-

No-Code

Platform

-

Studio

No-code agentic platform delivering the fastest time-to-value and the highest ROI

-

Studio

-

AI-Native CRM

CRM

-

AI-Native CRM

New era CRM to manage customer & operational workflows

CRM Products -

AI-Native CRM

- Industries

- Customers

- Partners

- About

Creatio: Cutting Edge CRM for Insurance Companies

The life insurance market in the US is growing fast, and the necessity of having functional life insurance CRMs is indisputable.

Based on data from the Insurance Information Institute, Forbes reported the insurance market size jumped from $143.1 billion in 2020 to $159.5 billion in 2021, demonstrating an 11.5% rise. But with growth, there come challenges.

Insurance firms often struggle with a few areas, including maintaining customers’ happiness, meeting sales goals, and adhering to laws. A dedicated and specialized Customer Relationship Management (CRM) system can help solve these issues for life insurance businesses. Today, we’ll examine how insurance companies can utilize life insurance CRMs to achieve business success. We’ll also explore what insurance solution is a top choice for many businesses.

What is a Life Insurance CRM?

A Life Insurance CRM is a specialized customer relationship management platform tailored to the unique needs of life insurance companies, helping them efficiently manage customer relationships, policies, and related information. The platform lets you carry out and manage all of your customer-side activities, which include:

- Contact management

- Policy management for individual customers

- Lead segmentation and management

- Marketing and sales automation

- Customer onboarding

- Claims management and settlements

- Compliance management, and more

Insurance agents have to deal with intense competition as a part of their job. Manual handling of a lot of repetitive tasks leaves room for error.

In such cases, the automation capabilities of a robust insurance CRM can make a huge positive difference. A good customer management software suite can enhance the operational efficiencies of insurance companies to a great extent.

Importance of Life Insurance CRM

Considering the competition in the insurance industry, having a good customer relationship is necessary for business sustainability.

Realizing the importance, thousands of businesses globally are now adopting dedicated CRM solutions. Statista forecasted that the global CRM market will expand by approximately $4 billion between 2021 and 2025 to reach $57 billion in 2025.

The life insurance industry is no exception, where a CRM tool is one of your most convenient tools to manage operations and customer relations effectively. Let's break down the tool’s benefits and importance for your life insurance business.

Customer retention

Retaining existing customers rather than chasing new ones is often easier and more impactful. Here’s how a life insurance CRM helps.

- Tailored service: CRM tools let you make offers and interact in ways that personally resonate with each customer. As a result, your customers will feel understood, valued, and welcomed.

- Prompt follow-ups: Automated CRM reminders ensure you never miss a beat regarding policy renewals or feedback sessions.

- Reward loyalty: CRMs can help structure loyalty programs to reward long-term customers, encouraging them to stay on board.

Data-driven insights

With an insurance CRM that can draw insights from real-time data from various sources, you no longer need to wait for days to make a decision.

- Smart predictions: By looking at past data, CRM helps guess what customers might need next or how market trends may shift. Such intelligent forecasts and market predictions always keep you ahead of the curve.

- Clear performance metrics: CRM lays out how well different areas of your business are doing. You’ll quickly find where to improve and which areas are causing bottlenecks or inefficiencies.

- Better decision-making: With all the insights, making informed decisions becomes a breeze, paving the way for smarter strategies.

Sales and marketing efficiency

A CRM makes your life insurance sales and marketing team more efficient and result-driven. Here’s how:

- Lead juggling: Sales agents can keep tabs on potential customers and always have the most updated communication data available.

- Easy campaign checks: Marketing managers can assess the performance of marketing efforts and make necessary adjustments to promotional campaigns.

- Efficient communication: A CRM consolidates several communication channels and lets you coordinate sales and marketing efforts seamlessly. The tool is excellent for keeping everyone on the same page through configurable notifications and workspace management.

Streamlined document handling

An insurance company may have to store and manage a massive amount of documents for each customer. You can leverage a software product for that.

- All documents in one spot: Having a central place for all documents makes it easy to find what you need. You can always pull out the right legal documents in seconds.

- Clear audit trails: Every interaction and transaction is logged clearly with your insurance CRM. As a result, compliance checks and audits become a breeze.

- Lesser paperwork: Digital storage of documents directly contributes to your cost savings through reduced need for physical storage and office space.

Improved customer service

Providing superior customer service is one of the biggest benefits you can achieve with a good life insurance CRM.

- Quick answers: Having customer data at hand means queries get resolved faster, keeping customers happy.

- Speedy automated replies: CRMs let you handle routine communications swiftly with automated responses. Advanced features like sentiment and emotion analysis also help with personalized communications.

- Streamlined claims processing: Process claims faster and more accurately. You can reduce hassle for both staff and customers.

CRM Use Cases for Insurance Agents

It’s not uncommon for life insurance agents to suddenly find themselves under tons of paperwork and miss the potential daily leads. A dedicated life insurance CRM can be a lifesaver in those challenging times and help insurance agents manage their daily work efficiently.

Lead management

Any lead can be a golden opportunity. Acquiring, nurturing, and managing the leads can significantly help you expand your customer base. A CRM for insurance can help with:

- Organizing leads: Life insurance agents can keep all lead information in one place – contact details, preferences, interaction history, and more. CRM software tools typically include a comprehensive and unified dashboard that gives you a bird's-eye view of the lead status.

- Prioritizing leads: Agents can identify and focus on high-potential leads more likely to convert. Also, delegating low-potential leads to less experienced team members and trainees for initial communications becomes easier.

- Timely follow-ups: The automated reminders are always there so that the sales agents won’t find it difficult to initiate on-time follow-ups with prospective leads. Also, it’s easier to find previous communication records within the CRM system.

Claims management

An efficient and robust claim management system is one of the primary things you can do to maintain customer satisfaction in a life insurance business. Right from the moment a customer files a claim request, a life insurance CRM starts to streamline the process. The centralized platform ensures smooth coordination among several departments.

The CRM system starts by logging the claim details into its database, ensuring a formal record of the claim along with all relevant details and documents. At the same time, the CRM system also helps organize and store the documents digitally with features like OCR or optical character recognition.

To ensure clear communication throughout the claim management process, agents can always access the documents and communication records. You can add extra layers of security through configurable user access control.

Once a claim is approved, the CRM helps in tracking the disbursement process as well. All of the involved parties will remain aware of fund disbursement. Finally, your life insurance CRM can collect customers’ feedback on their experience for future improvements.

Document management

If you want to modernize and automate your life insurance document management process, implementing a CRM can greatly help. Customer management software products with cloud and digital document storage capabilities help with:

- Managing every document and communication in a centralized storage that is easy to share and retrieve.

- Secure sharing and customized access control ensure your confidential and sensitive documents are always handled with care. Also, it protects you from potential non-compliance with privacy regulations.

- Real-time editing and collaboration capabilities help mitigate procedural delays and keep everyone connected.

Automation

Automation is like having an extra set of hands for your team members. Your agents can now easily leave the routine and repetitive tasks to automation that works with predefined rules. Many platforms also come with intelligent automation of administrative tasks leveraging AI and ML.

Here’s an example. When a policy renewal date approaches, you can configure your life insurance CRM system to automatically send a payment reminder to the customer that is also copied to the relevant sales agents.

Analytics and reporting

A life CRM insurance saves your time by efficiently tracking metrics like:

- Sales performance

- Campaign effectiveness comparison

- Customer interactions

- Regional data comparison, and more.

For example, after launching a new policy, you can monitor the sales and customer responses through CRM analytics. This gives you a clear understanding of its market reception. Moreover, you can refine business and sales strategies for better outcomes through regular reports and analytics.

Why Creatio Is the Perfect Solution for the Life Insurance Industry

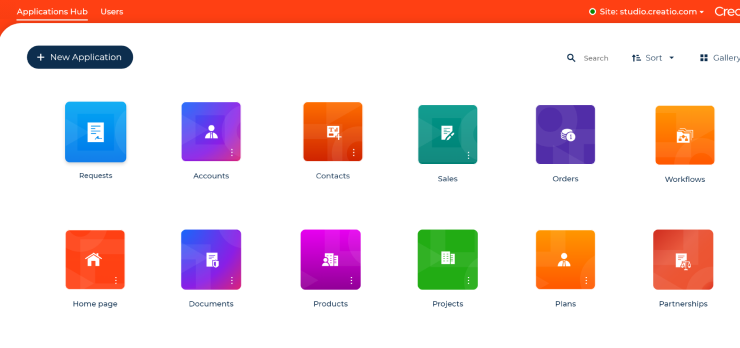

Creatio offers a cutting-edge CRM and no-code solution designed to meet the diverse needs of the insurance industry, including life insurance providers. This comprehensive solution not only streamlines CRM processes but also transforms internal administrative tasks within insurance companies.

Here are some of Creatio’s top features:

- Marketing and sales automation: Creatio empowers insurance professionals with robust tools to automate and optimize marketing and sales efforts, ensuring efficient customer acquisition and retention.

- Omnichannel customer service: the platform facilitates seamless communication with policyholders across various channels, enhancing the overall customer experience.

- End-to-end claim cycle automation: Creatio simplifies and accelerates the often complex and time-consuming claims process, promoting rapid resolution and customer satisfaction.

- Policy administration: Creatio allows you to efficiently manage policy-related tasks, from policy issuance to renewals, ensuring accuracy and compliance.

- Document management: the solution simplifies document handling, enabling easy access, storage, and retrieval of insurance-related documents.

- Self-service: Creatio provides policyholders with a user-friendly self-service portal, enabling them to obtain information and complete tasks on their own and reducing the pressure on the support staff.

- Advanced process automation: leveraging industry-leading BPM (Business Process Management) and AI/ML tools, Creatio provides advanced automation capabilities, streamlining complex insurance processes.

- No-code customization: Creatio's no-code architecture allows insurance companies to create and customize workflows of any complexity with ease, offering limitless possibilities for tailoring the solution to their specific needs.

Transform your life insurance operations with Creatio's CRM solutions

FAQ

What is CRM in life insurance?

CRM (Customer Relationship Management) in life insurance refers to using specialized tools, systems, and strategies for managing interactions with current and potential customers. CRM software helps life insurance agents and companies to stay connected with their customers, streamline processes, and improve profitability.

What is CRM responsible for in the insurance industry?

CRM is responsible for tasks across various domains in an insurance company. The roles include managing customer information, handling leads and opportunities, managing the sales pipeline, and smooth onboarding of customers. In addition, CRM plays a significant role in service delivery tasks, compliance, and documentation.

What is the CRM strategy in the life insurance industry?

A CRM strategy in the life insurance industry is a complete action plan for your insurance business on how you would grow your customer service through coordinated activities and technologies. It requires several business departments (sales, marketing, customer support, accounting, and administration) to coordinate with each other. You can often use CRM solutions for planning and executing the CRM strategy.