-

No-Code

Platform

-

Studio

No-code agentic platform delivering the fastest time-to-value and the highest ROI

-

Studio

-

AI-Native CRM

CRM

-

AI-Native CRM

New era CRM to manage customer & operational workflows

CRM Products -

AI-Native CRM

- Industries

- Customers

- Partners

- About

What is Banking CRM? The 10 Best Banking CRM Software

Updated on

October 31, 2025

21 min read

Achieve Success in Financial Industry With Creatio

As customers' needs grow and competition heats up, banks need tools that will help them deliver personalized experiences, respond quickly to market changes, and build long-term customer loyalty.

A robust banking CRM system provides the foundation for achieving these goals, and using it is now more valuable than ever. In 2021, the banking CRM software market was worth $9.5 billion, and it is estimated to skyrocket to $39.2 billion by 2031, with an impressive growth rate of 15.7%.

In this article, we explore how banking CRM solutions are reshaping the future of financial services, delivering a lifeline to both customers and bank employees alike.

Key Takeaways

- Banking CRMs centralize customer data, automate workflows, and streamline services across channels.

- With purpose-built CRMs, banks can boost customer satisfaction, enhance productivity, and drive business growth.

- Equipped with centralized data storage, advanced security, and compliance tools, banking CRMs are built to safeguard customer data and keep regulators satisfied.

- Whether it's marketing, service, loan processing, or onboarding, the CRM optimizes every touchpoint, helping banks stay competitive and efficient.

- The best banking CRMs in 2025 to consider are Creatio, Salesforce, Microsoft, Oracle, Pegasystems, ServiceNow, BUSINESSNEXT, Total Expert, Zoho CRM, and Hubspot.

What is CRM in the Banking Industry?

Banking CRM (customer relationship management) is a specialized software designed to help banks and financial institutions manage customer relationships. It provides a comprehensive platform for storing and organizing customer data, tracking communication history, and automating crucial banking processes.

By using a CRM system for the banking industry, financial organizations can offer highly personalized experiences to customers across all touchpoints, predict customer needs, and consistently provide exceptional service. Moreover, a banking CRM platform plays a crucial role in assuring compliance with complex regulatory requirements, enabling banks to navigate the ever-changing regulatory landscape with confidence and efficiency.

The State of AI Agents & No-Code: FinServ Edition

Learn how financial leaders use AI agents and no-code to fuel smarter transformation

Banking CRM Benefits

When properly implemented and utilized, CRM enables banks to:

Elevate customer satisfaction and loyalty

A banking CRM enhances customer experience and loyalty by providing banks with a comprehensive view of each customer's preferences, behaviors, and past interactions. This wealth of data facilitates tailored engagements and services, meeting customers’ individual requirements. Consequently, this leads to higher customer satisfaction and greater trust, fostering long-term loyalty and a higher rate of customer retention.

Boost employee efficiency and collaboration

A CRM for banking solution enhances employee productivity by automating routine tasks, allowing staff to focus on more strategic and value-added activities. Additionally, it promotes collaboration by providing a centralized platform for sharing customer information and insights, fostering better teamwork and coordination among employees. This leads to improved customer retention, productivity, and service delivery.

Drive profit growth

By streamlining processes, improving customer relationships, and identifying new sales opportunities, banks can effectively manage their resources, improve their bottom line, and boost their overall profitability.

Ensure regulatory compliance and mitigate risk

CRM assists banks in compliance management by providing a structured platform to document and track customer interactions and transactions, ensuring adherence to regulatory requirements. The system's robust reporting and analytics capabilities help to track customer interactions and identify potential compliance issues, giving you actionable insights and reducing the risk of regulatory violations and penalties.

Cultivate brand advocates and enhance reputation

A banking CRM improves brand awareness and helps banks' reputation by enabling banks to consistently deliver high-quality and personalized services, which are more likely to be positively shared through word-of-mouth and social media. As customers receive a superior level of service and engagement, they become brand advocates, attracting new customers, and reinforcing the bank's reputation as a customer-centric institution.

As a bank customer, you also reap the advantages of the banking CRM system in use, which include:

Tailored banking solutions aligned with your needs

A CRM for banking solution captures and analyzes customer preferences, behaviors, and transaction history. This data-driven approach allows banks to tailor offerings to individual needs and preferences, ensuring that customers receive financial solutions that are aligned with their unique requirements, expectations, and goals.

24/7 high-quality support at your fingertips

A CRM for banking solution enables customers to access high-quality and fast service 24/7 by centralizing customer information and interactions such as phone calls, allowing bank representatives to quickly access a customer's history and needs during any interaction. CRM also supports online self-service portals and chatbots, ensuring that customers can address their issues at any time, resulting in efficient and round-the-clock support.

Timely updates and seamless communication

Automation features in CRM ensure that customers receive timely notifications, updates, and reminders, guaranteeing that they stay informed and engaged with their bank. This leads to improved communication and a more seamless banking experience.

Core Features in a Banking CRM Systems

Choosing the right CRM system can pose a significant challenge. Each CRM solution boasts its unique attributes, features, strengths, and weaknesses. Nevertheless, regardless of the specific CRM platform you select, several fundamental features stand as essential pillars in enhancing customer journey in banking:

- Centralized data management. The cornerstone of an effective CRM system is the centralization and thoughtful organization of customer data. This encompasses financial history, preferences, interactions, critical documents, etc. A comprehensive view of customer information gives users an in-depth knowledge of their clients and enables banks to gain profound insights into individual customer needs, facilitating the provision of highly personalized services.

- Marketing and sales automation. Streamlining marketing campaigns, lead generation, and sales opportunity management is crucial. These capabilities ensure the efficient conversion of prospects into loyal customers, boosting revenue streams, and optimizing the return on marketing investments.

- Customer service and support. Robust CRM systems offer case management, support ticketing, and fast issue resolution. This ensures that customers receive timely and effective assistance, nurturing customer satisfaction and trust.

- Workflow automation. Automation underpins banking front-, middle-, and back-office activities. Processes like customer onboarding, loan management, verification, and underwriting benefit immensely from automation. CRM systems streamline decision-making, eliminate manual effort, and elevate operational efficiency.

- AI (artificial intelligence) and machine learning. These technologies are essential in modern banking, allowing bankers to analyze large volumes of data, identify patterns, and generate accurate predictions. AI/ML tools support data-driven decision-making and help deliver highly personalized financial solutions to customers.

- Integrated omnichannel communications. It is crucial to ensure seamless interactions between your bank and customers across all available channels. Integrated omnichannel communications enable customers to engage with your bank in the manner most convenient for them, enhancing their overall banking experience.

- Document management. Robust document management is a cornerstone of the banking sector. It involves centralized document storage and retrieval, simplifying access to customer records, financial forms, and other critical documents.

- Security. Robust data security features are paramount in a CRM for banking platform to safeguard sensitive financial information. Protecting customer data is essential for maintaining trust, meeting regulatory requirements, and preventing unauthorized access, thereby preserving the integrity of banking activities.

- Analytics and reporting. These tools provide valuable insights into customer behavior, performance metrics, and the efficacy of marketing and sales strategies. Armed with this data, banking professionals can make data-driven decisions, fine-tune their strategies, and perpetually enhance the quality of their services.

AI in Banking CRM

Artificial intelligence is rapidly transforming how banks operate and manage customer relationships. According to The Economist, over 80% of senior banking executives currently believe that adopting AI is the key to success in the financial industry.

Modern banking CRM systems powered by AI go far beyond basic contact management. AI in banking enables financial institutions to automate routine tasks, gain deeper insights from customer data, and deliver personalized experiences that contribute to long-term loyalty.

AI tools can handle repetitive, time-consuming tasks such as data entry, lead scoring, and follow-up reminders, freeing banks’ staff to focus on higher-value activities like cultivating customer relationships. Banks can also use AI-powered chatbots to provide 24/7 customer support to answer frequently asked questions regarding accounts, transactions, and the bank’s offers.

AI enables banks to deliver highly tailored interactions, from personalized product recommendations to proactive financial advice. With AI-driven insights, banks can better understand individual customer preferences and anticipate their needs, increasing customer satisfaction.

Banks and financial institutions can also use AI to enhance cybersecurity, fraud detection, and risk management. AI-powered algorithms can detect unusual patterns and anomalies in real time, identifying potential threats much sooner than humans. Banks can also leverage AI to streamline compliance processes, automatically generate reports, and stay ahead of evolving regulatory requirements.

Find out more about how leading banking institutions use AI to streamline operations, personalize customer experiences, and drive growth.

Staying Human in the Age of AI

Learn how financial institutions leverage AI and no-code to boost efficiency while delivering authentic, personalized customer experiences at scale

Solving Industry Challenges with Banking CRM

Banks these days all face similar challenges, from inefficient processes to data security concerns and dissatisfied customers. Many of these problems stem from disconnected outdated systems and lack of deep customer insight.

Here’s how a modern banking CRM helps address these issues:

Challenge: Fragmented customer data

Customer information is often scattered across multiple systems, making it hard to gain a complete view of clients' needs and previous interactions.

CRM solution: A banking CRM centralizes data from multiple disconnected systems to provide teams across all departments with access to a 360° customer view in one place.

Challenge: Limited personalization

Customers expect personalized advice and offers, but banks often fall back on generic communication due to limited customer insights and a lack of resources to tailor interactions at scale.

CRM solution: With powerful segmentation and generative AI tools, modern CRM systems enable personalized outreach based on customer behavior, preferences, and financial goals.

Challenge: Inefficient processes

Traditional banking processes are often complex and time-consuming with manual tasks and disjointed systems slowing down operations and hindering productivity.

CRM solution: Banking CRM streamlines workflows, automates repetitive tasks, and increases overall operational efficiency.

Challenge: Inconsistent customer service

Customers expect banks to provide consistent customer service across multiple channels. Without unified data, service teams struggle to resolve issues efficiently and follow up consistently.

CRM solution: A CRM equips support teams with easy access to full case histories and customer profiles, ensuring faster, more accurate service across all channels.

Challenge: Competing with fintech companies

Fintechs often offer faster, more intuitive services, raising the bar for customer expectations.

CRM solution: A modern CRM equips banks with tools to deliver agile, digital-first experiences that rival fintech offerings.

Challenge: Data security concerns

Cyber threats put sensitive customer data at risk. Banks often struggle with outdated security infrastructure and increasing regulatory demands, making it difficult to ensure data protection and maintain customer confidence.

CRM solution: Banking CRMs offer enterprise-grade security features, role-based access controls, and audit trails to help protect customer information and ensure compliance.

Challenge: Regulatory pressure

Staying compliant with regulations like KYC, AML, and data privacy laws requires rigorous documentation and tracking.

CRM solution: CRM platforms help automate compliance-related processes and store interaction logs securely.

10 Best Banking CRM Software

1. Creatio

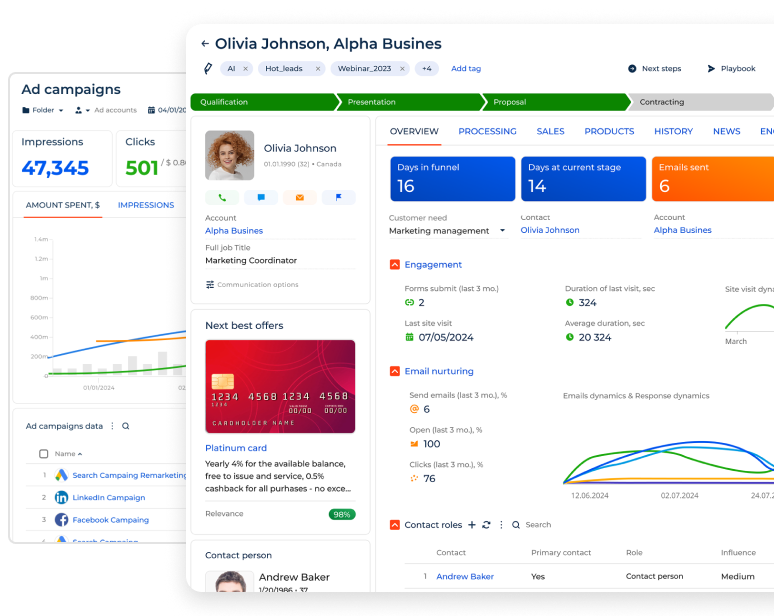

Creatio banking CRM is a new era CRM to manage all customer and operational workflows with no-code and AI at its core. Built for the demanding world of banking, it transforms every interaction and internal process into seamless, intelligent experiences by combining AI-native automation with no-code architecture.

Banks can adapt Creatio CRM to fit their unique business needs thanks to its no-code capabilities, which support limitless customization, and its composable architecture, which allows assembling apps and workflows from components and blocks.

Creatio offers banks access to a library of ready-to-use workflows to streamline every step of the banking journey — from onboarding and marketing to sales, service, and contact center. Thanks to embedded AI capabilities, banks can automate routine tasks, improve productivity, and make data-driven decisions while delivering highly personalized customer experiences that drive acquisition, increase satisfaction, and strengthen retention.

Creatio is an ideal choice for medium to large organizations, and its recognition by key industry analysts underlines its quality and performance. Nucleus Research found that organizations that choose Creatio can benefit from 37% lower total cost of ownership and 61% faster lead response compared to legacy CRM systems. This makes Creatio a strong contender for banks seeking an adaptable, efficient, and cost-effective CRM solution.

Creatio stands out for its exceptional ease of use and rapid setup, and what I appreciate most is the platform's flexibility - it empowers us to implement new functions effortlessly and tailor the system to our needs, all without coding

Key areas where Financial Services Creatio can enhance banking processes include:

- Customer 360: access an integrated view of each customer to personalize interactions and improve overall satisfaction.

- Marketing: boost demand generation with multichannel campaigns tailored to specific markets and regions, delivering offers at the right time and through the right channels.

- Sales: efficiently manage sales opportunities with automated workflows; allocate resources smartly with sales forecasting; and enhance engagement with personalized value propositions using predictive scoring and AI/ML-driven insights.

- Onboarding: provide personalized onboarding experiences with a 360-degree customer view, streamlined offer management, and an automated product catalog.

- Account opening: automate account opening procedures, streamline verification processes, accelerate approvals, and digitize document management to reduce errors and enhance customer satisfaction.

- Customer experience: improve the customer experience by responding promptly to inquiries, resolving issues effectively, and delivering tailored services.

- Lending: streamline loan origination, underwriting, and approvals through digital workflows and a consolidated 360-degree customer data view.

- Compliance management: ensure compliance, mitigate risks, and meet regulatory obligations with consolidated data management, reporting, and automation tools.

- No-code customization: customize your CRM to align with the specific needs and regulatory standards of the bank without the need for IT specialists or programmers.

Creatio's customers include banks, credit unions, insurance companies, and other financial institutions. For instance, Cornerstone Bank from Massachusetts integrated Creatio with its core banking system to centralize data and facilitate access to customer profiles. Creatio empowers Cornerstone Bank to provide personalized service and quickly address service requests.

Creatio is an ideal choice for medium to large organizations, and its recognition by key industry analysts underlines its quality and performance. Nucleus Research found that organizations that choose Creatio can benefit from 37% lower total cost of ownership and 61% faster lead response compared to legacy CRM systems. This makes Creatio a strong contender for banks seeking an adaptable, efficient, and cost-effective CRM solution.

Creatio key features:

- 360 customer view

- User-friendly interface

- Flexible customization and configuration capabilities

- Innovative composable no-code architecture

- AI-native capabilities tailored to banking processes

- Sales, marketing & service workflows

- Account opening and personalized onboarding

- Loan originating and underwriting

- Out-of-the-box workflows to manage compliance

Creatio limitations:

- Creatio may present a learning curve for people unfamiliar with no-code development

Creatio pricing options:

Creatio offers a unique, composable pricing model where you can choose which products to purchase. The core platform offers three plans: Growth for $25, Enterprise for $55, and Unlimited for $85 per user monthly. Its customer relationship management products, Sales, Marketing, and Service, are priced at $15 per user monthly and can be purchased separately. There is also a 14-day free trial.

Creatio customer ratings:

Capterra: 4.8/5

Gartner: 4.9/5

G2: 4.6/5

2. Salesforce

Salesforce Financial Services Cloud is a dedicated CRM platform that provides a comprehensive array of tools uniquely suited to the requirements of banks, insurance companies, wealth management firms, and other financial institutions. Financial Services Cloud empowers banking experts to gain deeper insights into their customers, personalize interactions, and optimize operations across different banking divisions. It offers tools for lead management, customer onboarding, financial planning, and regulatory compliance. With its data-driven insights and seamless integration with other Salesforce offerings, Financial Services Cloud assists banks in elevating customer relationships, fostering growth, and maintaining regulatory compliance.

Salesforce Financial Services Cloud key features:

- Client and household management

- 360-degree view of customers

- Financial planning tools

- Predictive analytics

- Low-code tools

- Einstein AI assistant

Salesforce Financial Services Cloud limitations:

- High implementation costs

- Steep learning curve

- Dependence on professional software developers

Salesforce Financial Services Cloud pricing options:

The prices for Salesforce Financial Services Cloud range from $300 (Sales or Service solution) to $700 (Sales + Service solution + Einstein AI) per user per month.

Salesforce Financial Services Cloud customer ratings:

Capterra: 4.7/5

Gartner: 4.4/5

G2: 4.2/5

See also: Salesforce Alternatives & Competitors and Salesforce Marketing Cloud Alternatives & Competitors

3. Microsoft

Microsoft Cloud for Financial Services is a comprehensive suite of integrated solutions designed specifically for banks and other FinServ businesses. It leverages the power of Microsoft Azure, Microsoft Dynamics 365, Microsoft Teams, and Power Platform to address the unique needs of financial companies. This tailored solution empowers banks to efficiently manage vast financial data, deliver exceptional customer experiences, enhance staff capabilities, and combat financial crime. By promoting collaboration, automation, and data insights, it optimizes banking operations, personalizes customer engagement, elevates overall customer experiences, and provides valuable data-driven insights.

Microsoft Cloud for Financial Services key features:

- Integration into Microsoft Dynamics' ecosystem

- Pre-built solutions for banking, insurance, and capital markets

- Robust data-driven insights

- 360-degree view of the customer

- Virtual agent chatbots that understand natural language queries

- Tools for customization

Microsoft Cloud for Financial Services limitations:

- High subscription costs

- Underwhelming investment and wealth management features

Microsoft Cloud for Financial Services pricing options:

For this product, Microsoft offers a composable pricing model that allows you to pay only for the Microsoft tools that you don't already own. You can pay up to $20,000 per tenant/month for the full suite, which incorporates other Microsoft products. Check out this pricing guide to calculate what you might be paying.

Microsoft Dynamics customer ratings:

Capterra: 4.4/5

Gartner: 4.3/5

G2: 3.9/5

4. Oracle

Oracle CX for Financial Services enables banks to shift towards a digital customer experience. With a holistic view of data and interactions, banks can build a more personalized customer experience and offer tailor-made financial solutions. Automation simplifies the process of identifying, nurturing, and generating referrals for cross-selling products across diverse channels like social, mobile, and web. The Needs Analysis feature facilitates guided selling and self-service personalized product recommendations, streamlining customer onboarding and account origination, ultimately elevating the customer experience.

Oracle CX key features:

- AI tools for lead management

- Guided insights, next-best actions, and automated workflows

- Knowledge base enhanced by AI insights

- Robust data-driven insights

- 360-degree view of the customer

Oracle CX limitations:

- Lack of capabilities for B2C retail banking, insurance, as well as investment and wealth management

Oracle CX pricing options:

The pricing varies from $65 to $300 per user/month.

Oracle CX customer ratings:

Capterra: 4.3/5

Gartner: 4.3/5

G2: 3.9/5

5. Pegasystems

Pegasystems is a dedicated solution that unifies marketing, sales, and service applications and a general-purpose solution that has the ability to automate large-scale repetitive tasks. This tool streamlines customer management, enabling personalized financial planning services and promoting deeper customer relationships. Tailored features and AI-powered functionalities consolidate customer data and facilitate seamless communication, empowering banks to provide exceptional services and foster enduring customer relationships. With Pegasystems, banks can focus on maximizing client value and delivering top-notch customer service, ensuring clients receive the best financial guidance and support.

Pegasystems key features:

- AI-powered workflow automation

- Robust campaign orchestration tools

- Infusion of AI and next best actions within customer 360 view

- Robust data-driven insights

- 360-degree view of the customer

Pegasystems limitations:

- Lack of investment and wealth management solutions

- Lack of tools for customer self-service

Pegasystems pricing options:

The pricing varies from $30 to $250 per user/month.

Pegasystems customer ratings:

Capterra: 4.3/5

Gartner: 4.6/5

G2: 4.2/5

See also: Pega alternatives

6. ServiceNow

ServiceNow provides CRM functionality tailored for retail banking, wealth management, and insurance firms. While it excels in customer service with robust workflow and operational features, its sales and marketing functionalities are comparatively limited.

ServiceNow’s Financial Services Operations platform is designed for effective employee collaboration, featuring embedded channels, advanced work assignment routing, and extensibility through declarative actions and API accessibility. It also supports curated agent and advisor role profiles complete with impressive risk management features.

However, for essential in-house financial services functions like lead generation, prioritization, and prospecting, the platform relies on third-party integrations. Fortunately, the app integration marketplace offers robust options to meet these needs.

Overall, ServiceNow is a suitable choice for midsize and large financial services organizations with complex customer service processes.

ServiceNow key features:

- Robust workflow automation

- Comprehensive employee collaboration tools

- Focus on customer service supported by an extensive list of tools

- Tools for wealth management and insurance

ServiceNow limitations:

- Limited marketing and sales features

- Limited offer of third-party integrations

ServiceNow pricing options:

Pricing is calculated on demand based on your requirements.

ServiceNow customer ratings:

Capterra: 4.5/5

Gartner: 4.6/5

G2: 4.4/5

7. BUSINESSNEXT

BUSINESSNEXT offers a customizable CRM platform designed to accelerate digital transformation with a focus on self-service rather than agent-led service. Although BUSINESSNEXT does not have a purpose-built offering for financial services, it provides robust features valuable to retail banking, wealth management, and insurance businesses.

BUSINESSNEXT's CRM integrates AI across the platform to enhance:

- Prospecting and outreach capabilities, continuously learning and improving offer recommendation accuracy.

- Lead generation and prioritization, automating prospect scoring and routing.

- Customer 360 view, generating insights for its smart Action Center.

Additionally, the platform provides AI-powered chatbots for customer interactions.

BUSINESSNEXT is best suited for midsize to large financial services firms with complex processes looking for a comprehensive solution for digital transformation.

BUSINESSNEXT key features:

- AI automation built into core processes

- Smart Action Center

- AI-powered chatbots for customers

- Easy-to-use interface

BUSINESSNEXT limitations:

- Lack of agent-led customer service features

BUSINESSNEXT pricing options:

Pricing is calculated on demand based on your requirements.

BUSINESSNEXT customer ratings:

Capterra: 4.5/5

Gartner: 4.1/5

G2: 4.1/5

8. Total Expert

Total Expert is primarily focused on the lending sector, particularly the mortgage industry, but is gradually expanding its capabilities to better serve retail banking and insurance businesses. Known for its purpose-built CRM for mortgages, Total Expert aims to create a comprehensive customer profile.

Total Expert’s CRM offers extensive prospecting and outreach features and integrates well with retail banking, particularly favoring mortgage-related businesses.

The platform provides firms with access to hundreds of prebuilt compliant assets connected to a journey creator and campaign builder. These intelligent customer journeys can trigger automatic events, suggestions, and actions based on workflow rules for agents.

However, Total Expert falls short in several areas compared to other leading CRM solutions. It lacks robust lead generation, prioritization and customer acquisition tools, prepackaged analytics, customer self-service, knowledge management, goal tracking, and programmatic customization.

Total Expert is well-suited for small financial services firms looking to automate and consolidate customer data across multiple platforms, offering a user-friendly solution with strong support.

Total Expert's key features:

- Emphasis on the mortgage industry

- Retail banking integrations

- Pre-built compliant templates

- Campaign builder

- Intelligent customer journeys

Total Expert limitations:

- Underwhelming lead generation tools

Total Expert pricing options:

Pricing is calculated on demand based on your requirements.

Total Expert customer ratings:

Capterra: 4.3/5

G2: 4.5/5

9. Zoho CRM

Zoho is a horizontal CRM that offers high customizability. Although Zoho does not provide purpose-built solutions for financial services, it offers generic capabilities that can be adapted for retail banking, wealth management, and insurance businesses.

Zoho CRM boasts broad capabilities in lead generation and prioritization, knowledge management assistance, and automated workflows. While Zoho provides generic prepackaged integrations, it does not offer integrations specifically tailored to retail banking, insurance, or wealth management.

Despite these limitations, Zoho is a suitable choice for small and midsize financial services organizations with moderate process management needs, offering a customizable and user-friendly solution.

Zoho CRM's key features:

- AI assistants for customer service and analytics

- Broad capabilities in lead generation and prioritization

- Freemium options for small businesses

Zoho CRM limitations:

- No self-service tools

- No customer-specific integrations

Zoho CRM pricing options:

Zoho CRM's pricing starts at $15.

Zoho CRM customer ratings:

Capterra: 4.3/5

Gartner: 4.3/5

G2: 4.1/5

See also: Top 10 Zoho CRM Alternatives and Competitors

10. Hubspot

HubSpot is known for its CRM marketing solution. The platform offers customizable products focusing on marketing, sales, services, operations, and content management, which can be combined to meet various business needs. Although HubSpot does not provide a purpose-built solution for financial services, it includes generic elements that can support some financial services organizations.

The HubSpot CRM suite offers tools to support agents, such as a chatbot that retrieves support resources and a sidebar that facilitates employee collaboration on customer cases. It provides role and profile identification with relevant knowledge and workflow support but is not specifically designed for retail banking, insurance, or wealth management roles.

The suite lacks crucial functionalities needed by many financial services firms, including advanced prospecting and outreach, lead generation and prioritization, comprehensive customer insights, and customer goal tracking.

HubSpot is best suited for small and low-complexity financial service firms with straightforward CRM requirements.

Hubspot's key features:

- Flexible pricing and product bundling

- AI assistant for service agents

- Automated workflows for sales, marketing, service, and operations

Hubspot limitations:

- No specific banking features

Hubspot pricing options:

Hubspot's pricing ranges from $15 to $3,600 per month, depending on your bundle.

Hubspot customer ratings:

Capterra: 4.5/5

Gartner: 4.5/5

G2: 4.4/5

See also: Top 10 HubSpot Alternatives & Competitors

How to Choose the Right Banking CRM?

There are many modern CRM systems on the market and plenty of factors to consider besides the features when choosing CRM software. In this section, we recommend the steps to selecting the best CRM solution that will help enhance customer engagement in your organization.

- Determine your budget: to decide how much you can spend on the software consider the number of users, the volume of data you aim to manage, and the functionalities you require that may cost extra such as AI-powered personalized customer service.

- Prioritize user-friendliness: A powerful state-of-the-art CRM tool is no use if its interface is too complicated to operate properly. Choose the CRM that your sales reps, marketing managers, a service agents will be able to master without a hitch.

- Consider the ease of data migration: It's likely you're already using a legacy CRM system or another data management tool. Inquire how streamlined the migration of data from your existing storage is to make sure it won't be an issue during implementation.

- Ensure scalability: Your core banking system should be growing along with your company - make sure your CRM of choice can handle a larger number of operations and data on individual customers.

- Check the compliance and security: Ensure that the software you purchase complies with local and international standards of security such as GDPR and regularly undergoes regular independent audits like the SOC 2 Type II Compliance Audit.

- Check the integration: An effective CRM system should be compatible with other business automation tools in your ecosystem to facilitate exchange of data and workflows. Make sure your solution fits in with other software you're using.

- Research the vendor's experience with banking organizations: Many CRM vendors provide case studies and success stories from their clients, which you can read to see what banking-specific advantages the CRM offers. Moreover, you can browse the reviews focusing on those coming from companies providing banking services. Ensuring that the vendor has experience providing CRM solutions for your industry helps eliminate issues such as lack of industry-specific integrations or features.

- Request demos: Once you've narrowed down your list, request the demos for the remaining candidates and evaluate the features, customization, and ease-of-use yourself. Then, you'll have all the information to choose the best option for your business.

How to Implement Banking CRM

Implementing a banking CRM system involves more than just choosing the right software, it requires aligning technology with business goals, processes, existing tools, and people.

Here’s a step-by-step guide to ensure a smooth CRM implementation in a banking environment:

- Define your goals - identify what you want to achieve with your CRM and which processes could be improved. Whether it’s enhancing customer satisfaction, increasing sales, streamlining onboarding, or improving service efficiency, the banking CRM of your choice should support your goals.

- Choose the right CRM platform - a modern CRM solution designed for the banking industry should be user-friendly, easy to customize, and provide crucial features, such as centralized data management, workflow automation, and AI assistant.

- Ensure integration with existing tools - the CRM should seamlessly integrate with your existing systems, including core banking, digital channels, loan origination systems, and KYC/AML tools.

- Customize and configure - tailor the system to reflect your unique banking processes. Choose a banking CRM solution that offers no-code tools to accelerate customization without heavy IT involvement.

- Train teams and drive adoption - make sure that your staff has the knowledge to effectively use the CRM system. Focus on demonstrating how it benefits their daily work and customers to support widespread adoption.

- Monitor, optimize, and scale - a successful CRM implementation doesn’t end with deployment; that’s why you should continuously track key performance indicators (KPIs) such as customer satisfaction, lead conversion, and service response times to make sure the banking CRM of your choice supports your goals.

Creatio Banking CRM Implementation Case

Explore the transformative journey of the bank as it enhances operational efficiency, delivering unmatched seamless banking services to its customers

Conclusion

Banking CRM solutions reshape the future of banking by emphasizing customer satisfaction and loyalty, brand advocacy, employee efficiency, profit growth, and regulatory compliance. For customers, these systems offer round-the-clock support, tailored solutions, and seamless communication, enhancing the overall banking experience. In a competitive financial landscape, CRM is the cornerstone for banks to adapt and thrive, ensuring they deliver exceptional services while maintaining regulatory compliance and achieving sustainable growth.

FAQ

What is CRM in banking?

CRM in banking refers to a specialized software platform designed to help financial institutions manage and improve customer relationships, streamline operations, and enhance the customer experience and service in the banking sector.

How does a banking CRM benefit financial institutions?

Banking CRM solutions enable banks to consolidate customer data, personalize interactions, streamline processes, and optimize sales and marketing efforts, ultimately leading to improved customer satisfaction and increased revenue.

Can banking CRM solutions handle regulatory compliance?

Yes, many banking CRM solutions offer features for compliance management, helping banks adhere to regulatory requirements and mitigate risks effectively.

What are the key features of a banking CRM system?

Key features include customer data centralization, lead management, marketing automation, sales workflow optimization, document management, and advanced analytics for data-driven decision-making.

Is customization possible with banking CRM solutions?

Yes, most banking CRMs offer customization options, allowing financial institutions to tailor the platform to their unique requirements and compliance standards without extensive IT expertise.