First United Bank & Trust Seamlessly Runs Operations with Creatio's No-Code Platform

First United Bank & Trust is a premier full-service financial institution offering a comprehensive range of consumer deposit and loan products, as well as various banking services. With over a century of experience and an unwavering commitment to excellence, the institution stands as a reliable partner in navigating diverse financial landscapes, ensuring client success across all aspects of money management.

Key figures

Key deliverables

Watch the interview with Christopher Bladen, Operations Analyst at First United Bank & Trust

From challenges to no-code solutions

First United Bank and Trust identified a bottleneck in its operational efficiency. The Bank utilized two CRM systems simultaneously yet neither provided a comprehensive view of a customer's relationship. The existing solutions failed to keep up with customer demands and rapidly changing market conditions.

The CRMs were rigid and lacked essential functionalities. Information was scattered, the reporting process lengthy and complicated, and it was not possible to integrate them with other tools to effectively support operations.

The bank recognized the need for a more efficient and cohesive CRM solution. The urgency escalated when one of the systems announced it would no longer provide updates and that real-time API integration would take years to implement. This scenario made it clear that a new, more advanced, and flexible solution was necessary.

To address these challenges, First United Bank and Trust took decisive action to implement the Creatio

One platform for holistic customer view and better service

In the past, due to limitations in both systems, customer data was fragmented, making tracking and accessing difficult. This resulted in misunderstandings between departments and communication challenges, exacerbating existing inefficiencies. As a result, it became a significant pain point within the organization.

The implementation of the Creatio no-code CRM system has dramatically improved communication within the bank, leading to enhanced customer service and smoother operations. Automation features allow the system to scrape fields and automatically populate data, eliminating the need for users to re-enter information. This reduces the likelihood of errors and miscommunications when maintaining accounts. By consolidating data into a single platform, multiple departments now have access to the same information, significantly minimizing potential miscommunication between service teams and customers. The consolidation has greatly improved the way the bank serves its customers.

Creatio allowed us to achieve a streamlined and holistic view of customers. With the new system, if a customer interacts with the commercial department, this information is visible to the retail or wealth management sides. This visibility enables better coordination and more informed responses, ultimately enhancing the overall customer experience.”

No-code as a game changing factor

Due to limitations in their previous systems, First United Bank and Trust recognized a significant opportunity in the Creatio no-code platform. With its

The CRM is great, but what really sold us on Creatio was the no-code features. The ability to make changes ourselves was incredibly empowering and the idea of self-servicing the platform was very appealing.”

Core banking system integration that changes the game

Integration with the core banking system was paramount for First United Bank and Trust. It was necessary to address data inconsistencies and provide a 360-degree customer experience. Leveraging

The pivotal difference was seen with the integration of Glyue™ by Sandbox Banking. This integration not only provided robust API connectivity but also maximized the value of existing systems and amplified data across critical platforms. Now, First United Bank and Trust operates more effectively by streamlining communication and data flow, ensuring a cohesive and responsive banking experience.

Unleashing data power

Lastly, First United Bank and Trust faced challenges in reporting and making informed decisions. They relied on manual data requests, resulting in delays, lack of synchronization, and hindered real-time data exchange. Customer information was fragmented in silos, making valuable insights invisible. Additionally, the process to request and assess data was lengthy, compounded by complex Excel files.

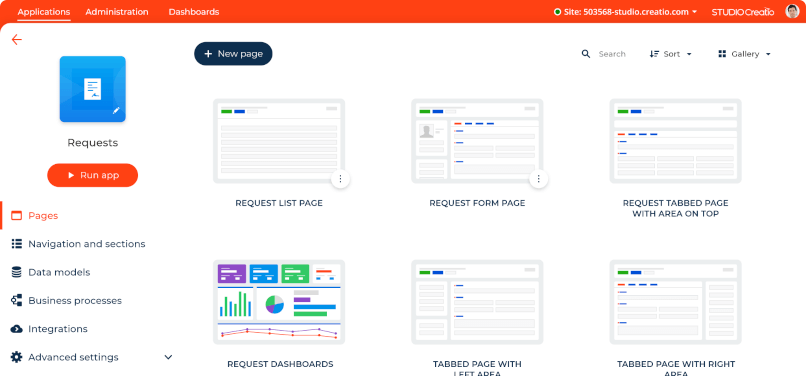

To overcome this, the bank now utilizes Creatio's reporting capabilities and dashboards for real-time data access. Creatio allows users to generate customized reports on demand. This transition automated reporting processes, enhancing efficiency and reducing errors. Centralizing data within the CRM platform improved visibility into customer interactions and operational metrics, fostering data-driven decisions. With Creatio's

We're continually enhancing our dashboards and reporting tools across different sections. The contact section stands out as especially valuable, offering a convenient place to showcase every departmental dashboard effectively.”

About Solutions Metrix

Solutions Metrix is a consulting and CRM integration organization headquartered in Montreal, dedicated to driving technological innovation for its clients, with a focus on enhancing customer experiences. Recognized for prioritizing business capabilities and solutions over specific platforms, the company guides clients through every stage of their digital transformation journey. This includes CRM procurement and selection, CX consulting and best practices, planning and roadmap development, implementation and integration, business consulting, CRM user adoption and change management, CRM self-sufficiency, and the development of custom applications.