-

No-Code

Platform

-

Studio

No-code agentic platform delivering the fastest time-to-value and the highest ROI

-

Studio

-

AI-Native CRM

CRM

-

AI-Native CRM

New era CRM to manage customer & operational workflows

CRM Products -

AI-Native CRM

- Industries

- Customers

- Partners

- About

Private Equity CRM - 10 Best CRMs for Private Equity in 2025

Updated on

November 20, 2025

11 min read

Creatio: Agentic CRM to Enhance Private Equity Deals

Private equity CRM is an essential tool in the technology stack of a modern private equity firm. It helps businesses manage investor relations and portfolios, and streamline deal flow to achieve higher profitability.

In this article, we’ll explore what a private equity customer relationship management system is, its benefits and key features, and compare the top 10 CRMs for private equity firms.

What is Private Equity CRM?

Private equity CRM is a customer relationship management software designed to effectively manage private equity portfolios and relations with investors. PE CRM provides a centralized platform with all crucial data necessary to streamline deal tracking, portfolio monitoring, and fundraising.

The success of private equity firms relies on building strong relationships with investors based on mutual trust and understanding, and having a dedicated tool to enhance relationship management is essential. Private equity CRM centralizes investor data to personalize interactions, monitor investor preferences, and deliver timely updates, fostering deeper trust and long-term partnerships.

By automating workflows and deal tracking, private equity CRM tools boost productivity, helping private equity professionals to focus on high-value activities, such as nurturing relationships with investors, identifying profitable opportunities and maximizing deal potential.

Benefits of Using a Dedicated Private Equity CRM

Private equity CRM platforms provide multiple benefits that directly impact the success and profitability of private equity firms.

Here are the benefits of adopting a CRM for private equity:

1. Stronger relationships with private equity investors

In the private equity industry, maintaining trust and long-term relationships with investors is essential. A private equity CRM empowers firms to do that by helping them deliver relevant and personalized experiences for investors tailored to their unique needs, preferences, and risk tolerance. By consistently meeting and exceeding investor expectations, private equity firms can gain trust and loyalty, securing repeat commitments for future fundraising.

2. Accelerated deal closures

Private equity companies usually have to deal with long sales cycles and prolonged decision-making processes, because of the complexity and high stakes involved in their transactions. Deals often require extensive due diligence, multiple rounds of negotiations, and input from various stakeholders. Private equity CRM can help streamline deal flow, ensure transparency, and keep all parties aligned by providing clear visibility into deal progress, automating routine tasks, and facilitating effective communication. This results in shorter deal cycles and reduced time-to-closure.

3. More effective fundraising campaigns

Fundraising is a cornerstone of private equity success, but it’s also a time-consuming process. With a private equity CRM, firms can operate more strategically, targeting the right prospects with tailored pitches and tracking progress in real-time.

4. Data-driven decision making

A private equity CRM improves data management across the whole company and provides detailed insights into investor preferences, market trends, and portfolio performance. Private equity professionals can use this information to identify lucrative opportunities, improve portfolio outcomes, and refine their strategies.

5. Enhanced collaboration and increased operational efficiency

A private equity CRM fosters teamwork by centralizing data and communication, ensuring everyone has access to the same up-to-date information. This reduces miscommunication and helps all teams align their efforts towards a shared goal.

By automating repetitive tasks such as data entry, reporting, and follow-ups, a private equity CRM frees up valuable time for private equity professionals to focus on finding new investors, nurturing relationships with them, and closing deals.

Key Features of Private Equity CRM

Private equity CRM platforms are equipped with industry-specific features that enable firms to manage relationships, deals, and operations more effectively.

Here’s an overview of the most important features:

- Data management - automatically captures and updates all critical data regarding deals, portfolio companies, and private equity investors from multiple sources including emails, calls, etc., and stores that data in a centralized platform so that all employees have easy access to up-to-date information.

- Data enrichment - integrates various external data sources to enrich internal data with insights about market trends, competition performance, and investor activity.

- Relationship intelligence – an advanced form of data enrichment that analyzes data points across the firm’s business network to identify potential connections, find the warmest introductions, and prioritize valuable investment opportunities.

- Pipeline management - tracks deals across the whole sales cycle from sourcing to closure, providing clear visibility into the pipeline.

- Deal flow management - organizes and categorizes deals, making it easier to prioritize them, efficiently allocate resources, and make data-driven decisions.

- Reporting and data analysis - automatically tracks, analyzes, and creates dashboards with KPIs such as liquidity, multiple on invested capital (MOIC), cash flow, expense control, internal rate of return (IRR), and customer lifetime value.

- Workflow automation - automates routine tasks such as data entry, call scheduling, etc., to allow private equity professionals to focus on high-value activities like deal sourcing and relationship building.

- Virtual AI assistant - robust private equity CRMs provide AI-empowered assistants to further enhance process automation.

- Portfolio management - tracks the performance of portfolio companies, including financial metrics, operational updates, and key milestones.

Top 10 CRMs for Private Equity Firms

Now that you know what are the benefits of private equity CRM you may wonder what will be the best solution for your company. There are multiple software available on the market, so to make your choice easier, we prepared this guide.

Here's a comparison of the10 best private equity CRM systems:

1. Creatio

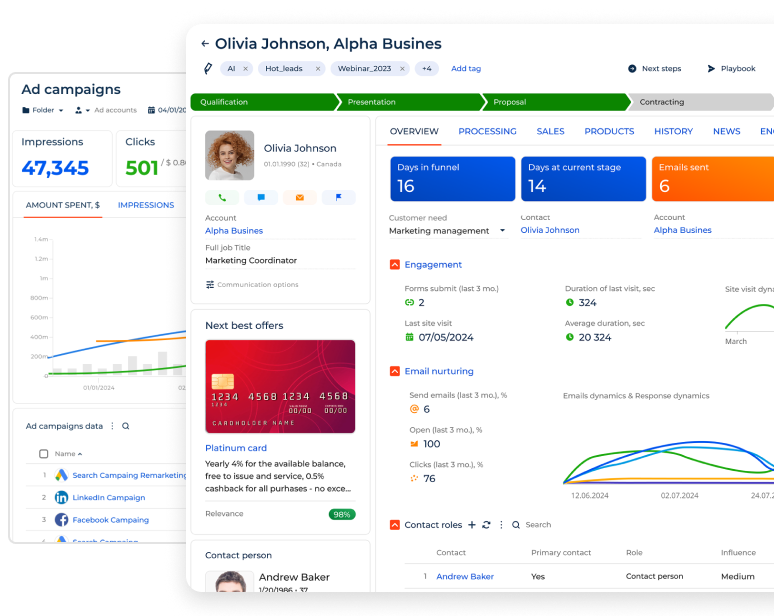

Creatio CRM is an agentic, no-code CRM and workflow automation tool designed to support sales, marketing, and customer service teams. Its composable no-code architecture empowered by AI-native capabilities for predictive, generative, and agentic AI, allows PE professionals to easily automate their unique use cases and customize the solution to their unique business needs.

Creatio CRM provides features crucial for private equity firms, including data management with a 360-degree view of all investors and portfolio companies’ data, robust pipeline management, data analytics, and reporting enriched with actionable insights. It seamlessly integrates with over 700 third-party applications, ensuring seamless data flow across the entire technology stack.

Creatio AI helps PE professionals with no technical expertise create new functionalities and workflows by using natural language and composable components to further customize their CRM solutions. Creatio AI also empowers private equity professionals to work more efficiently and strategically by automating routine tasks, such as data entry and update, and providing business intelligence for informed decision-making.

Pros

- intuitive, user-friendly interface

- highly customizable and scalable solution

- access to powerful unified AI capabilities across predictive, generative, and agentic AI use cases at no additional cost

- robust data analytics and reporting capabilities with interactive dashboards and real-time data-driven insights

- omnichannel data capture and tracking, including the entire history of interactions and communications

- seamless email and calendar integration

- highest security standards including end-to-end encryption, and multi-factor authentication

- compliance with industry standards and regulations

- eliminate manual data entry

Cons

- might present an initial learning curve due to extensive customization options

Rating

4.9/5

Pricing

Pricing starts at approximately $25 per user per month with no extra fees for advanced features.

2. Affinity

Affinity is a CRM system designed for alternative investment firms, including private equity and venture capital firms to build and nurture investor relations. It helps find, manage, and close more investments with relationship intelligence. Affinity CRM provides enriched data on investors and portfolio companies to better match investment criteria, and simple deal management features to deliver insights to key stakeholders. It also automates data entry, helping private equity professionals save hundreds of manual work.

Pros

- 360° view of network and deals, including relationship intelligence and actionable insights provided by artificial intelligence

- automated data capture from email, and calendar events

- integration with third-party data sources

- easy-to-use, intuitive platform

Cons

- high costs of ownership

- lack of control over how the company’s data is shared

- limited analytics and reporting capabilities

Rating

4.4/5

Pricing

The pricing for Affinity CRM starts at $2000 per user per year.

3. Altvia

Altvia is an industry-specific CRM for private capital relationships and deal-making built on top of Salesforce. It empowers private equity companies to centralize their data and enhance informed decision-making across investing, fundraising, and Limited Partner (LP) engagement. With Altvia CRM businesses can ensure steady deal flow and prioritize the most valuable opportunities, streamline workflows, and analyze the investment outcomes.

Pros

- Robust tools for tracking and reporting calls, meetings, and events

- Secure communication and data-sharing platform for LP engagement

- Features for streamlining due diligence and risk assessment processes

- Personalized reporting and interactive dashboards with data-driven insights

Cons

- setting up the system takes a considerable amount of time

- steep learning curve for new users

- limited customization options

- setting up reporting requires additional support from third parties

Rating

4.3/5

Pricing

Pricing starts from $1800 per year.

4. Salesforce CRM

Salesforce is a CRM software providing solutions for sales, marketing, and customer service teams. Salesforce CRM is not a tool built with PE firms in mind, however, it provides essential features including workflow automation, central partnership and contact management, portfolio performance insights, data analytics, and reporting.

Pros

- seamless integration with third-party tools

- customizable and scalable solution

- streamlined deal flow management with potential acquisitions monitoring

- centralized investor data with contact information, communication history, and preferences

- AI-powered automation with Einstein virtual assistant

Cons

- requires developers support to customize and maintain the system

- high costs of ownership

- additional fees for advanced features like AI assistant

- limited out-of-the-box reporting capabilities

- might be over complicated for private equity firms needs

Rating

4.2/5

Pricing

Pricing for Salesforce starts at around $300 per user per month but largely depends on the chosen solutions and additional features.

See also: Salesforce Alternatives & Competitors and Salesforce Marketing Cloud Alternatives & Competitors

5. 4Degrees

4Degrees is a private equity CRM platform designed to drive proprietary deal flow, and close more investments. It streamlines relationship management to originate and close more deals with relationship-strength scoring algorithms. It helps private equity firms customize deal flow to their unique dealmaking processes, track and manage deals' progress, and automate data entry to record all interactions with the entire network.

Pros

- integrates with over 1000 third-party apps and selected CRM systems

- customizable dashboards with real-time key metrics visualization

- portfolio monitoring and document management capabilities

Cons

- integrations require a third-party tool called Zapier

- limited capabilities for developing deep insights

Rating

4.5/5

Pricing

Pricing is available upon request.

6. Navatar

Navatar is a private equity CRM system empowered by proprietary intelligence. It automatically collects data to provide a clear view of each opportunity and connects all intelligence within investments to improve qualification and evaluation. Navatar CRM provides deep insights for improving investor relationships, building strategic partnerships, and enhancing fundraising capabilities.

Pros

- deal evaluation and due diligence features

- automated intelligence engine for gathering all important information

- deep insights into prospect engagement strategy

Cons

- requires manual data entry

- deployment requires a considerable amount of time

- limited customization capabilities

- poor reporting capabilities

Rating

4.0/5

Pricing

Pricing available upon request

7. Dynamo

Dynamo is a cloud-based investment management software tailored to private equity business needs. It helps private equity professionals drive relationships and deals, improve their outreach efforts, track relations with investors, and monitor the performance of existing investments. Dynamo provides features for capital raising and investor pipeline management, investor relations, and fundraising management, portfolio monitoring and valuation, and fund accounting.

Pros

- robust deal management from souring through funded investments

- real-time reporting, configurable dashboards, and data visualization

- mass-mailing outreach capabilities

- investor portal for robust reporting and centralized document delivery

- user-friendly design and simple navigation

Cons

- requires manual data entry

- some users reported occasional glitches and lags

- limited customization options

Rating

3.9/5

Pricing

Pricing is available upon request.

8. eFront

eFront is a private equity software that streamlines and centralizes the investment cycles, optimizing the capital raising process, and enhancing data and reporting. It provides six modular products that help private equity professionals maximize the performance of their portfolios, mitigate risks, and accurately respond to changing private equity needs and regulatory requirements. eFront provides features for deal sourcing, fundraising, valuations, performance evaluation, data collection and portfolio monitoring, and investment and fund management.

Pros

- transparent investor reporting

- comprehensive portfolio management feature

- intuitive and easy-to-use interface

- easy implementation

Cons

- lack of insights and relationship intelligence

- limited integration capabilities with third-party applications

Rating

4.0/5

Pricing

Pricing is available upon request.

9. Xpedition

Xpedition is a private equity CRM solution leveraging Microsoft Dynamics 365 and generative AI to accelerate decision-making with actionable insights. Thanks to powerful data analytics it provides a 360-degree view of all the investments and investors. Xpedition is designed to improve productivity and integrate with existing technology and data of PE firms. It provides features for deal flow, fundraising, and investor relations to track, nurture, and progress fundraising targets and control, monitor, and advance deals through the sales pipeline.

Pros

- seamless integration with Microsoft Dynamics technology stack and third-party data

- integrated platforms for reporting, portfolio monitoring, and data analysis

- enhanced real-time business intelligence for data analysis and visualization

Cons

- unintuitive and difficult-to-use user interface

- users reported occasional glitches

- requires support from developers to maintain the system

Rating

-/-

Pricing

Pricing is available only upon request.

10. Satuit

Satuit is a private equity CRM software designed to streamline operations and increase the value of client relationships. It provides features for deal flow management, investor relations, and fundraising to support complex private equity operations. Satuit empowers private equity professionals to manage fundraising activities, portfolio oversights, and legal contracts, and track potential investments with ease.

Pros

- robust deal lifecycle management from prospecting to closing

- capital calls management and investor compliance reporting

- integration with Outlook and Gmail

Cons

- challenging integration with third-party tools

- unintuitive and outdated user interface

- insufficient customization capabilities compared to other solutions

- lack of workflow automation, and predictive analytics

Rating

4.3/5

Pricing

Pricing starts at $150 per user per month for the Satuit Essentials plan.

How to Choose the Right Private Equity CRM?

To choose the best private equity CRM for your business you should consider some key factors including your business goals, the ease of use of the solution, its scalability, etc.

- Business goals - define specific goals you want to achieve by implementing a CRM solution for private equity. Whether it’s improving relationships with investors, enhancing fundraising efforts, or improving the deal flow, having specific goals in mind will help you assess which CRM is right for your needs.

- Available features - make sure the chosen solution has all the features your business requires or offers the capability to develop them, for example, through no-code tools. Look for essential private equity features including data and pipeline management, workflow automation, data analysis, and reporting.

- Ease of use - look for a solution that will be easy to use for users with no technical expertise. Consider choosing a no-code solution that offers an intuitive interface and drag-and-drop tools that facilitate user adoption.

- Customization options - opt for CRM software that can be fully customized to your business, especially if you have unique processes. Check if the platform has a customizable interface, workflows, business logic, etc.,

- Integration capabilities - the private equity CRM of your choice should be able to seamlessly integrate with your existing technology stack and third-party applications, including email, calendar, etc.

- AI assistant - benefit from the newest technology advancements and choose a CRM software that offers a virtual AI assistant for enhanced automation and data analysis.

- Data security - managing sensible financial investor information requires maintaining the highest security standards. Look for a CRM software that provides security features, including multi-factor authentication, and ensures compliance with industry regulations such as the Sarbanes-Oxley Act, Investment Advisers Act, and Bank Secrecy Act.

- Scalability - as your company grows, you’ll need a solution that can grow alongside it. Opt for a CRM that can seamlessly scale to accommodate increased data and user volume.

- Total cost of ownership - estimate the total cost of private equity CRM solutions, including any additional fees, and make sure the chosen software fits within your budget.

Transform Your Private Equity Operations with Dedicated CRM

A dedicated CRM transforms how private equity firms operate, helping them strengthen relationships with investors, accelerate deal flow, and improve their fundraising efforts. By centralizing all important data regarding investors and portfolio companies in a unified platform, automating workflows, and providing actionable insights, a private equity CRM empowers firms to shorten their sales cycles, manage portfolios more efficiently, and make data-driven decisions.

When choosing a solution tailored to their unique needs and preferences, private equity companies should consider factors such as the functionality of the platform, its ease of use, and customization capabilities. Among many solutions available on the market, Creatio CRM stands out as the best private equity CRM software. With its no-code platform, powerful AI tools, advanced analytics, and industry-specific capabilities, Creatio empowers private equity firms to succeed in their fast-paced and highly competitive landscape.