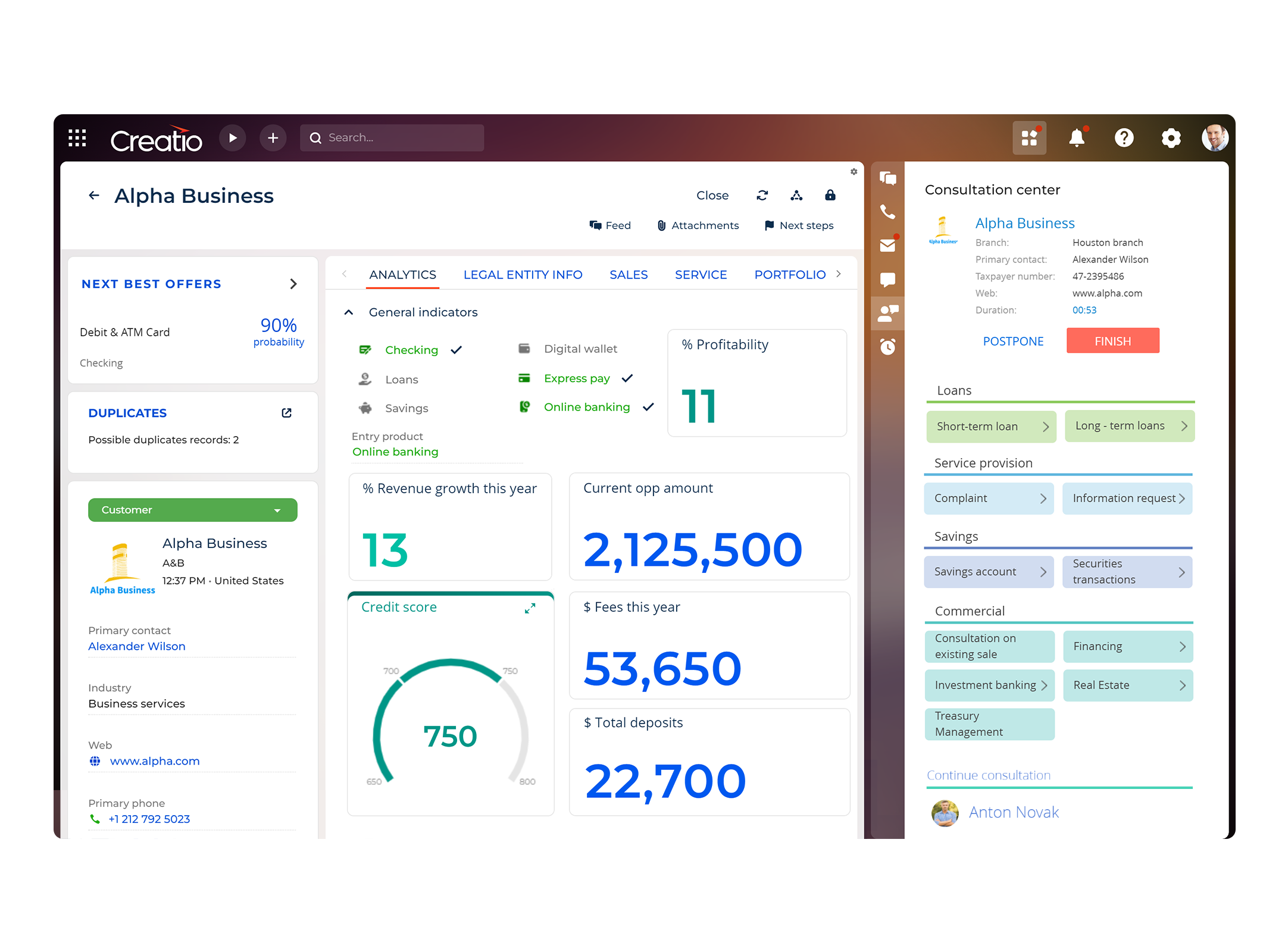

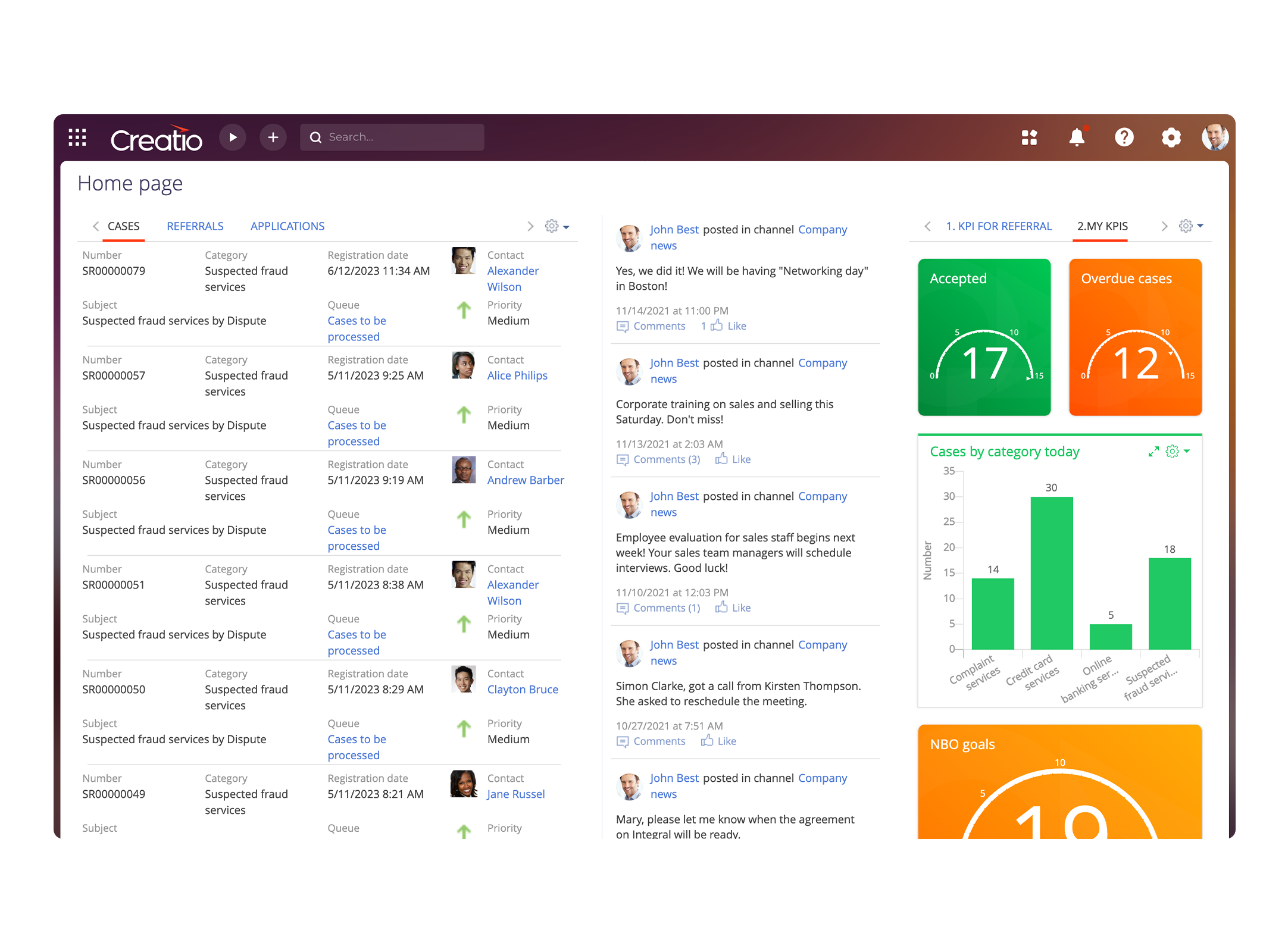

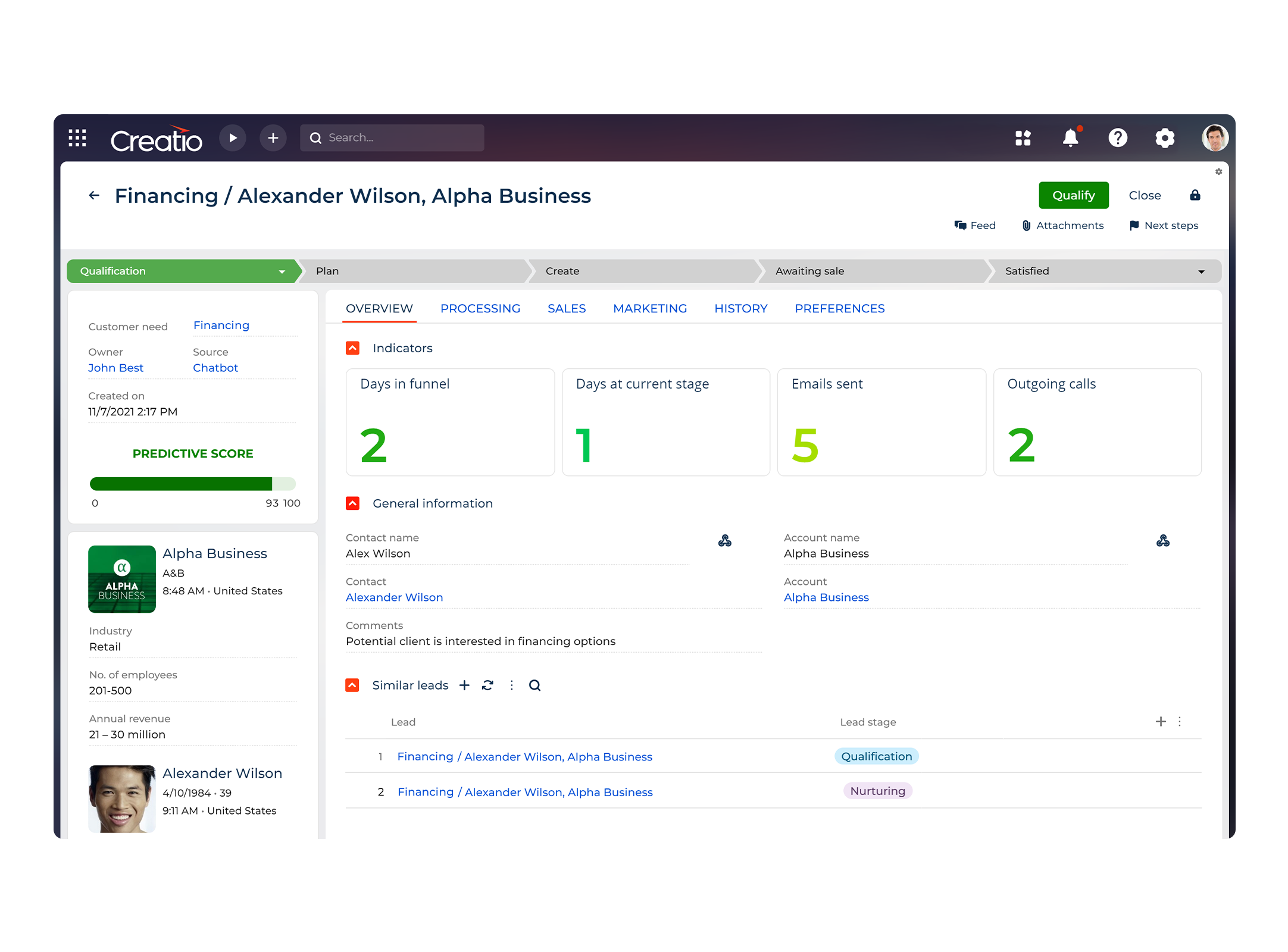

Creatio provides the best CRM solution for finance - Financial Services Creatio, a no-code platform designed to automate financial services processes and CRM with a maximum degree of freedom. It enables retail and business banks, alongside other financial service institutions, to orchestrate comprehensive client journeys and streamline operations across the front, middle, and back offices.

Financial Services Creatio enables organisations to deliver highly personalised customer experiences, enhance their success in up- and cross-selling success, execute seamless workflows, accelerate the launch of new financial products, centralise data and applications, drive rapid innovation through no-code empowerment for business users, and establish a robust alignment between business and IT teams.

Here are a few instances of CRM tasks and internal operational processes that can be enhanced through Financial Services Creatio:

- Customer 360: gain access to a complete and integrated view of each client to enhance personalisation, improve interactions, and cultivate strong client relationships.

- Marketing: enhance demand generation with multichannel marketing campaigns spanning various markets and regions; engage your audience by delivering tailored offers through the appropriate channels at precisely the right moment.

- Sales: manage sales opportunities efficiently utilising workflow automation; enhance client engagement with personalised value propositions driven by predictive scoring and AI/ML-powered next-best-offer insights.

- Onboarding: provide personalised onboarding experiences by utilising a comprehensive 360-degree view of clients, conducting needs analysis, streamlining offer management, and automating product catalogue.

- Account opening: automate account opening procedures, streamline screening and verification processes, expedite approvals, and digitise document management to eliminate errors and enhance customer satisfaction.

- Customer experience: enhance clients' experience by promptly responding to inquiries, efficiently resolving issues, and delivering personalised services.

- Lending: simplify loan origination, underwriting, and approval processes utilising automated digital workflows and a consolidated customer 360-degree data view.

- Compliance management: ensure compliance, mitigate risks, and fulfil regulatory obligations through consolidated data management, reporting, and automation tools.

- No-code customisation: adapt your CRM to align with the organisation's specific requirements and regulatory standards, all without needing the expertise of IT specialists or programmers.

Discover the benefits of Finance Creatio CRM for optimising your financial service

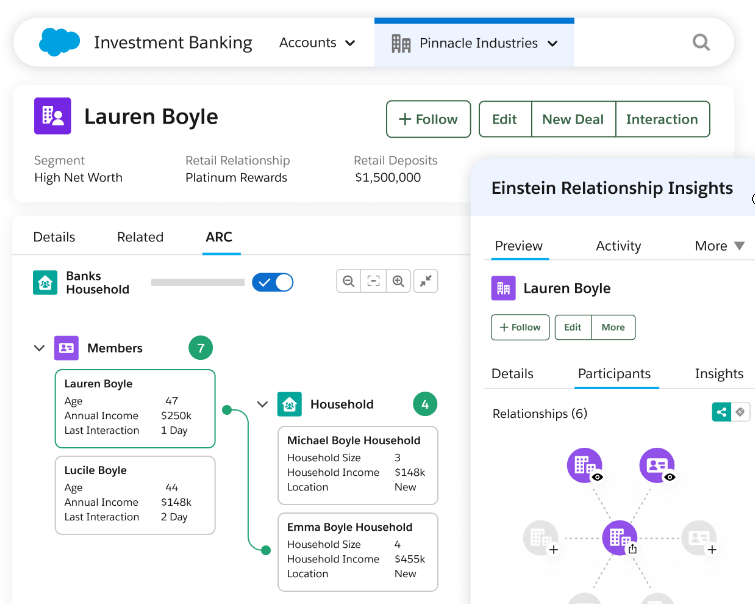

2. Salesforce

Salesforce Financial Services Cloud is a specialised CRM platform meticulously crafted for the financial services industry. It presents a comprehensive array of tools and functionalities tailored to meet the distinctive requirements of banks, insurance companies, wealth management firms, and other financial institutions.

Financial Services Cloud empowers financial professionals to gain deeper insight into their clients, customise interactions, and optimise operations across diverse departments. It encompasses capabilities for lead management, customer onboarding, financial planning, and regulatory compliance.

Through its data-driven insights and seamless integration with other Salesforce products, Financial Services Cloud enables financial organisations to enhance customer relationships, stimulate growth, and ensure compliance.

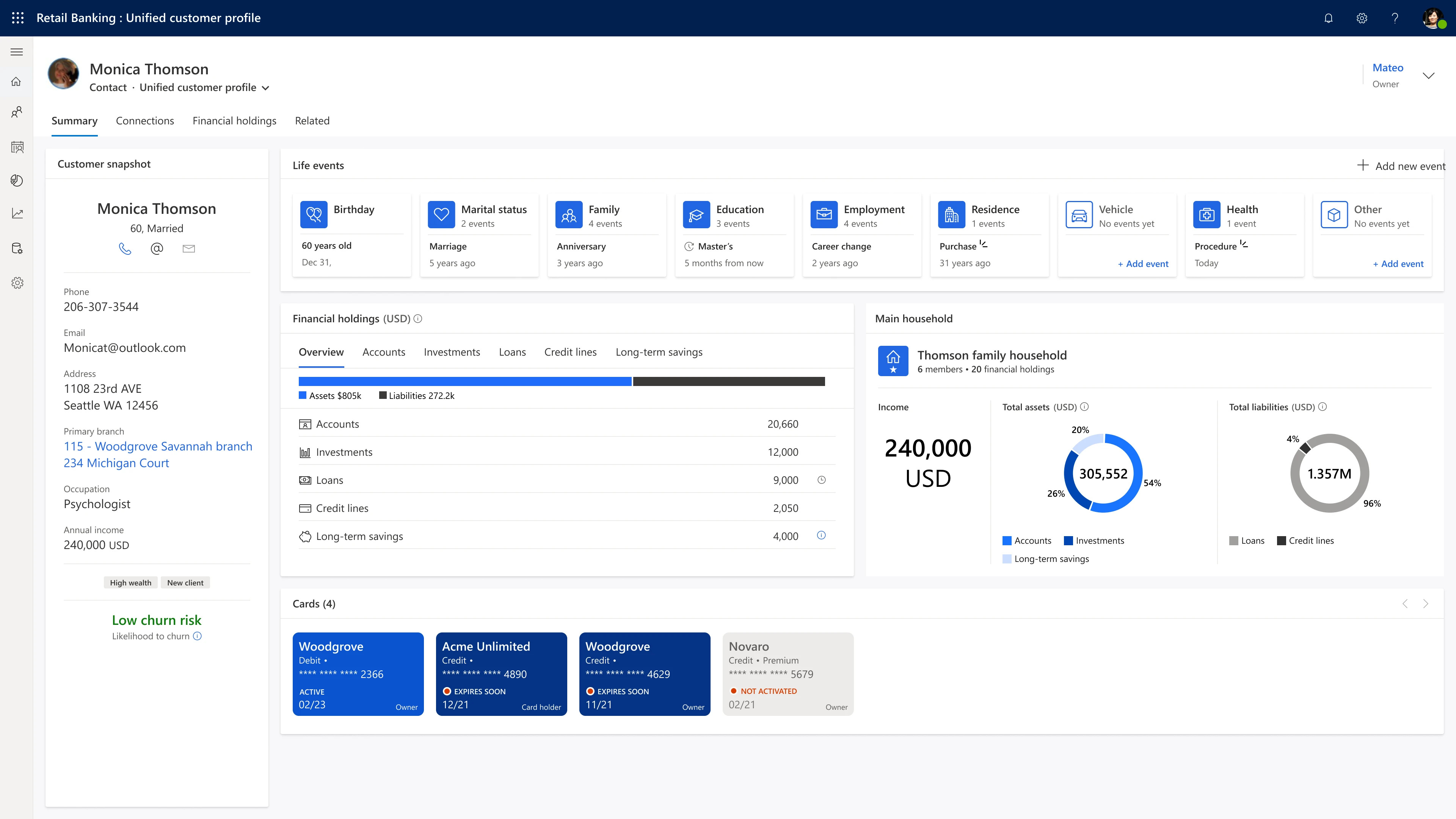

3. Microsoft

Microsoft Cloud for Financial Services represents an all-in-one suite of integrated solutions, featuring Microsoft Azure, Microsoft 365, Dynamics 365, Microsoft Teams, and Power Platform, designed to meet the distinctive demands of the financial industry. It empowers financial advisers to efficiently manage extensive volumes of financial data, facilitating the delivery of exceptional experiences, empowering staff, and combating financial crime.

This cloud-based solution places paramount importance on security, compliance, and seamless integration. By enhancing collaboration, automation, and insights, it optimises operations, improves personalised customer interactions, as well as overall customer experiences, and offers valuable data insights.

This industry-specific cloud harnesses the full potential of Microsoft's existing and emerging capabilities, fostering responsible and sustainable growth, further enhanced by a robust partner ecosystem.

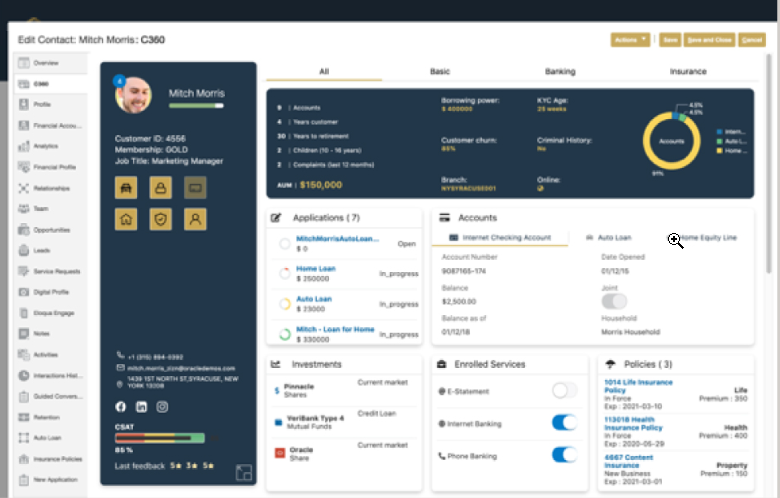

4. Oracle

Oracle CX for Financial Services enables financial advisers to revolutionise their operations and shift towards a digital client experience. By providing a comprehensive 360-degree view of customer data and interactions, financial organisations can establish personalised relationships with each customer, delivering tailored financial solutions to meet their exact needs.

Automation facilitates seamless identification, nurturing, and generation of referrals for cross-selling products through diverse channels such as social, mobile, and the web. The Needs Analysis feature facilitates guided selling and self-service personalised product recommendations, thereby streamlining customer onboarding and account origination processes to enhance the overall customer experience.

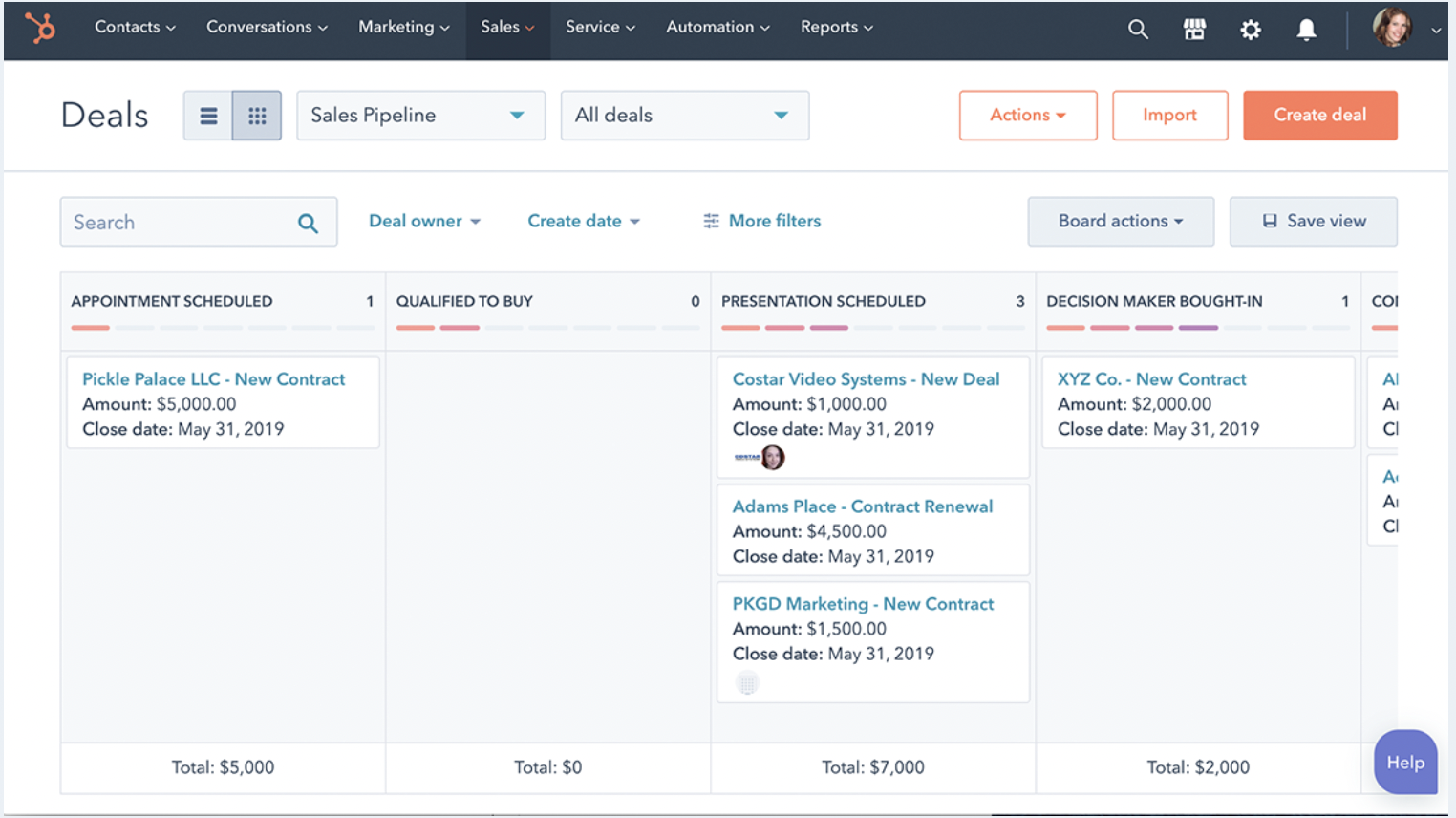

5. HubSpot

HubSpot CRM is a versatile customer relationship management solution that incorporates tools for marketing, sales, services, operations, and content management. While it does not offer a specialised solution explicitly tailored for financial services, it can be customised to support the needs of certain financial advisers.

This integrated platform enables financial professionals to effectively organise, track, and nurture client interactions, thereby enhancing customer relationships. HubSpot CRM also includes analytics and reporting features to facilitate data-driven decision-making.

It supports compliance management and integrates smoothly with other HubSpot tools, streamlining data sharing and communication throughout the organisation. With its user-friendly interface and scalability, HubSpot CRM empowers financial institutions to deliver personalised experiences and stimulate growth.

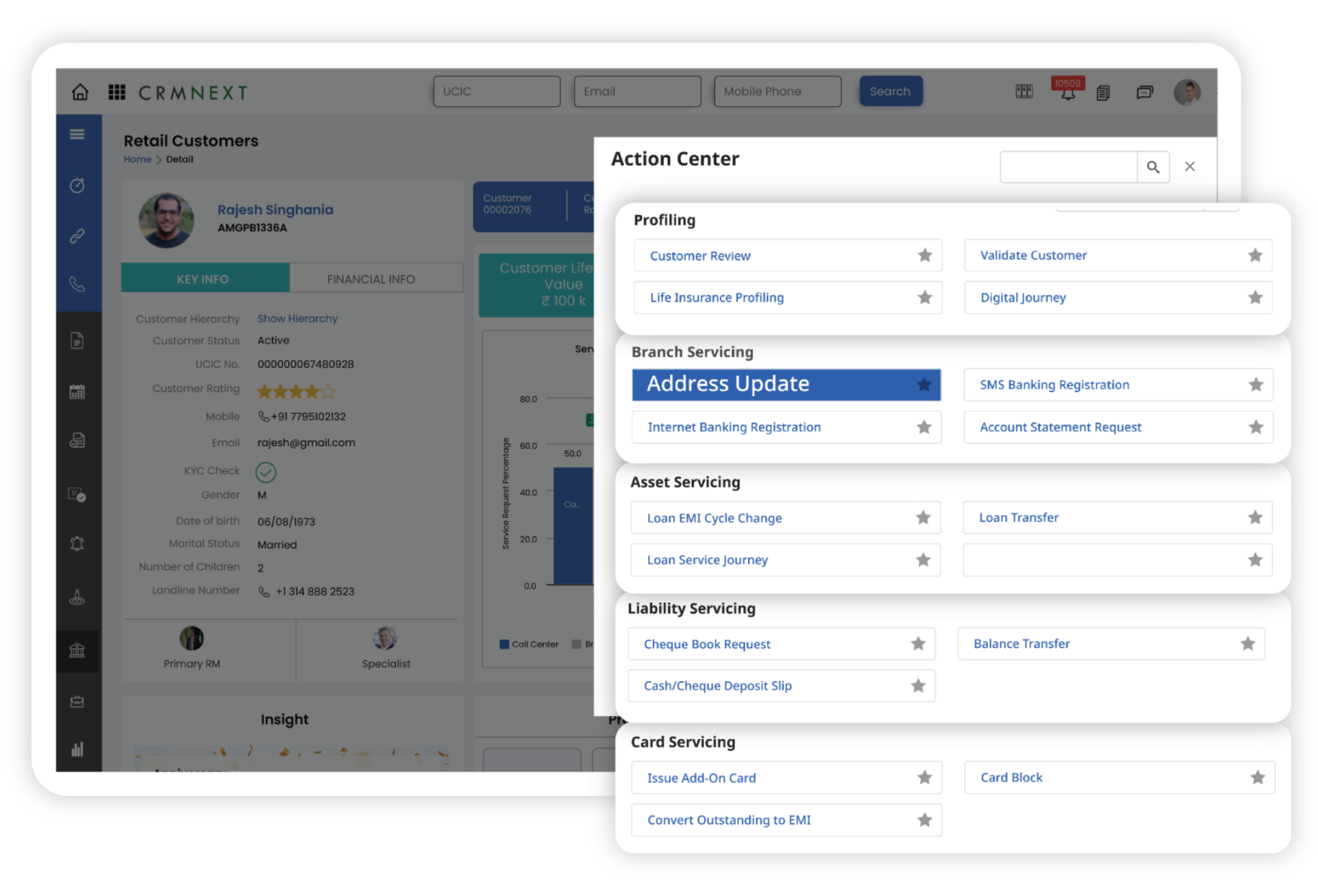

6. BUSINESSNEXT

BUSINESSNEXT is a CRM suite specifically designed for financial advisers. It aims to pioneer autonomous banking by offering a modular set of platforms including CRMNEXT, DATANEXT, CUSTOMERNEXT, and over 12 pre-configured products.

BUSINESSNEXT empowers businesses to undertake a transformative journey towards achieving true autonomous banking, delivering a comprehensive experience for users, customers, and partners. It harnesses the capabilities of full-stack big data and AI, enabling businesses to reconstruct, reorganise, and realign their technological components utilising the flexible architecture known as “Fybre”. This approach ensures exceptional scalability, cloud-native configurations, and observability, paving the way for a complete shift towards autonomous banking.

FAQ

What is finance CRM?

Finance CRM, or Financial Customer Relationship Management, is a specialised software solution crafted for the financial services industry. It assists financial advisers in managing customer interactions, streamlining operations, ensuring compliance, and delivering personalised products and services.

How does Financial CRM software improve customer experiences?

CRM for finance offers a comprehensive view of client information, facilitating personalised interactions, prompt responses, and bespoke financial solutions. This fosters greater customer satisfaction and trust.

Which departments within financial institutions can benefit from finance CRM?

Across departments such as marketing, sales, customer service, loan origination, compliance, HR, IT, and finance, CRM tools can be utilised to streamline operations and enhance customer experience.

What are the key features of financial CRM software?

Key features include unified data management, marketing and sales automation, customer service support, workflow automation, AI and machine learning, omnichannel communication, document management, and analytics and reporting.

How do you choose the best CRM for your bank?

When selecting the optimal CRM for finance, consider factors such as customisation, user adoption, ease of use, security, scalability, and openness to ensure it aligns with your institution's precise requirements and support long-term growth.