-

No-Code

Platform

-

Studio

No-code agentic platform delivering the fastest time-to-value and the highest ROI

-

Studio

-

AI-Native CRM

CRM

-

AI-Native CRM

New era CRM to manage customer & operational workflows

CRM Products -

AI-Native CRM

- Industries

- Customers

- Partners

- About

Credit Union Software: Top 10 Software for Credit Unions in 2026

Updated on

July 30, 2025

14 min read

Accelerate Credit Union Ops at Scale With Creatio

By 2030, the global core banking software market, which also includes solutions for credit unions, is projected to grow by nearly 75%, reaching $21.61 billionbillion, according to Grand View Research. This growth highlights a broader trend toward digital transformation as financial organizations seek modern solutions to optimize workflows, improve member relationships, and remain competitive in a rapidly evolving landscape, and credit unions are no exception.

Credit union software is a key part of credit unions’ digital stacks, helping them consolidate member data, integrate core banking systems and CRM, and streamline various credit union processes to increase member satisfaction and drive revenue.

In this article, we will discuss the core benefits and features of credit union software and also review the top 10 software solutions for credit unions that effectively meet their business goals and needs.

What is Credit Union Software?

Credit union software is a specialized solution designed to manage the full range of credit union operations, including member relationships, middle office operations such as loan management, and administrative workflows like employee lifecycle management.

Some software systems provide a comprehensive suite of features covering multiple areas of credit union operations, while others focus on specific processes. Overall, credit union software can offer the following functionality:

- Member data management – to centralize, securely store and seamlessly share member information across departments

- Sales, marketing, and service automation – to improve engagement, personalize offerings and streamline member communications

- Loan origination and servicing – to manage end-to-end lending processes, from first touchpoint to repayment and repeat applications

- Compliance management – to maintain regulatory compliance, reduce risk exposure, and strengthen audit readiness

- Digital banking – to provide members with intuitive self-service portals and mobile banking capabilities

- Underwriting, verification, and document management – to accelerate risk assessment, approvals, and document workflows

- Customer onboarding – to deliver a fast, frictionless experience for new members

- Payment processing – to support secure, efficient transactions across channels

- Accounting – to gain financial visibility, automate reporting, get in-depth financial insights, and support audits and internal controls

- AI-powered capabilities – to enhance decision-making, automate manual processes, and deliver personalized member experiences

Modern credit union platforms are increasingly embedding AI across various business operations. For instance, AI tools can analyze member data for tailored recommendations, accelerate loan approvals with predictive scoring, support 24/7 service through chatbots, ensure real-time fraud detection, and automate document processing. These capabilities not only reduce operational overhead but also enable credit unions to enhance their service quality and member experience.

According to McKinsey, 78% of organizations used AI in at least one business function in 2024, up from 55% in 2023.

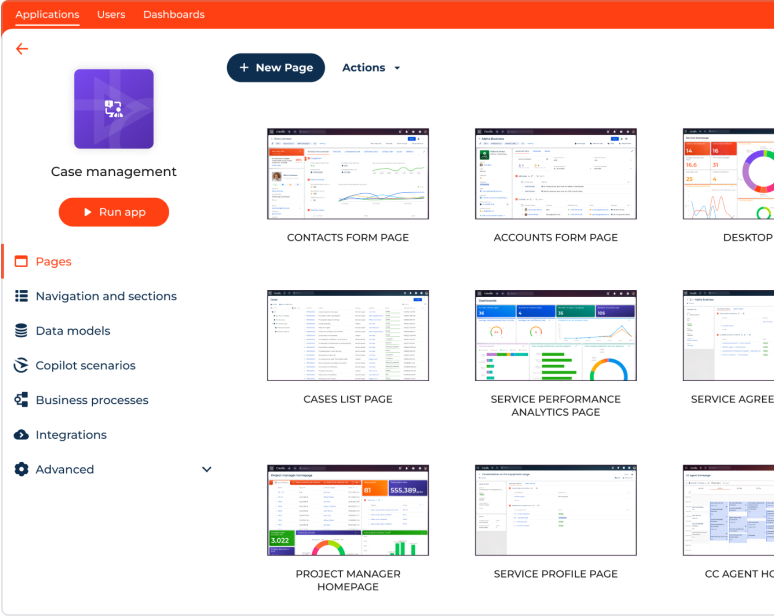

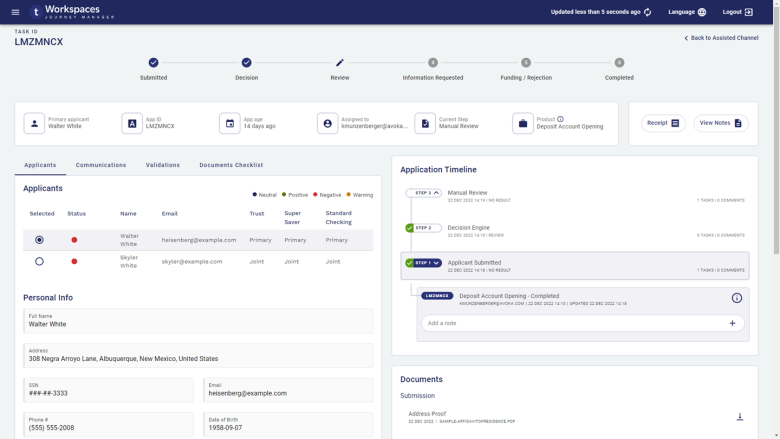

Example of Creatio’s AI-native Software for Credit Unions

Key Benefits of Using Credit Union Software

Centralization of Data and Processes for Enhanced Member Experience

Credit union software allows your employees to quickly and accurately respond to member inquiries by centralizing all member data into one system and providing a complete 360-degree view of each member's profile.

With all the relevant information in one place, teams can easily address members’ questions, resolve member service issues faster, and offer personalized financial product recommendations, improving members’ satisfaction.

According to McKinsey’s analysis, choosing the right data architecture archetype in banking could cut implementation time in half and lower costs by 20%.

Increased Employee Productivity

An all-in-one credit union software solution automates repetitive, time-consuming tasks like data entry and KYC, while employees can focus on high-value work such as building relationships with members.

The software also enhances collaboration between departments by giving employees access to complete member data and omnichannel communication tools. These tools enable them to share information and documents, easily organize tasks and meetings, and coordinate reviews and approvals via unified workflows.

Increased Revenue

Credit union software streamlines lead generation to attract more members, improves sales efficiency by providing relevant member information for cross-selling and upselling, and enhances member satisfaction with faster, more efficient communication — ultimately increasing retention rates.

Data-Based Insights to Improve Your Operations

Credit union software provides in-depth analytics on member behavior and their preferences, as well as insights into the credit union's performance. These insights help optimize operations by introducing changes to inefficient workflows and reinforcing best practices.

Enhanced Data Security

Credit union software features strong encryption, access controls, and verification systems to guard against unauthorized access and potential breaches. Moreover, leading credit union software vendors regularly undergo independent certifications, penetration tests, and security audits to validate the effectiveness of their security protocols.

The State of AI Agents & No-Code: FinServ Edition

Learn how financial leaders use AI agents and no-code to fuel smarter transformation

Real-World Examples of Credit Union Software Implementation

#1. Ent Credit Union Enhanced Member and Employee Experience with Creatio

Colorado’s leading credit union – Ent Credit Union – adopted Creatio to support its rapid expansion and ensure a first-class experience for its members. Within just three months, Ent launched Creatio for its outbound relationship team, later expanding the platform to manage the core credit union operations across 35+ service centers.

Key Achievements:

- Deployed Creatio in just 3.5 months across 1,200 users

- Provided a 360° view of each member, enabling smarter product recommendations and service continuity

- Achieved 18.5% growth in new deposit conversions and 8.5% in new loan conversions, resulting in impressive ~$1.4M YOY annual revenue uplift

With Creatio’s no-code capabilities and robust scalability, Ent Credit Union has successfully streamlined branch consultations, enhanced member onboarding, and improved experiences for both members and employees.

Finally, as a strong advocate for agile innovation in credit union services, the company is actively integrating AI-powered technologies across its tech stack. With agentic CRM by Creatio, Ent is empowering employees with real-time insights, predictive prompts, and contextual guidance across every member touchpoint.

The centralization of data gives us member 360. But AI really takes that data up a notch rather than trying to sift through tons of data, AI can help us summarize what’s most relevant or suggest products and services that make sense for where that member is in their journey.

#2. Consumers Credit Union Improved Member Engagement with Creatio

Consumers Credit Union (CCU), one of the largest in Illinois, serving over 200,000 members with $3.5B in assets, faced the challenge of navigating 15 different systems to access member information. After implementing Creatio’s no-code CRM, CCU unified member data, streamlined service delivery, and empowered its staff with an intuitive, centralized workspace. The platform now supports seamless case management, personalized interactions, and improved lead tracking — all while upholding CCU’s member-first mission.

Key Achievements:

- One centralized workspace to unify 15 fragmented systems

- Enhanced service delivery through Member360 and case management tools

- Over 45,000 member cases processed yearly through Creatio platform

- Just THREE administrators serving 250,000 members and 500 employees

- Cut a 6-day mortgage process down to just ONE hour

Through Creatio’s no-code CRM transformation, Consumers Credit Union has successfully simplified operations and elevated member satisfaction. Today, CCU continues to turn member insights into action — creating more unified, responsive, and future-ready credit union services enhanced by AI-powered capabilities.

In the video below, Consumers Credit Union shares how they integrated Creatio’s agentic platform into their core operations — and the opportunities it opens across member engagement, service delivery, and operational efficiency.

12 Features to Look for in Credit Union Management Software

To enable effective process automation, credit union software must offer the following features:

- 360-degree member profile brings together all the information and the history of interactions with a specific credit union member in one dashboard.

- Lead and opportunity management tools visualize your pipeline and allow you to seamlessly transition leads to opportunities and close deals faster.

- Member consultations management including omnichannel communication tools, intelligent AI-powered insights on member preferences, and the next best offer suggestions.

- Loan management automates the loan process from application to disbursement and handles servicing tasks like payment processing, interest calculations, and delinquency management.

- Marketing automation tools, including audience segmentation, campaign management, and content creation tools, enable you to create targeted marketing campaigns.

- Member experience management tools, such as an omnichannel contact center, case management and dispute management, help streamline member service and shorten response times.

- Compliance and risk management tools ensure regulatory compliance, allow you to automate compliance tasks, and support risk management with AML, KYC, and risk catalog management features.

- AI-driven data analytics and reporting allow you to gain data-driven predictions and suggestions on how to improve your performance.

- AI automated workflows automate routine tasks and processes using AI. AI bots can even take over conversations with members, solving simple queries and transferring more complicated issues to human agents.

- Generative AI tools help with a variety of tasks from content creation to building customer reports. When combined with no-code tools, generative AI can help create new functionalities and business apps to address your automation needs.

- Governance features allow you to manage the credit union software and track its performance and security.

- Security features, including encryption, multi-factor authentication, and real-time threat detection, safeguard sensitive member information and help ensure compliance with industry security standards.

Top 10 Credit Union Software Vendors to Consider in 2026

Having explored the features and benefits of credit union software, the next step is selecting a platform that delivers real impact to your business. Below, we’ve reviewed the most trusted and widely adopted software vendors serving credit unions today, focusing on solutions that drive efficiency, member experience, compliance, and innovation.

Platform | Best for | G2 Rating |

| Creatio | A comprehensive agentic platform to automate credit union workflows and member relationship management | 4.6 / 5 |

| Podium | Member interaction platform for communication, reviews, and SMS-based engagement | 4.5 / 5 |

| Salesforce Financial Services | Financial services CRM with enterprise-grade customization and AI for large FIs | 4.3 / 5 |

| Alkami | Digital banking platform to accelerate credit union sales and services | 4.4 / 5 |

| FIS Profile | Core banking platform for real-time deposit and loan processing | 4.1 / 5 |

| Microsoft Dynamics 365 | CRM and productivity tools with robust Office 365 integration | 4.2 / 5 |

| Temenos Infinity | Digital banking platform to accelerate front and middle office operations | 4.2 / 5 |

| Bloomfire | Internal knowledge management and content sharing for credit union staff | 4.3 / 5 |

| Finovera | Digital bill aggregation and payment management for credit unions | 4.0 / 5 |

| Q2 | Omnichannel digital banking and member engagement platform | 4.4 / 5 |

1. Creatio

Creatio is an agentic no-code platform designed to support credit unions with intelligent workflow automation and CRM. With agentic, generative, and predictive AI embedded into the platform’s core, Creatio empowers teams to optimize unique business processes and workflows, support members on their journey with human-like assistance, and drive productivity at scale. Moreover, thanks to its AI and no-code capabilities, employees can streamline multiple tasks with Creatio’s embedded AI agents for Sales, Marketing, and Service, or build custom AI agents for credit unions to expand and augment their business results.

The platform includes a wide range of out-of-the-box capabilities tailored to the key credit union operations, such as lending, compliance, underwriting and verification, member relationship management, and other specialized workflows. With Creatio, employees can implement end-to-end, member-centric automation to capture and nurture leads, manage loan workflows, accelerate onboarding, streamline underwriting, assess risks, and ensure regulatory compliance. These capabilities enable credit unions to improve loan conversion rates, strengthen member engagement, and build lasting relationships.

Moreover, Creatio’s no-code tools and composable architecture enable both non-technical business users and IT professionals to build or extend applications without writing a single line of code. With access to over 700 third-party applications, prebuilt integrations, and connectors via Creatio Marketplace, the platform can be fully adapted to meet the unique operational needs of any credit union.

Creatio is an ideal platform for credit unions aiming to automate operations, strengthen member relationships, and stay competitive in a highly regulated financial industry. With its powerful no-code capabilities, the platform enables credit unions to quickly enhance various business operations, reduce reliance on IT, and innovate at scale. Creatio customers have achieved a 37% reduction in total cost of ownership (TCO) and a 70% decrease in implementation time, making it a top choice over the other vendors, according to Nucleus Research.

Key features:

- Unified Member 360 View: Consolidate all member interactions, service requests, and financial data in one interface.

- Lead Management and Opportunity Management: Boost conversions and revenue with AI-driven insights and personalized engagement.

- Out-of-the-box Functionality for Credit Unions: Manage reward programs, onboarding, account opening, loan origination, underwriting, compliance, and more – all using one platform.

- Prebuilt CRM for Marketing, Sales, and Service: Enable cross-functional alignment with prebuilt solutions for credit union institutions.

- End-to-End Workflow Automation: Automate a range of processes across onboarding, loan management, case handling, and contact center operations.

- Prebuilt AI Agents: Leverage embedded AI agents for sales, marketing, and service to streamline repetitive tasks like account research, quote generation, marketing content and emails generation, knowledge base management, and more.

- No-Code Agent Builder: Create and deploy custom AI agents with generative, predictive, and agentic capabilities to automate credit union operations such as member inquiries, loan prequalification, compliance checks, and others — without a line of code.

- Composable Architecture: Extend platform capabilities with ready-made apps, blocks, and UI components.

- No-Code Development: Enable industry experts and IT teams to create and adapt apps and workflows – fast, easy and with no programming required.

- 700+ third-party add-ons and applications: Expand functionality with hundreds of solutions offered via Creatio Marketplace.

Best for:

Credit unions seeking an AI-powered credit union software to modernize their unique operations, enhance member engagement, and seamlessly connect with specialized industry systems.

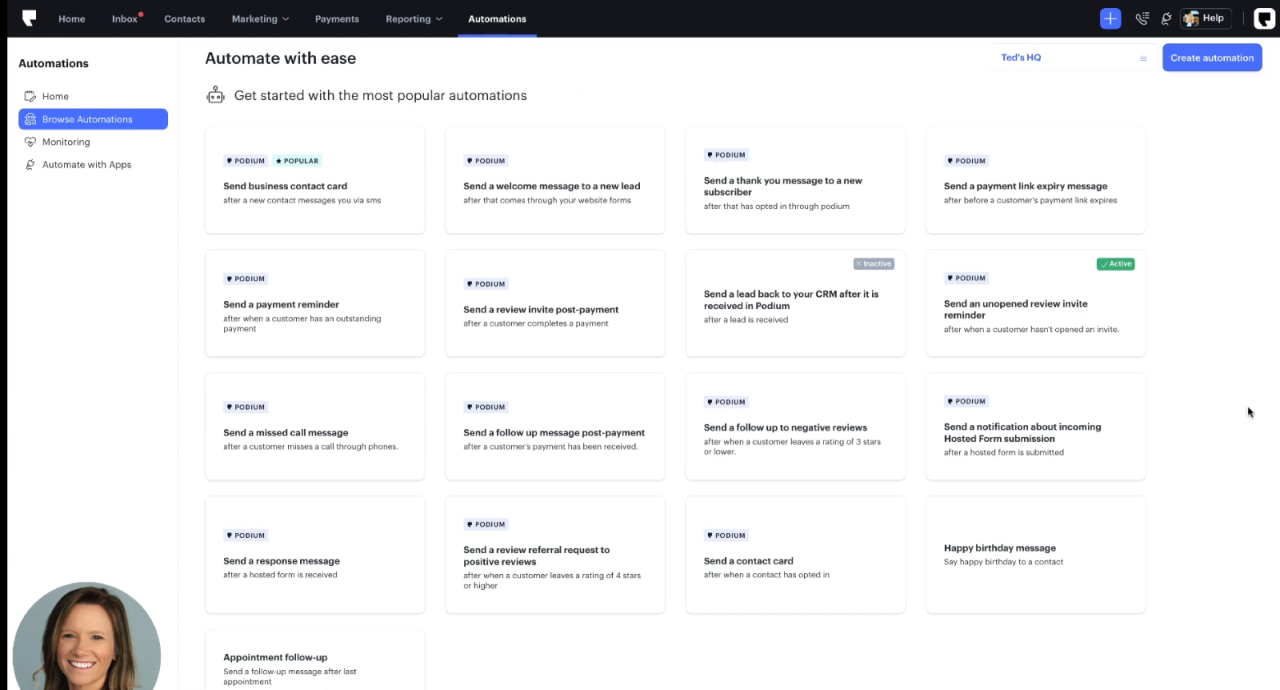

2. Podium

Podium is a customer communication platform designed to enhance member engagement and streamline operations for credit unions. It facilitates real-time communication, feedback collection, and reputation management, enabling credit unions to build stronger relationships and enhance service quality.

Key features:

- Unified messaging centralizes communication across SMS, web chat, and social media for seamless member engagement.

- Feedback and reviews management tools to collect member feedback and manage online reviews to enhance reputation and service.

- Personalized communication: customizes messages based on member preferences to boost satisfaction.

- AI assistants for marketing, sales, and customer service.

- Online payment solution.

- Analytics and reporting.

Best for:

Credit unions seeking to improve member engagement and communication through a comprehensive, user-friendly platform.

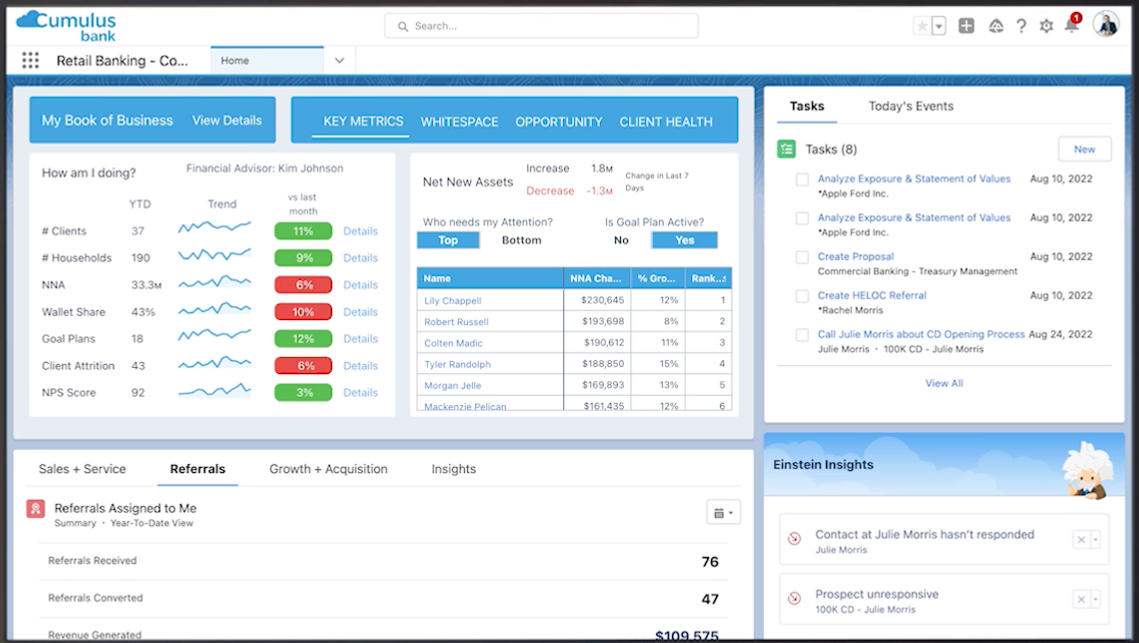

3. Salesforce Financial Services Cloud

Salesforce Financial Services Cloud is a robust CRM solution with advanced features for credit unions aiming to enhance member relationships and operational efficiency. It enables personalized engagement through purpose-built automation and AI capabilities. The platform is highly efficient in delivering intelligent insights for financial planning, accelerating customer onboarding and improving client loyalty.

Key features:

- Comprehensive view of each member’s financial journey.

- Variety of tools to automate onboarding, service requests, and compliance processes.

- Customizable dashboards to facilitate real-time insights and decision-making.

- Financial Services Cloud Accelerator solution for streamlining implementation and reducing time to value.

- AI-powered insights for predictive lead scoring, next-best-action recommendations, and personalized member engagement strategies.

Best for:

Credit unions seeking an enterprise-grade CRM and member relationship management system.

See also: Salesforce Alternatives & Competitors and Salesforce Marketing Cloud Alternatives & Competitors

4. Alkami

Alkami is a digital banking solution designed to power efficiency and ease across onboarding, engagement, and account servicing across mobile and desktop.

Key features:

- Tailored, real-time financial insights to better understand your account holders.

- Digital Account Opening to streamline the deposit account origination process.

- Centralized payment hub to drive engagement and revenue.

- Banking APIs & SDKs to customize credit union workflows.

- 270+ available innovative integrations.

Best for:

Credit unions seeking to improve the banking experience through sales and service solutions.

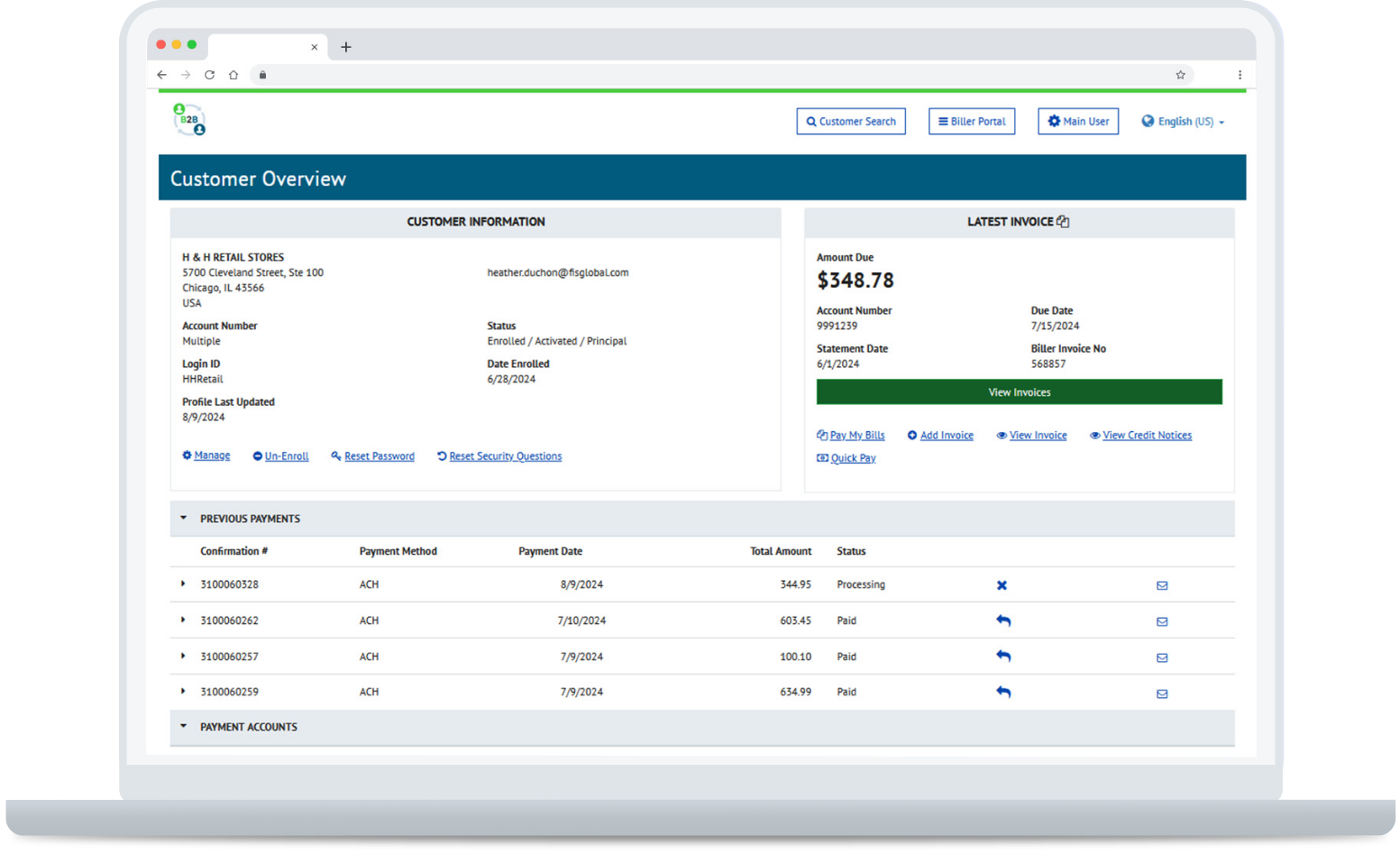

5. FIS Profile

FIS Profile is a comprehensive core banking system designed to meet the complex needs of financial institutions. Its real-time processing capabilities and modular design enable credit unions to efficiently manage deposits, loans, and customer data across multiple currencies and geographies.

Key features:

- Fraud and risk management tools to support AML, KYC and fraud prevention

- Account origination capabilities supporting the full member lifecycle

- Real-time, multi-currency processing for deposits and loans

- Business tools to support workflows, product pricing and client communications

Best for:

Credit unions aiming to improve back-end banking operations and scale globally.

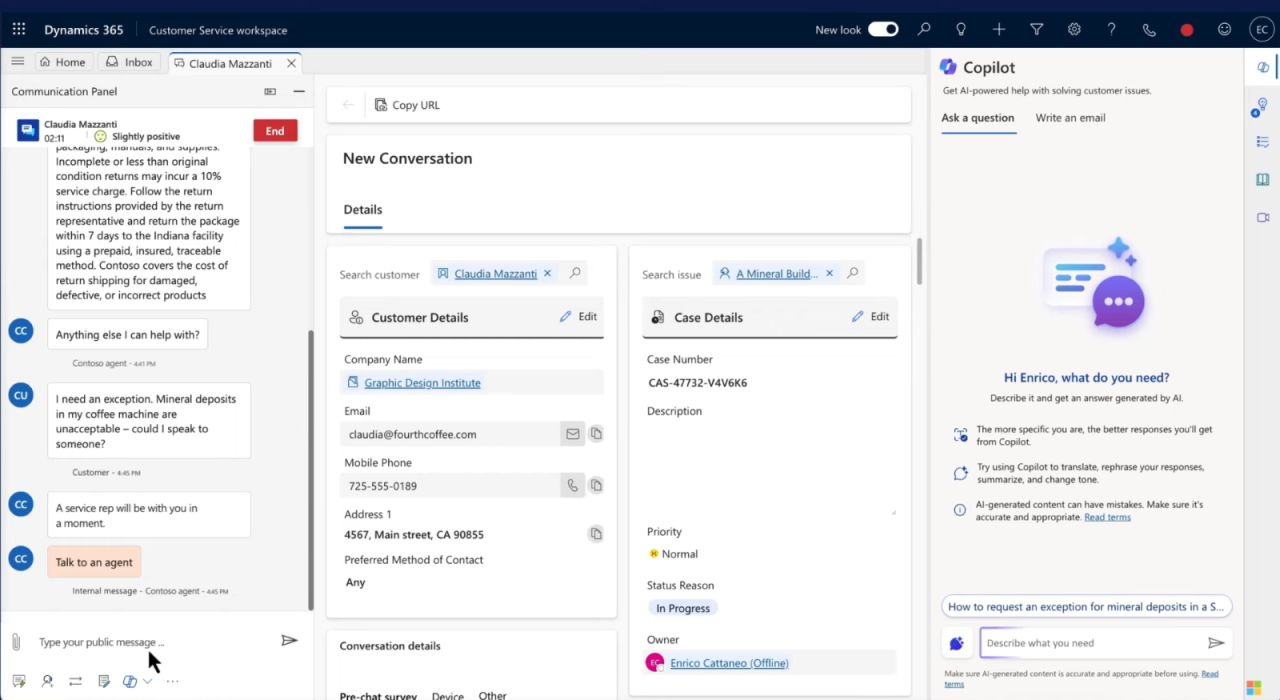

6. Microsoft Dynamics 365

Microsoft Dynamics 365 is a versatile CRM and ERP platform designed to help credit unions streamline operations and enhance member experiences. In particular, the platform offers several products for credit union workflows: Dynamics 365 for Customer Service and Sales, which enables credit unions to manage interactions, get 360-degree member views, and personalize services; and Dynamics 365 Finance and Operations, to streamline financial ops and provide data-driven insights into team performance and workflows.

Key features:

- A 360-degree view of member profiles

- Automation and workflow tools

- AI-powered insights

- Integration with other Microsoft solutions, such as Office 365 and Power BI

- Tailored tools for managing loans, accounts, and other financial services

- Customizable dashboards and reports

Best for:

Credit unions seeking an integrated CRM and ERP platform with advanced analytics and automation tools to improve member experiences and streamline operations.

7. Temenos Infinity

Temenos is a core banking software offering innovative solutions to help credit unions enhance member experiences, streamline operations, and grow revenue. Its platform is built on an open-API architecture which ensures rapid integration.

Key features:

- Member lifecycle solutions to manage onboarding, loan origination, and collections.

- Automated rule-based processes for loan origination, risk management, and member services.

- A catalog of APIs and low-code tools for integrations with other platforms.

Best for:

Credit unions looking for a scalable, cloud-enabled platform that automates key processes and supports agile integration.

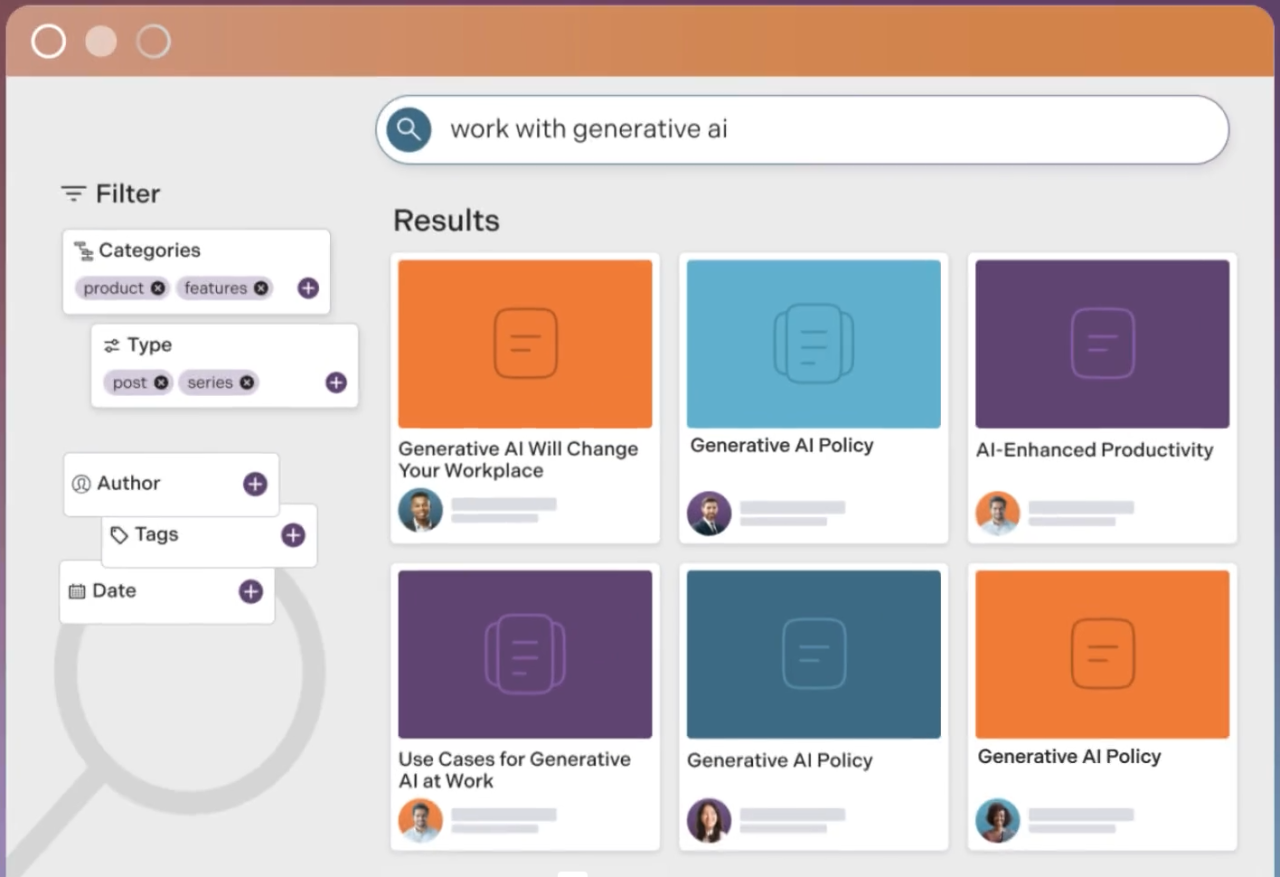

8. Bloomfire

Bloomfire offers a powerful knowledge-sharing platform designed to help credit unions enhance internal collaboration and improve member service. The software enables credit unions to document, store, and share knowledge across teams, making information more accessible and streamlining day-to-day operations.

Key features:

- Centralized knowledge repository.

- Enhanced collaboration tools.

- Searchable content database and AI-driven search tools to help employees quickly locate information.

- Analytics and insights with detailed insights into how employees interact with content.

Best for:

Credit unions looking to centralize internal knowledge sharing, streamline operations, and empower employees to provide fast, accurate member service.

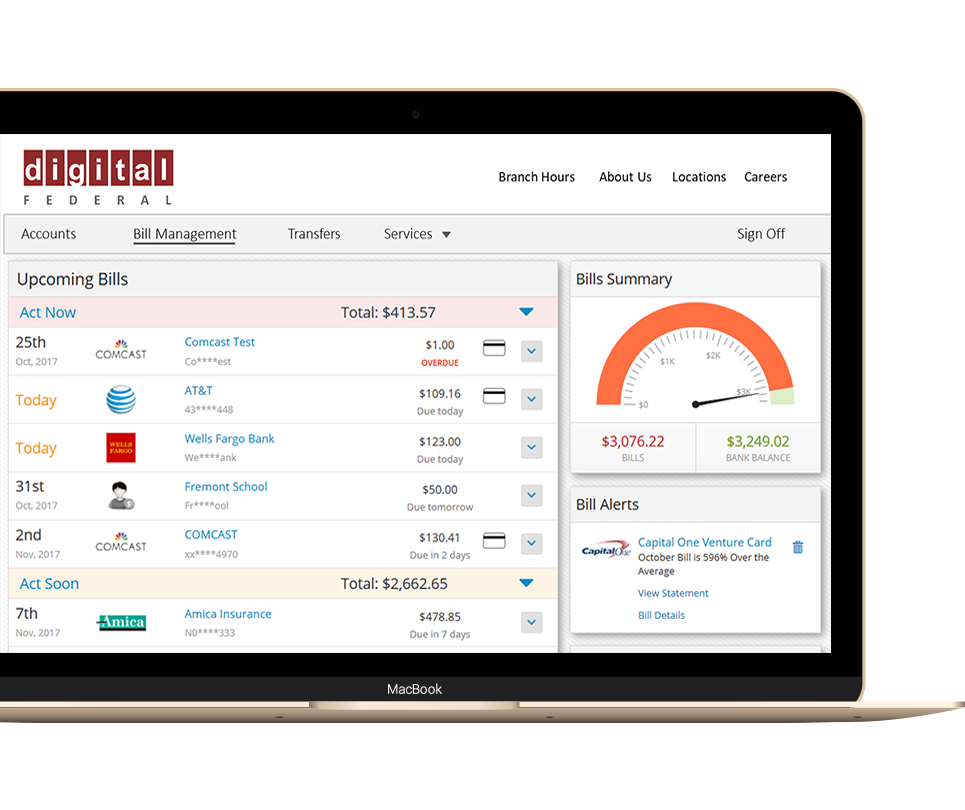

9. Finovera

Finovera is a digital bill management and payment platform specifically designed for banks and credit unions. It enables institutions to provide their members with a centralized, convenient, and secure way to manage their bills from a unified system.

Key features:

- Digital bill aggregation.

- Secure document management

- Automated bill alerts.

- Personalized bill reminders and payment schedules.

Best for:

Credit unions aiming to streamline bill management and improve member experience.

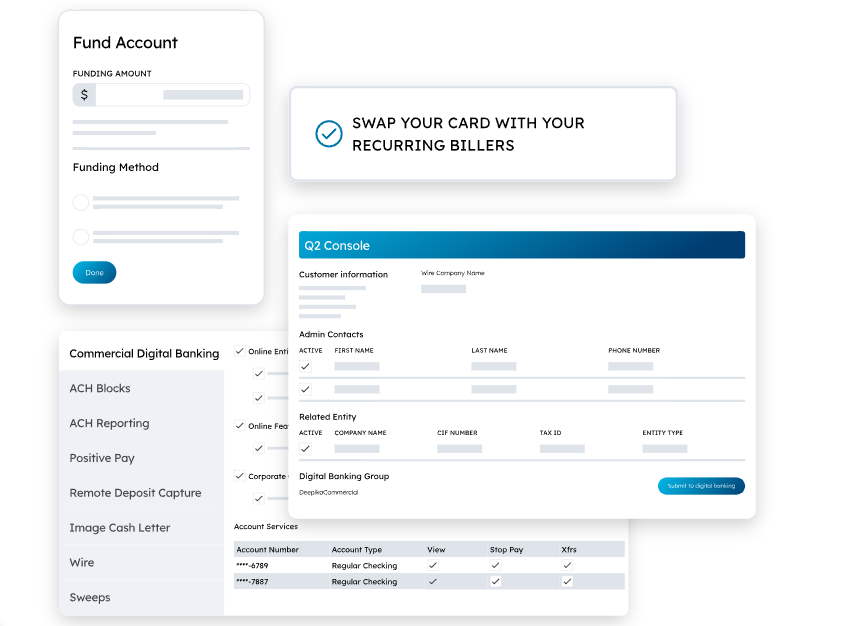

10. Q2

Q2 is a digital banking platform designed to help credit unions deliver consistent experiences and create robust relationships with members through web, mobile, and in-branch channels. It enables teams to reduce risks and prevent financial fraud, increase the value of new accounts and build personalized experiences for credit union members.

The platform doesn’t provide traditional CRM and workflow automation tools, but integrates well with core systems to support member self-service, digital onboarding, and secure communication.

Key features:

- Tailored dashboards with tools, guides, and offers for meaningful engagement

- Integrated fraud detection and secure member authentication

- Account segmentation for enhanced, dynamic member experiences

- Seamless API connectivity for fintech and third-party services

Best for:

Credit unions prioritizing omnichannel communication and risk management capabilities.

Achieve Operational Excellence With Credit Union Software

Credit union software is the key component that enables organizations to modernize operations, enhance member experiences, and maximize revenue. Powered by workflow automation, AI-powered analytics, and robus CRM tools, these systems help credit unions streamline various credit union processes, deliver personalized services, and enhance decision-making through deep analytics and data-driven insights.

Creatio provides a powerful combination of AI-native capabilities, end-to-end process automation, no-code customization, and seamless integration with specialized solutions for credit unions. With these core strengths, credit unions enhance their services, optimize workflows, and deliver personalized member engagement at scale.